GSA Capital Partners LLP acquired a new stake in shares of Marathon Petroleum Co. (NYSE:MPC - Free Report) in the 3rd quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The fund acquired 11,170 shares of the oil and gas company's stock, valued at approximately $1,820,000.

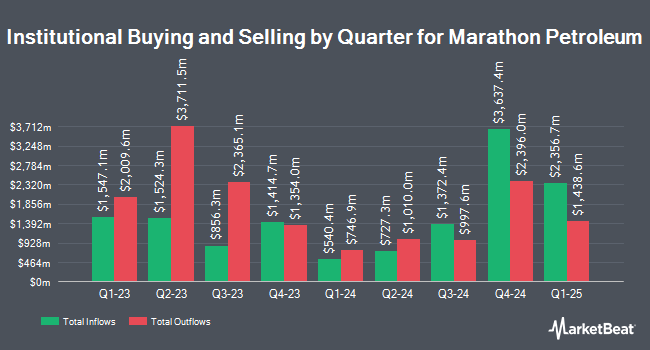

Other hedge funds and other institutional investors have also recently bought and sold shares of the company. International Assets Investment Management LLC increased its position in shares of Marathon Petroleum by 19,153.8% in the third quarter. International Assets Investment Management LLC now owns 1,311,182 shares of the oil and gas company's stock worth $213,605,000 after acquiring an additional 1,304,372 shares in the last quarter. Granite Bay Wealth Management LLC purchased a new stake in Marathon Petroleum in the 2nd quarter worth about $219,537,000. Assenagon Asset Management S.A. grew its stake in Marathon Petroleum by 980.3% during the 2nd quarter. Assenagon Asset Management S.A. now owns 684,718 shares of the oil and gas company's stock valued at $118,785,000 after acquiring an additional 621,336 shares in the last quarter. Panagora Asset Management Inc. grew its position in Marathon Petroleum by 64.1% during the second quarter. Panagora Asset Management Inc. now owns 619,049 shares of the oil and gas company's stock valued at $107,393,000 after purchasing an additional 241,746 shares in the last quarter. Finally, Pacer Advisors Inc. lifted its stake in Marathon Petroleum by 8.5% during the second quarter. Pacer Advisors Inc. now owns 2,669,815 shares of the oil and gas company's stock worth $463,160,000 after purchasing an additional 209,270 shares during the period. 76.77% of the stock is owned by institutional investors.

Analyst Upgrades and Downgrades

Several research firms have issued reports on MPC. JPMorgan Chase & Co. dropped their price target on shares of Marathon Petroleum from $172.00 to $171.00 and set a "neutral" rating on the stock in a research report on Wednesday, October 9th. Bank of America initiated coverage on Marathon Petroleum in a report on Thursday, October 17th. They set a "neutral" rating and a $174.00 price objective for the company. Wells Fargo & Company reduced their target price on Marathon Petroleum from $196.00 to $183.00 and set an "overweight" rating on the stock in a report on Wednesday, October 9th. BMO Capital Markets reduced their price target on shares of Marathon Petroleum from $200.00 to $190.00 and set an "outperform" rating on the stock in a research note on Friday, October 4th. Finally, Wolfe Research initiated coverage on shares of Marathon Petroleum in a research note on Thursday, July 18th. They set an "outperform" rating and a $200.00 target price on the stock. Two analysts have rated the stock with a sell rating, six have assigned a hold rating, nine have assigned a buy rating and one has issued a strong buy rating to the stock. Based on data from MarketBeat.com, the stock currently has a consensus rating of "Moderate Buy" and a consensus target price of $185.07.

View Our Latest Analysis on Marathon Petroleum

Marathon Petroleum Trading Up 2.5 %

Marathon Petroleum stock traded up $3.90 during trading hours on Wednesday, hitting $159.11. The company had a trading volume of 2,183,519 shares, compared to its average volume of 2,657,798. The firm has a market cap of $51.14 billion, a P/E ratio of 12.33, a P/E/G ratio of 2.75 and a beta of 1.38. The company has a 50-day moving average price of $159.69 and a two-hundred day moving average price of $168.87. The company has a debt-to-equity ratio of 0.94, a quick ratio of 0.76 and a current ratio of 1.23. Marathon Petroleum Co. has a 1 year low of $140.98 and a 1 year high of $221.11.

Marathon Petroleum (NYSE:MPC - Get Free Report) last announced its earnings results on Tuesday, November 5th. The oil and gas company reported $1.87 earnings per share for the quarter, topping the consensus estimate of $0.97 by $0.90. Marathon Petroleum had a return on equity of 16.19% and a net margin of 3.15%. The firm had revenue of $35.37 billion for the quarter, compared to the consensus estimate of $34.34 billion. During the same period in the previous year, the business earned $8.14 EPS. The firm's revenue for the quarter was down 14.9% on a year-over-year basis. On average, sell-side analysts anticipate that Marathon Petroleum Co. will post 9.41 earnings per share for the current year.

Marathon Petroleum Increases Dividend

The firm also recently declared a quarterly dividend, which will be paid on Tuesday, December 10th. Shareholders of record on Wednesday, November 20th will be issued a $0.91 dividend. This represents a $3.64 annualized dividend and a yield of 2.29%. This is a positive change from Marathon Petroleum's previous quarterly dividend of $0.83. The ex-dividend date is Wednesday, November 20th. Marathon Petroleum's dividend payout ratio is presently 26.15%.

Marathon Petroleum declared that its Board of Directors has authorized a share buyback program on Tuesday, November 5th that allows the company to buyback $5.00 billion in shares. This buyback authorization allows the oil and gas company to purchase up to 10% of its shares through open market purchases. Shares buyback programs are often an indication that the company's board of directors believes its stock is undervalued.

About Marathon Petroleum

(

Free Report)

Marathon Petroleum Corporation, together with its subsidiaries, operates as an integrated downstream energy company primarily in the United States. The company operates through Refining & Marketing, and Midstream segments. The Refining & Marketing segment refines crude oil and other feedstocks at its refineries in the Gulf Coast, Mid-Continent, and West Coast regions of the United States; and purchases refined products and ethanol for resale and distributes refined products, including renewable diesel, through transportation, storage, distribution, and marketing services.

Further Reading

Before you consider Marathon Petroleum, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Marathon Petroleum wasn't on the list.

While Marathon Petroleum currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.