GSA Capital Partners LLP raised its stake in ARS Pharmaceuticals, Inc. (NASDAQ:SPRY - Free Report) by 67.7% during the third quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The fund owned 98,900 shares of the company's stock after acquiring an additional 39,921 shares during the quarter. GSA Capital Partners LLP owned approximately 0.10% of ARS Pharmaceuticals worth $1,434,000 as of its most recent filing with the Securities & Exchange Commission.

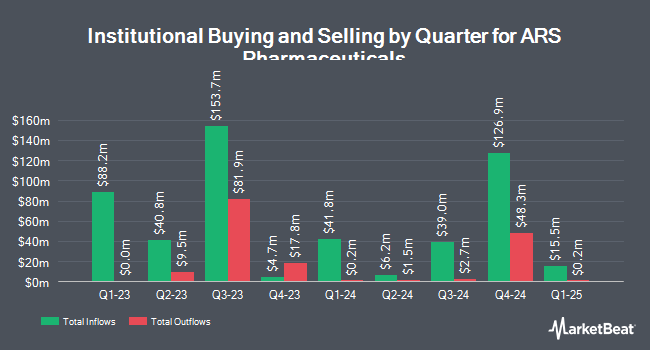

Other hedge funds and other institutional investors have also recently added to or reduced their stakes in the company. J.W. Cole Advisors Inc. lifted its stake in shares of ARS Pharmaceuticals by 10.8% during the 2nd quarter. J.W. Cole Advisors Inc. now owns 15,400 shares of the company's stock valued at $131,000 after buying an additional 1,500 shares in the last quarter. nVerses Capital LLC purchased a new stake in shares of ARS Pharmaceuticals during the 3rd quarter valued at approximately $30,000. Creative Planning lifted its stake in shares of ARS Pharmaceuticals by 7.0% during the 3rd quarter. Creative Planning now owns 35,263 shares of the company's stock valued at $511,000 after buying an additional 2,307 shares in the last quarter. Levin Capital Strategies L.P. lifted its stake in shares of ARS Pharmaceuticals by 5.7% during the 1st quarter. Levin Capital Strategies L.P. now owns 55,250 shares of the company's stock valued at $565,000 after buying an additional 3,000 shares in the last quarter. Finally, Zurcher Kantonalbank Zurich Cantonalbank increased its holdings in ARS Pharmaceuticals by 151.7% during the 2nd quarter. Zurcher Kantonalbank Zurich Cantonalbank now owns 7,419 shares of the company's stock worth $63,000 after acquiring an additional 4,472 shares during the period. 68.16% of the stock is currently owned by hedge funds and other institutional investors.

ARS Pharmaceuticals Price Performance

SPRY traded up $0.10 during trading on Thursday, hitting $14.18. 763,001 shares of the stock traded hands, compared to its average volume of 802,915. The firm has a market capitalization of $1.37 billion, a P/E ratio of -29.96 and a beta of 0.90. The firm has a 50-day moving average of $14.53 and a 200 day moving average of $11.65. ARS Pharmaceuticals, Inc. has a 12-month low of $4.27 and a 12-month high of $18.51.

Analysts Set New Price Targets

A number of analysts recently weighed in on the stock. Cantor Fitzgerald reaffirmed an "overweight" rating and set a $30.00 target price on shares of ARS Pharmaceuticals in a report on Tuesday, October 8th. Leerink Partners increased their price target on shares of ARS Pharmaceuticals from $21.00 to $25.00 and gave the stock an "outperform" rating in a report on Friday, September 20th. William Blair raised shares of ARS Pharmaceuticals to a "strong-buy" rating in a report on Friday, August 30th. Finally, Raymond James raised shares of ARS Pharmaceuticals from an "outperform" rating to a "strong-buy" rating and upped their price objective for the company from $18.00 to $22.00 in a research note on Tuesday, August 13th. Four analysts have rated the stock with a buy rating and two have given a strong buy rating to the company's stock. According to MarketBeat.com, ARS Pharmaceuticals has an average rating of "Buy" and a consensus price target of $24.00.

View Our Latest Stock Report on ARS Pharmaceuticals

Insider Buying and Selling at ARS Pharmaceuticals

In other ARS Pharmaceuticals news, COO Brian Dorsey sold 50,000 shares of the stock in a transaction on Tuesday, August 20th. The shares were sold at an average price of $15.00, for a total transaction of $750,000.00. Following the completion of the sale, the chief operating officer now owns 6,024 shares of the company's stock, valued at $90,360. This represents a 0.00 % decrease in their position. The sale was disclosed in a filing with the SEC, which is available at the SEC website. In other news, COO Brian Dorsey sold 50,000 shares of the firm's stock in a transaction dated Tuesday, August 20th. The shares were sold at an average price of $15.00, for a total value of $750,000.00. Following the completion of the sale, the chief operating officer now directly owns 6,024 shares of the company's stock, valued at approximately $90,360. This trade represents a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is accessible through the SEC website. Also, CEO Richard E. Lowenthal sold 100,000 shares of the firm's stock in a transaction dated Tuesday, August 20th. The stock was sold at an average price of $15.03, for a total transaction of $1,503,000.00. Following the completion of the sale, the chief executive officer now directly owns 1,497,447 shares of the company's stock, valued at approximately $22,506,628.41. This represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 1,584,351 shares of company stock valued at $24,152,378 in the last quarter. Company insiders own 40.10% of the company's stock.

ARS Pharmaceuticals Profile

(

Free Report)

ARS Pharmaceuticals, Inc, a biopharmaceutical company, develops treatments for severe allergic reactions. The company is developing neffy, a needle-free and low-dose intranasal epinephrine nasal spray for the emergency treatment of Type I allergic reactions, including anaphylaxis. It serves healthcare professionals, patients, and caregivers.

See Also

Before you consider ARS Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ARS Pharmaceuticals wasn't on the list.

While ARS Pharmaceuticals currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.