GSA Capital Partners LLP acquired a new stake in Duolingo, Inc. (NASDAQ:DUOL - Free Report) during the third quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The firm acquired 2,152 shares of the company's stock, valued at approximately $607,000.

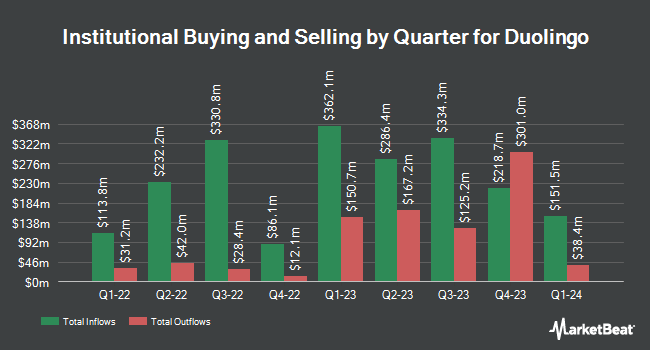

Several other institutional investors have also added to or reduced their stakes in the company. Larson Financial Group LLC acquired a new position in Duolingo during the 2nd quarter worth about $31,000. Blue Trust Inc. acquired a new stake in shares of Duolingo during the second quarter worth $32,000. GAMMA Investing LLC raised its stake in Duolingo by 350.0% during the second quarter. GAMMA Investing LLC now owns 171 shares of the company's stock worth $36,000 after buying an additional 133 shares during the last quarter. Mark Sheptoff Financial Planning LLC acquired a new position in Duolingo in the second quarter valued at $36,000. Finally, Farther Finance Advisors LLC boosted its position in Duolingo by 164.6% during the third quarter. Farther Finance Advisors LLC now owns 127 shares of the company's stock valued at $36,000 after acquiring an additional 79 shares during the last quarter. 91.59% of the stock is currently owned by institutional investors and hedge funds.

Insider Buying and Selling

In other Duolingo news, CFO Matthew Skaruppa sold 17,591 shares of the stock in a transaction on Wednesday, August 21st. The stock was sold at an average price of $207.27, for a total transaction of $3,646,086.57. Following the sale, the chief financial officer now owns 88,856 shares of the company's stock, valued at approximately $18,417,183.12. This trade represents a 16.53 % decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Also, General Counsel Stephen C. Chen sold 19,464 shares of Duolingo stock in a transaction dated Friday, August 30th. The shares were sold at an average price of $211.55, for a total value of $4,117,609.20. Following the completion of the transaction, the general counsel now owns 35,558 shares in the company, valued at $7,522,294.90. This trade represents a 35.37 % decrease in their position. The disclosure for this sale can be found here. In the last three months, insiders sold 70,374 shares of company stock valued at $15,802,382. Insiders own 18.30% of the company's stock.

Duolingo Stock Performance

Shares of NASDAQ DUOL traded up $15.15 during midday trading on Tuesday, hitting $322.07. 646,945 shares of the stock traded hands, compared to its average volume of 696,486. The firm has a market capitalization of $14.17 billion, a P/E ratio of 167.72 and a beta of 0.79. Duolingo, Inc. has a one year low of $145.05 and a one year high of $330.61. The company has a debt-to-equity ratio of 0.07, a quick ratio of 3.09 and a current ratio of 3.09. The firm has a 50-day moving average of $283.47 and a two-hundred day moving average of $225.51.

Duolingo (NASDAQ:DUOL - Get Free Report) last released its earnings results on Wednesday, November 6th. The company reported $0.49 EPS for the quarter, topping analysts' consensus estimates of $0.35 by $0.14. Duolingo had a net margin of 12.59% and a return on equity of 11.74%. The company had revenue of $192.59 million for the quarter, compared to analysts' expectations of $189.19 million. During the same quarter last year, the business earned $0.06 EPS. The firm's revenue was up 39.9% compared to the same quarter last year. On average, equities analysts forecast that Duolingo, Inc. will post 2.02 EPS for the current fiscal year.

Analysts Set New Price Targets

A number of equities analysts have issued reports on the company. DA Davidson increased their price target on Duolingo from $250.00 to $350.00 and gave the stock a "buy" rating in a report on Thursday, November 7th. Piper Sandler lifted their price target on shares of Duolingo from $271.00 to $351.00 and gave the company an "overweight" rating in a research note on Thursday, November 7th. Barclays increased their price objective on shares of Duolingo from $183.00 to $295.00 and gave the stock an "equal weight" rating in a research report on Thursday, November 7th. UBS Group upped their price target on Duolingo from $355.00 to $408.00 and gave the stock a "buy" rating in a research note on Thursday, November 14th. Finally, JMP Securities cut Duolingo from an "outperform" rating to a "market perform" rating in a research note on Monday, October 14th. Five analysts have rated the stock with a hold rating, six have given a buy rating and one has assigned a strong buy rating to the company's stock. Based on data from MarketBeat.com, the company presently has an average rating of "Moderate Buy" and an average target price of $331.33.

Check Out Our Latest Research Report on DUOL

Duolingo Company Profile

(

Free Report)

Duolingo, Inc operates as a mobile learning platform in the United States, the United Kingdom, and internationally. The company offers courses in 40 different languages, including Spanish, English, French, German, Italian, Portuguese, Japanese, and Chinese through its Duolingo app. It also provides a digital English language proficiency assessment exam.

See Also

Before you consider Duolingo, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Duolingo wasn't on the list.

While Duolingo currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.