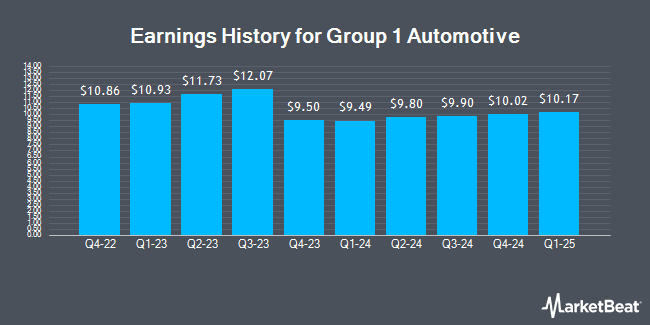

Group 1 Automotive (NYSE:GPI - Get Free Report) announced its quarterly earnings data on Wednesday. The company reported $10.02 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $8.77 by $1.25, Zacks reports. Group 1 Automotive had a return on equity of 18.25% and a net margin of 2.47%.

Group 1 Automotive Price Performance

GPI traded down $5.32 during trading hours on Friday, hitting $456.62. The company's stock had a trading volume of 109,985 shares, compared to its average volume of 111,525. The stock has a market cap of $6.08 billion, a price-to-earnings ratio of 12.43 and a beta of 1.36. The business's 50-day moving average price is $431.34 and its 200-day moving average price is $387.39. The company has a current ratio of 1.00, a quick ratio of 0.24 and a debt-to-equity ratio of 0.91. Group 1 Automotive has a 12 month low of $255.73 and a 12 month high of $471.28.

Group 1 Automotive Announces Dividend

The company also recently disclosed a quarterly dividend, which was paid on Monday, December 16th. Shareholders of record on Monday, December 2nd were paid a $0.47 dividend. This represents a $1.88 dividend on an annualized basis and a yield of 0.41%. The ex-dividend date of this dividend was Monday, December 2nd. Group 1 Automotive's payout ratio is 5.12%.

Analysts Set New Price Targets

A number of research firms have weighed in on GPI. StockNews.com upgraded shares of Group 1 Automotive from a "sell" rating to a "hold" rating in a research report on Friday, November 8th. JPMorgan Chase & Co. dropped their target price on shares of Group 1 Automotive from $425.00 to $420.00 and set an "overweight" rating for the company in a report on Friday, January 17th. Stephens reissued an "equal weight" rating and set a $460.00 price target on shares of Group 1 Automotive in a report on Thursday. Guggenheim boosted their price objective on Group 1 Automotive from $420.00 to $442.00 and gave the company a "buy" rating in a research report on Thursday, November 21st. Finally, Jefferies Financial Group initiated coverage on Group 1 Automotive in a research report on Friday, December 13th. They set a "buy" rating and a $500.00 target price for the company. Two investment analysts have rated the stock with a hold rating and five have issued a buy rating to the company. According to data from MarketBeat.com, the company currently has an average rating of "Moderate Buy" and a consensus price target of $447.83.

Check Out Our Latest Research Report on Group 1 Automotive

Insider Buying and Selling at Group 1 Automotive

In related news, Director Lincoln Pereira sold 6,000 shares of the firm's stock in a transaction on Monday, December 16th. The stock was sold at an average price of $426.68, for a total value of $2,560,080.00. Following the completion of the sale, the director now directly owns 98,467 shares in the company, valued at $42,013,899.56. This trade represents a 5.74 % decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available through this hyperlink. Also, VP Edward Mckissic sold 79 shares of Group 1 Automotive stock in a transaction on Tuesday, November 5th. The stock was sold at an average price of $374.01, for a total transaction of $29,546.79. Following the transaction, the vice president now directly owns 6,259 shares of the company's stock, valued at $2,340,928.59. The trade was a 1.25 % decrease in their ownership of the stock. The disclosure for this sale can be found here. 1.70% of the stock is owned by company insiders.

Group 1 Automotive declared that its board has authorized a share repurchase plan on Tuesday, November 12th that allows the company to repurchase $500.00 million in shares. This repurchase authorization allows the company to purchase up to 9.3% of its shares through open market purchases. Shares repurchase plans are typically an indication that the company's board believes its stock is undervalued.

Group 1 Automotive Company Profile

(

Get Free Report)

Group 1 Automotive, Inc, through its subsidiaries, operates in the automotive retail industry in the United States and the United Kingdom. The company sells new and used cars, light trucks, and vehicle parts, as well as service and insurance contracts; arranges related vehicle financing; and offers automotive maintenance and repair services.

Featured Articles

Before you consider Group 1 Automotive, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Group 1 Automotive wasn't on the list.

While Group 1 Automotive currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.