GSA Capital Partners LLP lessened its holdings in shares of Las Vegas Sands Corp. (NYSE:LVS - Free Report) by 75.5% during the 3rd quarter, according to its most recent disclosure with the SEC. The fund owned 4,304 shares of the casino operator's stock after selling 13,276 shares during the period. GSA Capital Partners LLP's holdings in Las Vegas Sands were worth $217,000 at the end of the most recent reporting period.

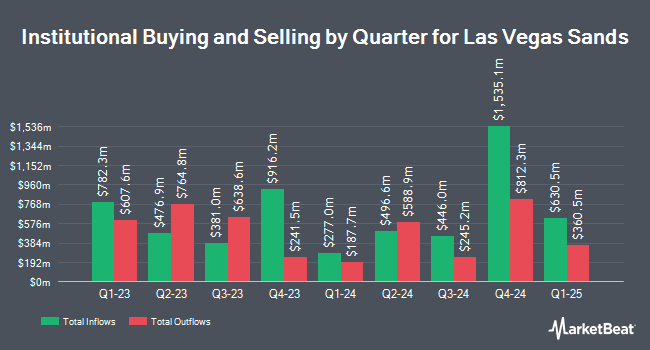

Several other hedge funds have also added to or reduced their stakes in the company. Assenagon Asset Management S.A. grew its stake in Las Vegas Sands by 7,647.7% in the second quarter. Assenagon Asset Management S.A. now owns 443,325 shares of the casino operator's stock valued at $19,617,000 after purchasing an additional 437,603 shares in the last quarter. Sanctuary Advisors LLC acquired a new position in Las Vegas Sands in the 2nd quarter valued at $619,000. Clearbridge Investments LLC raised its holdings in Las Vegas Sands by 29.9% in the 2nd quarter. Clearbridge Investments LLC now owns 833,487 shares of the casino operator's stock valued at $36,882,000 after acquiring an additional 191,805 shares in the last quarter. Principal Financial Group Inc. raised its holdings in shares of Las Vegas Sands by 33.3% during the 3rd quarter. Principal Financial Group Inc. now owns 548,072 shares of the casino operator's stock worth $27,590,000 after buying an additional 136,859 shares in the last quarter. Finally, Cetera Investment Advisers raised its holdings in shares of Las Vegas Sands by 148.3% during the 1st quarter. Cetera Investment Advisers now owns 32,443 shares of the casino operator's stock worth $1,677,000 after buying an additional 19,376 shares in the last quarter. Institutional investors own 39.16% of the company's stock.

Analysts Set New Price Targets

A number of equities research analysts have commented on the company. Mizuho upped their price target on Las Vegas Sands from $52.00 to $57.00 and gave the company an "outperform" rating in a research report on Thursday, October 24th. Argus lowered Las Vegas Sands from a "buy" rating to a "hold" rating in a report on Thursday, August 15th. Stifel Nicolaus raised their price target on Las Vegas Sands from $55.00 to $64.00 and gave the company a "buy" rating in a research report on Thursday, October 24th. JPMorgan Chase & Co. lifted their price objective on Las Vegas Sands from $53.00 to $60.00 and gave the company an "overweight" rating in a research report on Tuesday, October 15th. Finally, Wells Fargo & Company upped their price objective on Las Vegas Sands from $53.00 to $60.00 and gave the company an "overweight" rating in a research report on Tuesday, October 1st. Four equities research analysts have rated the stock with a hold rating and ten have assigned a buy rating to the company's stock. According to MarketBeat.com, the company currently has a consensus rating of "Moderate Buy" and a consensus price target of $58.00.

View Our Latest Report on LVS

Insiders Place Their Bets

In other Las Vegas Sands news, CEO Robert G. Goldstein sold 24,324 shares of the stock in a transaction on Thursday, November 7th. The stock was sold at an average price of $52.00, for a total transaction of $1,264,848.00. Following the completion of the transaction, the chief executive officer now directly owns 60,187 shares of the company's stock, valued at approximately $3,129,724. This trade represents a 28.78 % decrease in their position. The sale was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. 1.20% of the stock is currently owned by insiders.

Las Vegas Sands Trading Up 2.1 %

Shares of LVS stock traded up $1.05 on Monday, hitting $51.13. The stock had a trading volume of 1,768,708 shares, compared to its average volume of 5,752,124. The company has a debt-to-equity ratio of 3.09, a current ratio of 0.90 and a quick ratio of 0.89. The firm has a market capitalization of $37.07 billion, a P/E ratio of 24.79, a P/E/G ratio of 1.32 and a beta of 1.11. Las Vegas Sands Corp. has a 1 year low of $36.62 and a 1 year high of $55.65. The company's 50 day moving average price is $49.73 and its 200-day moving average price is $44.84.

Las Vegas Sands (NYSE:LVS - Get Free Report) last posted its quarterly earnings data on Wednesday, October 23rd. The casino operator reported $0.44 earnings per share for the quarter, missing analysts' consensus estimates of $0.53 by ($0.09). Las Vegas Sands had a return on equity of 44.26% and a net margin of 13.29%. The company had revenue of $2.68 billion for the quarter, compared to analyst estimates of $2.79 billion. During the same period in the previous year, the business posted $0.55 earnings per share. The firm's revenue was down 4.0% compared to the same quarter last year. Analysts anticipate that Las Vegas Sands Corp. will post 2.33 earnings per share for the current year.

Las Vegas Sands Announces Dividend

The company also recently announced a quarterly dividend, which was paid on Wednesday, November 13th. Investors of record on Tuesday, November 5th were issued a $0.20 dividend. This represents a $0.80 dividend on an annualized basis and a yield of 1.56%. The ex-dividend date of this dividend was Tuesday, November 5th. Las Vegas Sands's payout ratio is currently 39.60%.

Las Vegas Sands Profile

(

Free Report)

Las Vegas Sands Corp., together with its subsidiaries, develops, owns, and operates integrated resorts in Macao and Singapore. It owns and operates The Venetian Macao Resort Hotel, the Londoner Macao, The Parisian Macao, The Plaza Macao and Four Seasons Hotel Macao, Cotai Strip, and the Sands Macao in Macao, the People's Republic of China; and Marina Bay Sands in Singapore.

See Also

Before you consider Las Vegas Sands, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Las Vegas Sands wasn't on the list.

While Las Vegas Sands currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.