Group 1 Automotive (NYSE:GPI - Get Free Report) had its price objective decreased by equities research analysts at JPMorgan Chase & Co. from $495.00 to $435.00 in a report released on Thursday,Benzinga reports. The firm presently has an "overweight" rating on the stock. JPMorgan Chase & Co.'s target price points to a potential upside of 14.93% from the stock's current price.

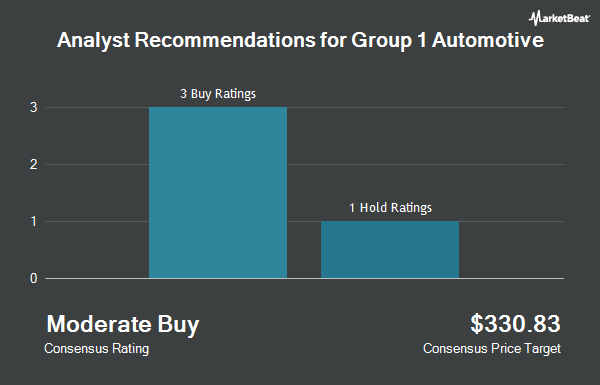

Other analysts also recently issued reports about the stock. Stephens reissued an "equal weight" rating and issued a $460.00 price target on shares of Group 1 Automotive in a research note on Thursday, January 30th. Jefferies Financial Group initiated coverage on Group 1 Automotive in a report on Friday, December 13th. They set a "buy" rating and a $500.00 target price for the company. Two analysts have rated the stock with a hold rating and five have issued a buy rating to the company. Based on data from MarketBeat, Group 1 Automotive presently has an average rating of "Moderate Buy" and a consensus price target of $450.33.

Check Out Our Latest Research Report on GPI

Group 1 Automotive Price Performance

GPI stock traded up $2.53 during mid-day trading on Thursday, hitting $378.49. 75,172 shares of the stock were exchanged, compared to its average volume of 157,907. The company has a debt-to-equity ratio of 0.92, a current ratio of 1.03 and a quick ratio of 0.24. The stock has a market capitalization of $5.01 billion, a price-to-earnings ratio of 10.30 and a beta of 1.33. The business has a fifty day moving average price of $442.80 and a 200 day moving average price of $413.91. Group 1 Automotive has a 12 month low of $262.31 and a 12 month high of $490.09.

Group 1 Automotive (NYSE:GPI - Get Free Report) last issued its quarterly earnings results on Wednesday, January 29th. The company reported $10.02 EPS for the quarter, beating analysts' consensus estimates of $8.77 by $1.25. Group 1 Automotive had a net margin of 2.47% and a return on equity of 18.09%. On average, sell-side analysts anticipate that Group 1 Automotive will post 41 EPS for the current year.

Hedge Funds Weigh In On Group 1 Automotive

Several hedge funds and other institutional investors have recently modified their holdings of the stock. Captrust Financial Advisors boosted its position in Group 1 Automotive by 4.2% during the 4th quarter. Captrust Financial Advisors now owns 571 shares of the company's stock valued at $241,000 after acquiring an additional 23 shares in the last quarter. Avior Wealth Management LLC lifted its stake in shares of Group 1 Automotive by 25.6% in the 4th quarter. Avior Wealth Management LLC now owns 152 shares of the company's stock valued at $64,000 after purchasing an additional 31 shares during the period. Bessemer Group Inc. boosted its position in shares of Group 1 Automotive by 119.4% during the fourth quarter. Bessemer Group Inc. now owns 68 shares of the company's stock valued at $29,000 after purchasing an additional 37 shares in the last quarter. EverSource Wealth Advisors LLC grew its stake in Group 1 Automotive by 13.4% in the fourth quarter. EverSource Wealth Advisors LLC now owns 346 shares of the company's stock worth $146,000 after purchasing an additional 41 shares during the period. Finally, HighPoint Advisor Group LLC raised its holdings in Group 1 Automotive by 2.7% in the fourth quarter. HighPoint Advisor Group LLC now owns 1,536 shares of the company's stock worth $647,000 after purchasing an additional 41 shares in the last quarter. Hedge funds and other institutional investors own 99.92% of the company's stock.

About Group 1 Automotive

(

Get Free Report)

Group 1 Automotive, Inc, through its subsidiaries, operates in the automotive retail industry in the United States and the United Kingdom. The company sells new and used cars, light trucks, and vehicle parts, as well as service and insurance contracts; arranges related vehicle financing; and offers automotive maintenance and repair services.

See Also

Before you consider Group 1 Automotive, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Group 1 Automotive wasn't on the list.

While Group 1 Automotive currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.