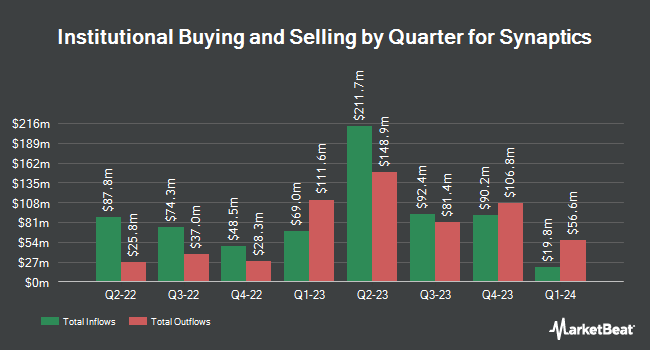

GSA Capital Partners LLP acquired a new position in shares of Synaptics Incorporated (NASDAQ:SYNA - Free Report) in the third quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The fund acquired 12,872 shares of the software maker's stock, valued at approximately $999,000.

A number of other institutional investors also recently made changes to their positions in SYNA. GAMMA Investing LLC boosted its stake in shares of Synaptics by 261.8% in the third quarter. GAMMA Investing LLC now owns 369 shares of the software maker's stock valued at $29,000 after buying an additional 267 shares during the period. Migdal Insurance & Financial Holdings Ltd. bought a new stake in shares of Synaptics in the second quarter valued at approximately $67,000. Innealta Capital LLC bought a new stake in shares of Synaptics in the second quarter valued at approximately $83,000. CWM LLC boosted its stake in shares of Synaptics by 58.1% in the third quarter. CWM LLC now owns 1,151 shares of the software maker's stock valued at $89,000 after buying an additional 423 shares during the period. Finally, Van ECK Associates Corp bought a new stake in shares of Synaptics in the third quarter valued at approximately $132,000. Institutional investors own 99.43% of the company's stock.

Synaptics Trading Down 0.8 %

NASDAQ SYNA traded down $0.60 on Friday, reaching $74.64. The company had a trading volume of 3,484,591 shares, compared to its average volume of 327,322. The firm has a market cap of $2.99 billion, a price-to-earnings ratio of 18.90 and a beta of 1.47. Synaptics Incorporated has a fifty-two week low of $67.83 and a fifty-two week high of $121.37. The business has a 50 day moving average of $73.89 and a two-hundred day moving average of $82.07. The company has a debt-to-equity ratio of 0.66, a current ratio of 4.49 and a quick ratio of 4.02.

Analyst Upgrades and Downgrades

SYNA has been the subject of several recent research reports. KeyCorp cut Synaptics from an "overweight" rating to a "sector weight" rating in a research note on Tuesday, October 8th. Rosenblatt Securities lowered their price objective on shares of Synaptics from $130.00 to $92.00 and set a "buy" rating for the company in a research report on Friday, November 8th. JPMorgan Chase & Co. lowered their price objective on shares of Synaptics from $120.00 to $100.00 and set an "overweight" rating for the company in a research report on Friday, August 9th. Susquehanna lowered their price objective on shares of Synaptics from $110.00 to $95.00 and set a "positive" rating for the company in a research report on Monday, October 21st. Finally, Craig Hallum lowered their price objective on shares of Synaptics from $105.00 to $80.00 and set a "hold" rating for the company in a research report on Friday, August 9th. Four investment analysts have rated the stock with a hold rating and six have assigned a buy rating to the company. According to data from MarketBeat, the stock currently has an average rating of "Moderate Buy" and an average target price of $97.33.

Read Our Latest Report on Synaptics

Insider Activity at Synaptics

In related news, insider Vikram Gupta sold 2,731 shares of the stock in a transaction on Friday, September 27th. The stock was sold at an average price of $80.00, for a total value of $218,480.00. Following the completion of the sale, the insider now directly owns 43,245 shares in the company, valued at $3,459,600. This represents a 5.94 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is available at this hyperlink. Insiders sold 5,609 shares of company stock worth $448,720 over the last three months. Company insiders own 1.30% of the company's stock.

Synaptics Profile

(

Free Report)

Synaptics Incorporated develops, markets, and sells semiconductor products worldwide. The company offers AudioSmart for voice and audio processing; ConnectSmart for high-speed video/audio/data connectivity; DisplayLink for transmitting compressed video frames across low bandwidth connections; VideoSmart that enables set-top boxes, over-the-top, streaming devices, soundbars, surveillance cameras, and smart displays; and ImagingSmart solutions.

Further Reading

Before you consider Synaptics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Synaptics wasn't on the list.

While Synaptics currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.