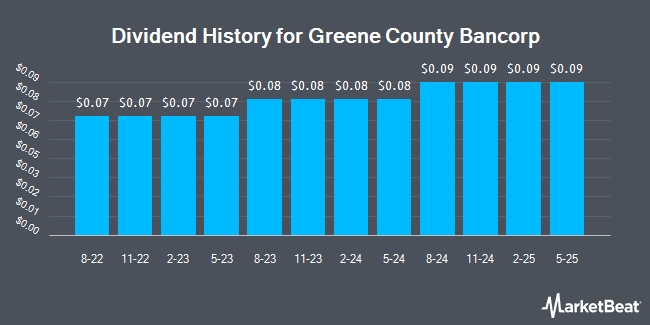

Greene County Bancorp, Inc. (NASDAQ:GCBC - Get Free Report) announced a quarterly dividend on Wednesday, April 16th, RTT News reports. Investors of record on Friday, May 16th will be paid a dividend of 0.09 per share by the real estate investment trust on Friday, May 30th. This represents a $0.36 dividend on an annualized basis and a yield of 1.73%. The ex-dividend date of this dividend is Friday, May 16th.

Greene County Bancorp has increased its dividend by an average of 10.8% annually over the last three years and has increased its dividend annually for the last 11 consecutive years.

Greene County Bancorp Trading Down 2.7 %

Shares of GCBC stock traded down $0.58 during trading hours on Monday, hitting $20.83. 19,268 shares of the company's stock traded hands, compared to its average volume of 27,290. The stock has a market cap of $354.67 million, a PE ratio of 13.44 and a beta of 0.36. The company has a quick ratio of 0.63, a current ratio of 0.63 and a debt-to-equity ratio of 0.03. Greene County Bancorp has a 12 month low of $20.00 and a 12 month high of $37.25. The stock's 50 day simple moving average is $24.21 and its 200 day simple moving average is $27.40.

Greene County Bancorp (NASDAQ:GCBC - Get Free Report) last issued its quarterly earnings results on Wednesday, January 22nd. The real estate investment trust reported $0.44 earnings per share (EPS) for the quarter. Greene County Bancorp had a net margin of 21.02% and a return on equity of 12.55%. During the same period in the prior year, the company posted $0.34 EPS.

Insiders Place Their Bets

In related news, Director Jay P. Cahalan bought 1,944 shares of Greene County Bancorp stock in a transaction dated Thursday, February 27th. The stock was purchased at an average cost of $26.45 per share, with a total value of $51,418.80. Following the transaction, the director now directly owns 29,324 shares of the company's stock, valued at approximately $775,619.80. The trade was a 7.10 % increase in their ownership of the stock. The acquisition was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through the SEC website. Also, Director Tejraj S. Hada bought 7,000 shares of the firm's stock in a transaction on Wednesday, March 19th. The stock was purchased at an average cost of $23.39 per share, with a total value of $163,730.00. Following the completion of the transaction, the director now directly owns 15,706 shares of the company's stock, valued at approximately $367,363.34. The trade was a 80.40 % increase in their ownership of the stock. The disclosure for this purchase can be found here. Over the last 90 days, insiders have acquired 9,784 shares of company stock worth $237,409. Insiders own 5.10% of the company's stock.

Analyst Ratings Changes

Separately, StockNews.com cut Greene County Bancorp from a "hold" rating to a "sell" rating in a report on Friday.

Get Our Latest Stock Report on Greene County Bancorp

Greene County Bancorp Company Profile

(

Get Free Report)

Greene County Bancorp, Inc operates as a holding company for The Bank of Greene County that provides various financial services in the United States. The company's deposit products include savings, NOW accounts, money market accounts, certificates of deposit, non-interest bearing checking accounts, and individual retirement accounts.

Featured Stories

Before you consider Greene County Bancorp, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Greene County Bancorp wasn't on the list.

While Greene County Bancorp currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.