Groupama Asset Managment increased its holdings in shares of Waste Management, Inc. (NYSE:WM - Free Report) by 40.3% during the 3rd quarter, according to the company in its most recent 13F filing with the SEC. The institutional investor owned 18,472 shares of the business services provider's stock after acquiring an additional 5,304 shares during the period. Groupama Asset Managment's holdings in Waste Management were worth $3,835,000 at the end of the most recent reporting period.

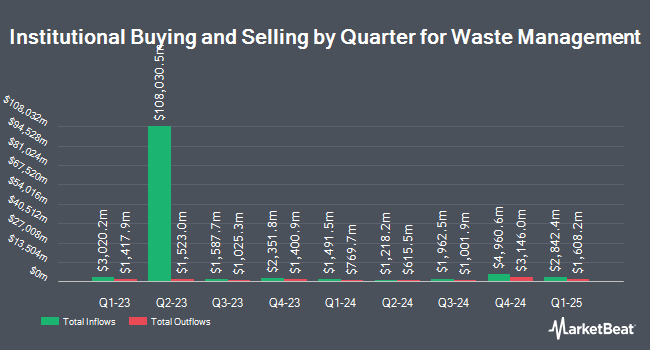

Other hedge funds have also recently added to or reduced their stakes in the company. Nomura Asset Management Co. Ltd. raised its position in Waste Management by 170.0% in the 3rd quarter. Nomura Asset Management Co. Ltd. now owns 333,922 shares of the business services provider's stock worth $69,322,000 after purchasing an additional 210,258 shares during the last quarter. MML Investors Services LLC raised its position in shares of Waste Management by 3.9% during the third quarter. MML Investors Services LLC now owns 74,066 shares of the business services provider's stock worth $15,376,000 after acquiring an additional 2,770 shares during the last quarter. Northeast Financial Consultants Inc lifted its stake in shares of Waste Management by 0.3% during the third quarter. Northeast Financial Consultants Inc now owns 32,893 shares of the business services provider's stock valued at $6,829,000 after acquiring an additional 89 shares during the period. Delos Wealth Advisors LLC boosted its holdings in Waste Management by 7.5% in the third quarter. Delos Wealth Advisors LLC now owns 718 shares of the business services provider's stock valued at $149,000 after acquiring an additional 50 shares during the last quarter. Finally, Orion Portfolio Solutions LLC raised its holdings in Waste Management by 36.0% during the 3rd quarter. Orion Portfolio Solutions LLC now owns 102,708 shares of the business services provider's stock worth $21,322,000 after purchasing an additional 27,212 shares during the last quarter. Institutional investors and hedge funds own 80.40% of the company's stock.

Insider Buying and Selling at Waste Management

In other Waste Management news, Director Maryrose Sylvester sold 310 shares of the company's stock in a transaction dated Tuesday, November 5th. The stock was sold at an average price of $215.47, for a total value of $66,795.70. Following the sale, the director now owns 3,875 shares in the company, valued at approximately $834,946.25. The trade was a 7.41 % decrease in their position. The transaction was disclosed in a filing with the SEC, which is accessible through this link. Corporate insiders own 0.18% of the company's stock.

Waste Management Stock Performance

Shares of NYSE WM traded down $4.29 during trading hours on Monday, reaching $217.90. 675,013 shares of the stock were exchanged, compared to its average volume of 1,608,901. The stock's fifty day simple moving average is $216.94 and its 200 day simple moving average is $211.22. The firm has a market capitalization of $87.46 billion, a price-to-earnings ratio of 33.97, a P/E/G ratio of 2.34 and a beta of 0.75. Waste Management, Inc. has a 52 week low of $172.30 and a 52 week high of $230.39. The company has a debt-to-equity ratio of 2.00, a quick ratio of 0.85 and a current ratio of 0.89.

Waste Management (NYSE:WM - Get Free Report) last released its earnings results on Monday, October 28th. The business services provider reported $1.96 earnings per share for the quarter, beating analysts' consensus estimates of $1.89 by $0.07. Waste Management had a return on equity of 39.88% and a net margin of 12.35%. The firm had revenue of $5.61 billion during the quarter, compared to the consensus estimate of $5.51 billion. During the same period in the prior year, the company posted $1.63 EPS. The company's revenue was up 7.9% compared to the same quarter last year. Sell-side analysts predict that Waste Management, Inc. will post 7.31 EPS for the current year.

Waste Management Announces Dividend

The company also recently announced a quarterly dividend, which will be paid on Friday, December 20th. Shareholders of record on Friday, December 6th will be issued a $0.75 dividend. The ex-dividend date is Friday, December 6th. This represents a $3.00 dividend on an annualized basis and a yield of 1.38%. Waste Management's payout ratio is presently 45.87%.

Wall Street Analyst Weigh In

A number of brokerages recently weighed in on WM. CIBC increased their price target on shares of Waste Management from $228.00 to $235.00 and gave the company a "neutral" rating in a research report on Wednesday, December 4th. BMO Capital Markets lifted their price target on shares of Waste Management from $213.00 to $220.00 and gave the stock a "market perform" rating in a research report on Wednesday, October 30th. Argus upped their price objective on shares of Waste Management from $230.00 to $240.00 and gave the company a "buy" rating in a research report on Thursday, October 31st. UBS Group lifted their target price on Waste Management from $220.00 to $226.00 and gave the stock a "neutral" rating in a report on Wednesday, October 30th. Finally, William Blair began coverage on Waste Management in a research report on Thursday, October 3rd. They set an "outperform" rating on the stock. Ten analysts have rated the stock with a hold rating, ten have issued a buy rating and two have assigned a strong buy rating to the company's stock. According to MarketBeat.com, the stock presently has an average rating of "Moderate Buy" and a consensus target price of $229.33.

Check Out Our Latest Analysis on WM

Waste Management Company Profile

(

Free Report)

Waste Management, Inc, through its subsidiaries, engages in the provision of environmental solutions to residential, commercial, industrial, and municipal customers in the United States and Canada. It offers collection services, including picking up and transporting waste and recyclable materials from where it was generated to a transfer station, material recovery facility (MRF), or disposal site; and owns and operates transfer stations, as well as owns, develops, and operates landfill facilities that produce landfill gas used as renewable natural gas for generating electricity.

Featured Articles

Before you consider Waste Management, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Waste Management wasn't on the list.

While Waste Management currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.