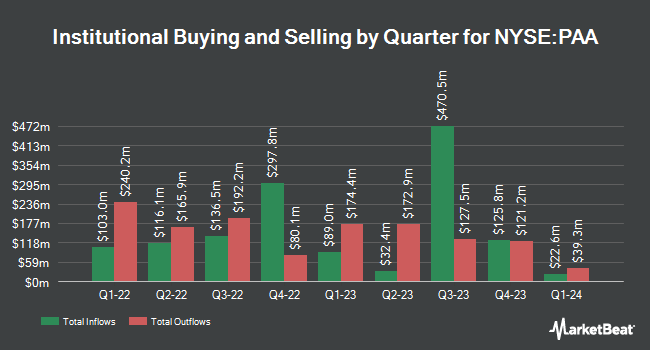

Greenland Capital Management LP purchased a new stake in Plains All American Pipeline, L.P. (NYSE:PAA - Free Report) in the 4th quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The institutional investor purchased 25,000 shares of the pipeline company's stock, valued at approximately $427,000.

Several other institutional investors and hedge funds have also recently bought and sold shares of PAA. Manning & Napier Advisors LLC bought a new position in Plains All American Pipeline during the fourth quarter worth about $1,708,000. Stifel Financial Corp raised its stake in Plains All American Pipeline by 30.6% during the third quarter. Stifel Financial Corp now owns 230,729 shares of the pipeline company's stock worth $4,008,000 after acquiring an additional 54,111 shares in the last quarter. FMR LLC lifted its holdings in shares of Plains All American Pipeline by 91.1% during the third quarter. FMR LLC now owns 600,282 shares of the pipeline company's stock valued at $10,427,000 after acquiring an additional 286,222 shares during the period. PFG Investments LLC boosted its stake in shares of Plains All American Pipeline by 47.0% in the 4th quarter. PFG Investments LLC now owns 45,151 shares of the pipeline company's stock valued at $771,000 after purchasing an additional 14,432 shares in the last quarter. Finally, Caprock Group LLC bought a new stake in shares of Plains All American Pipeline in the 4th quarter worth about $591,000. Institutional investors own 41.78% of the company's stock.

Plains All American Pipeline Stock Up 1.8 %

Shares of NYSE PAA traded up $0.30 during trading hours on Monday, hitting $17.08. The company had a trading volume of 1,596,076 shares, compared to its average volume of 4,219,049. The stock has a market capitalization of $12.02 billion, a P/E ratio of 23.40 and a beta of 1.17. The company has a quick ratio of 0.92, a current ratio of 1.01 and a debt-to-equity ratio of 0.64. The firm's 50 day moving average is $19.38 and its 200-day moving average is $18.45. Plains All American Pipeline, L.P. has a 1-year low of $15.57 and a 1-year high of $21.00.

Plains All American Pipeline Dividend Announcement

The firm also recently declared a quarterly dividend, which will be paid on Thursday, May 15th. Investors of record on Thursday, May 1st will be issued a dividend of $0.38 per share. This represents a $1.52 dividend on an annualized basis and a yield of 8.90%. The ex-dividend date of this dividend is Thursday, May 1st. Plains All American Pipeline's payout ratio is currently 208.22%.

Wall Street Analysts Forecast Growth

Several analysts have weighed in on the stock. Raymond James upped their price objective on shares of Plains All American Pipeline from $23.00 to $24.00 and gave the stock a "strong-buy" rating in a research note on Tuesday, January 28th. Barclays cut their price objective on Plains All American Pipeline from $19.00 to $18.00 and set an "underweight" rating for the company in a research report on Thursday. Morgan Stanley lifted their price target on Plains All American Pipeline from $19.00 to $23.00 and gave the company an "equal weight" rating in a report on Tuesday, March 25th. Scotiabank dropped their target price on shares of Plains All American Pipeline from $23.00 to $22.00 and set a "sector outperform" rating for the company in a research note on Thursday, March 6th. Finally, Wolfe Research upgraded shares of Plains All American Pipeline from a "peer perform" rating to an "outperform" rating and set a $22.00 price objective on the stock in a report on Friday, January 10th. One analyst has rated the stock with a sell rating, six have given a hold rating, five have given a buy rating and one has given a strong buy rating to the company. According to MarketBeat.com, the company has a consensus rating of "Hold" and an average target price of $20.50.

View Our Latest Analysis on PAA

Plains All American Pipeline Company Profile

(

Free Report)

Plains All American Pipeline, L.P., through its subsidiaries, engages in the pipeline transportation, terminaling, storage, and gathering of crude oil and natural gas liquids (NGL) in the United States and Canada. The company operates through two segments, Crude Oil and NGL. The Crude Oil segment offers gathering and transporting crude oil through pipelines, gathering systems, trucks, and on barges or railcars.

Recommended Stories

Before you consider Plains All American Pipeline, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Plains All American Pipeline wasn't on the list.

While Plains All American Pipeline currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.