Greenwood Capital Associates LLC acquired a new position in shares of Best Buy Co., Inc. (NYSE:BBY - Free Report) in the 3rd quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor acquired 7,905 shares of the technology retailer's stock, valued at approximately $817,000.

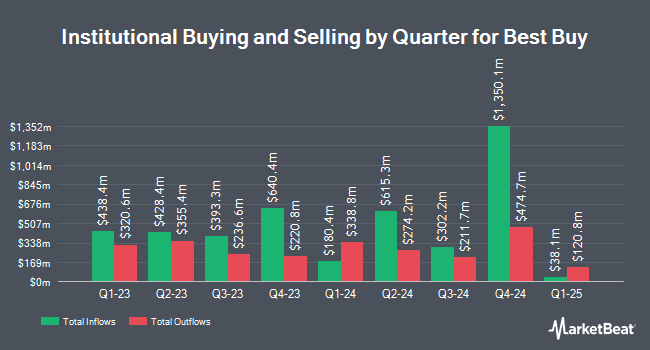

A number of other large investors have also recently bought and sold shares of the company. Ninety One UK Ltd acquired a new position in shares of Best Buy during the 2nd quarter worth $121,325,000. Thrivent Financial for Lutherans lifted its holdings in shares of Best Buy by 4,337.6% in the second quarter. Thrivent Financial for Lutherans now owns 1,099,495 shares of the technology retailer's stock worth $92,677,000 after acquiring an additional 1,074,718 shares during the last quarter. Bank of New York Mellon Corp lifted its holdings in shares of Best Buy by 55.7% in the second quarter. Bank of New York Mellon Corp now owns 2,863,291 shares of the technology retailer's stock worth $241,347,000 after acquiring an additional 1,024,824 shares during the last quarter. Swedbank AB bought a new stake in shares of Best Buy during the 1st quarter valued at approximately $43,522,000. Finally, AQR Capital Management LLC increased its position in Best Buy by 55.4% during the 2nd quarter. AQR Capital Management LLC now owns 1,379,195 shares of the technology retailer's stock worth $116,252,000 after purchasing an additional 491,781 shares in the last quarter. 80.96% of the stock is currently owned by institutional investors and hedge funds.

Wall Street Analyst Weigh In

A number of analysts have weighed in on BBY shares. Barclays boosted their target price on shares of Best Buy from $81.00 to $95.00 and gave the stock an "equal weight" rating in a research note on Friday, August 30th. UBS Group increased their target price on Best Buy from $106.00 to $123.00 and gave the company a "buy" rating in a research report on Friday, August 30th. The Goldman Sachs Group boosted their price target on Best Buy from $95.00 to $116.00 and gave the stock a "buy" rating in a report on Tuesday, September 3rd. Wedbush raised their price objective on shares of Best Buy from $85.00 to $95.00 and gave the company a "neutral" rating in a report on Friday, August 30th. Finally, BNP Paribas raised shares of Best Buy to a "strong-buy" rating in a report on Thursday, August 29th. One equities research analyst has rated the stock with a sell rating, seven have assigned a hold rating, ten have assigned a buy rating and one has assigned a strong buy rating to the stock. According to MarketBeat, the company currently has an average rating of "Moderate Buy" and an average price target of $103.71.

Get Our Latest Stock Report on Best Buy

Best Buy Stock Down 3.7 %

BBY stock traded down $3.42 during trading on Wednesday, reaching $89.42. 4,939,042 shares of the stock were exchanged, compared to its average volume of 2,995,458. The company has a current ratio of 1.01, a quick ratio of 0.34 and a debt-to-equity ratio of 0.37. Best Buy Co., Inc. has a twelve month low of $62.30 and a twelve month high of $103.71. The firm's 50 day moving average is $96.98 and its 200 day moving average is $87.43. The firm has a market cap of $19.20 billion, a P/E ratio of 15.41, a price-to-earnings-growth ratio of 2.38 and a beta of 1.47.

Best Buy (NYSE:BBY - Get Free Report) last posted its quarterly earnings results on Thursday, August 29th. The technology retailer reported $1.34 earnings per share (EPS) for the quarter, beating the consensus estimate of $1.16 by $0.18. Best Buy had a net margin of 2.96% and a return on equity of 47.19%. The business had revenue of $9.29 billion during the quarter, compared to the consensus estimate of $9.23 billion. During the same quarter last year, the firm posted $1.22 EPS. Best Buy's revenue was down 3.1% compared to the same quarter last year. As a group, research analysts forecast that Best Buy Co., Inc. will post 6.28 EPS for the current year.

Best Buy Dividend Announcement

The firm also recently declared a quarterly dividend, which was paid on Thursday, October 10th. Investors of record on Thursday, September 19th were given a $0.94 dividend. The ex-dividend date of this dividend was Thursday, September 19th. This represents a $3.76 annualized dividend and a yield of 4.20%. Best Buy's payout ratio is 64.83%.

About Best Buy

(

Free Report)

Best Buy Co, Inc engages in the retail of technology products in the United States, Canada, and international. Its stores provide computing and mobile phone products, such as desktops, notebooks, and peripherals; mobile phones comprising related mobile network carrier commissions; networking products; tablets covering e-readers; smartwatches; and consumer electronics consisting of digital imaging, health and fitness products, portable audio comprising headphones and portable speakers, and smart home products, as well as home theaters, which includes home theater accessories, soundbars, and televisions.

Featured Stories

Before you consider Best Buy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Best Buy wasn't on the list.

While Best Buy currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.