GSA Capital Partners LLP increased its stake in Otter Tail Co. (NASDAQ:OTTR - Free Report) by 285.1% during the third quarter, according to the company in its most recent 13F filing with the SEC. The firm owned 19,030 shares of the utilities provider's stock after purchasing an additional 14,089 shares during the quarter. GSA Capital Partners LLP's holdings in Otter Tail were worth $1,487,000 at the end of the most recent quarter.

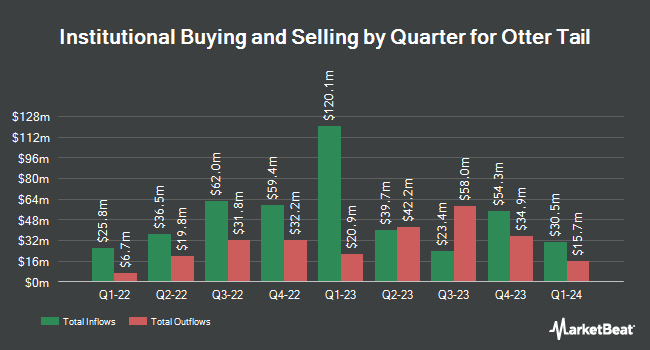

A number of other institutional investors have also bought and sold shares of OTTR. Vanguard Group Inc. increased its stake in Otter Tail by 3.9% in the 1st quarter. Vanguard Group Inc. now owns 5,238,510 shares of the utilities provider's stock worth $452,607,000 after buying an additional 197,617 shares in the last quarter. Bank & Trust Co purchased a new position in shares of Otter Tail during the second quarter valued at about $11,129,000. International Assets Investment Management LLC grew its position in shares of Otter Tail by 3,339.9% during the third quarter. International Assets Investment Management LLC now owns 76,434 shares of the utilities provider's stock valued at $5,974,000 after purchasing an additional 74,212 shares in the last quarter. Edgestream Partners L.P. grew its position in shares of Otter Tail by 2,055.2% during the second quarter. Edgestream Partners L.P. now owns 67,695 shares of the utilities provider's stock valued at $5,929,000 after purchasing an additional 64,554 shares in the last quarter. Finally, Jupiter Asset Management Ltd. purchased a new position in shares of Otter Tail during the first quarter valued at about $2,276,000. Hedge funds and other institutional investors own 61.32% of the company's stock.

Otter Tail Trading Up 0.1 %

Shares of NASDAQ:OTTR traded up $0.11 during trading on Thursday, reaching $80.42. The company's stock had a trading volume of 52,201 shares, compared to its average volume of 234,119. The company has a current ratio of 2.17, a quick ratio of 1.66 and a debt-to-equity ratio of 0.58. Otter Tail Co. has a 12 month low of $73.43 and a 12 month high of $100.84. The firm's 50 day simple moving average is $78.52 and its two-hundred day simple moving average is $85.54. The stock has a market capitalization of $3.36 billion, a PE ratio of 11.09 and a beta of 0.52.

Otter Tail (NASDAQ:OTTR - Get Free Report) last announced its quarterly earnings results on Monday, November 4th. The utilities provider reported $2.03 EPS for the quarter, beating analysts' consensus estimates of $1.97 by $0.06. Otter Tail had a net margin of 22.70% and a return on equity of 19.84%. The firm had revenue of $338.03 million during the quarter, compared to the consensus estimate of $362.20 million. During the same quarter last year, the firm earned $2.19 EPS. On average, research analysts predict that Otter Tail Co. will post 7.01 EPS for the current fiscal year.

Otter Tail Announces Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Tuesday, December 10th. Shareholders of record on Friday, November 15th will be paid a $0.468 dividend. This represents a $1.87 annualized dividend and a yield of 2.33%. The ex-dividend date of this dividend is Friday, November 15th. Otter Tail's payout ratio is currently 25.83%.

Analyst Upgrades and Downgrades

OTTR has been the subject of a number of research analyst reports. StockNews.com upgraded Otter Tail from a "sell" rating to a "hold" rating in a research report on Thursday. Siebert Williams Shank raised shares of Otter Tail from a "strong sell" rating to a "hold" rating in a report on Wednesday, November 6th.

Get Our Latest Stock Report on OTTR

Otter Tail Company Profile

(

Free Report)

Otter Tail Corporation, together with its subsidiaries, engages in electric utility, manufacturing, and plastic pipe businesses in the United States. It operates through three segments: Electric, Manufacturing, and Plastics. The Electric segment produces, transmits, distributes, and sells electric energy in Minnesota, North Dakota, and South Dakota; and operates as a participant in the Midcontinent Independent System Operator markets.

Read More

Before you consider Otter Tail, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Otter Tail wasn't on the list.

While Otter Tail currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.