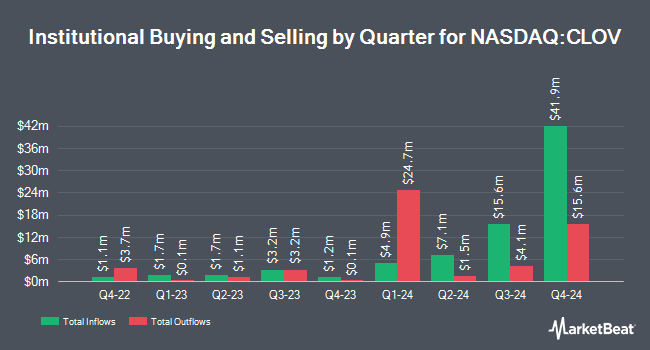

GSA Capital Partners LLP decreased its position in shares of Clover Health Investments, Corp. (NASDAQ:CLOV - Free Report) by 60.6% during the third quarter, according to its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 359,392 shares of the company's stock after selling 553,674 shares during the period. GSA Capital Partners LLP owned approximately 0.07% of Clover Health Investments worth $1,013,000 at the end of the most recent reporting period.

Several other hedge funds have also recently added to or reduced their stakes in the company. Jupiter Asset Management Ltd. raised its holdings in shares of Clover Health Investments by 18.1% during the 1st quarter. Jupiter Asset Management Ltd. now owns 4,525,079 shares of the company's stock valued at $3,593,000 after buying an additional 692,878 shares in the last quarter. XTX Topco Ltd bought a new position in Clover Health Investments during the second quarter valued at approximately $932,000. Choreo LLC purchased a new position in shares of Clover Health Investments during the second quarter worth approximately $344,000. Foundations Investment Advisors LLC bought a new stake in shares of Clover Health Investments in the 3rd quarter worth approximately $55,000. Finally, Marshall Wace LLP bought a new stake in shares of Clover Health Investments in the 2nd quarter worth approximately $55,000. Institutional investors own 19.77% of the company's stock.

Analysts Set New Price Targets

Separately, UBS Group initiated coverage on shares of Clover Health Investments in a report on Monday, October 7th. They set a "neutral" rating and a $4.00 target price on the stock.

Get Our Latest Report on CLOV

Clover Health Investments Trading Down 1.3 %

Shares of NASDAQ:CLOV traded down $0.04 on Friday, reaching $3.04. 5,291,003 shares of the company traded hands, compared to its average volume of 8,084,141. Clover Health Investments, Corp. has a 52 week low of $0.61 and a 52 week high of $4.71. The business's 50-day simple moving average is $3.52 and its 200 day simple moving average is $2.26. The stock has a market capitalization of $1.51 billion, a P/E ratio of -15.20 and a beta of 2.03.

Clover Health Investments (NASDAQ:CLOV - Get Free Report) last announced its quarterly earnings results on Wednesday, November 6th. The company reported ($0.02) EPS for the quarter, topping analysts' consensus estimates of ($0.03) by $0.01. The business had revenue of $330.99 million for the quarter, compared to analysts' expectations of $347.60 million. Clover Health Investments had a negative return on equity of 25.46% and a negative net margin of 5.92%. During the same period in the previous year, the firm earned ($0.09) EPS. Sell-side analysts expect that Clover Health Investments, Corp. will post -0.12 EPS for the current fiscal year.

About Clover Health Investments

(

Free Report)

Clover Health Investments, Corp. provides medicare advantage plans in the United States. It operates through two segments: Insurance and Non-Insurance. It also offers Clover Assistant, a cloud-based software platform, that enables physicians to detect, identify, and manage chronic diseases earlier; and access to data-driven and personalized insights for the patients they treat.

Further Reading

Before you consider Clover Health Investments, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Clover Health Investments wasn't on the list.

While Clover Health Investments currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.