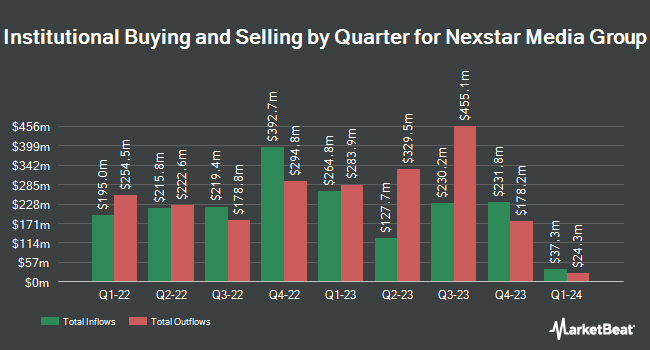

GSA Capital Partners LLP increased its position in shares of Nexstar Media Group, Inc. (NASDAQ:NXST - Free Report) by 211.2% in the 3rd quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The firm owned 6,195 shares of the company's stock after buying an additional 4,204 shares during the period. GSA Capital Partners LLP's holdings in Nexstar Media Group were worth $1,024,000 at the end of the most recent reporting period.

Several other large investors have also recently bought and sold shares of NXST. Mitsubishi UFJ Trust & Banking Corp raised its stake in Nexstar Media Group by 88.3% during the 1st quarter. Mitsubishi UFJ Trust & Banking Corp now owns 4,744 shares of the company's stock valued at $807,000 after purchasing an additional 2,225 shares during the last quarter. Vanguard Group Inc. raised its stake in Nexstar Media Group by 3.9% during the 1st quarter. Vanguard Group Inc. now owns 3,370,415 shares of the company's stock valued at $580,689,000 after purchasing an additional 127,783 shares during the last quarter. Ontario Teachers Pension Plan Board raised its stake in Nexstar Media Group by 16.5% during the 1st quarter. Ontario Teachers Pension Plan Board now owns 5,136 shares of the company's stock valued at $885,000 after purchasing an additional 728 shares during the last quarter. Cynosure Group LLC acquired a new position in shares of Nexstar Media Group in the 1st quarter valued at $325,000. Finally, O Shaughnessy Asset Management LLC raised its stake in shares of Nexstar Media Group by 41.4% in the 1st quarter. O Shaughnessy Asset Management LLC now owns 8,857 shares of the company's stock valued at $1,526,000 after buying an additional 2,591 shares in the last quarter. 95.30% of the stock is currently owned by institutional investors and hedge funds.

Insider Buying and Selling at Nexstar Media Group

In other news, COO Michael Biard sold 2,458 shares of Nexstar Media Group stock in a transaction that occurred on Thursday, August 22nd. The shares were sold at an average price of $169.28, for a total transaction of $416,090.24. Following the completion of the sale, the chief operating officer now owns 3,792 shares in the company, valued at $641,909.76. The trade was a 39.33 % decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available through this link. Also, CEO Perry A. Sook sold 12,239 shares of Nexstar Media Group stock in a transaction that occurred on Thursday, November 7th. The stock was sold at an average price of $190.28, for a total transaction of $2,328,836.92. Following the sale, the chief executive officer now owns 674,694 shares of the company's stock, valued at approximately $128,380,774.32. This represents a 1.78 % decrease in their position. The disclosure for this sale can be found here. In the last 90 days, insiders sold 48,437 shares of company stock worth $8,429,561. 6.30% of the stock is currently owned by corporate insiders.

Nexstar Media Group Price Performance

NXST stock traded down $2.62 during trading on Friday, hitting $161.84. 429,462 shares of the stock traded hands, compared to its average volume of 329,771. Nexstar Media Group, Inc. has a one year low of $141.38 and a one year high of $191.86. The stock has a market cap of $5.02 billion, a price-to-earnings ratio of 9.36, a P/E/G ratio of 0.19 and a beta of 1.48. The company has a 50 day simple moving average of $168.62 and a 200 day simple moving average of $167.09. The company has a current ratio of 1.68, a quick ratio of 1.68 and a debt-to-equity ratio of 2.98.

Nexstar Media Group (NASDAQ:NXST - Get Free Report) last announced its quarterly earnings results on Thursday, November 7th. The company reported $5.27 earnings per share (EPS) for the quarter, missing the consensus estimate of $5.51 by ($0.24). The firm had revenue of $1.37 billion for the quarter, compared to the consensus estimate of $1.37 billion. Nexstar Media Group had a net margin of 11.39% and a return on equity of 26.03%. The company's revenue for the quarter was up 20.7% on a year-over-year basis. During the same period in the prior year, the business earned $0.70 earnings per share. Equities analysts expect that Nexstar Media Group, Inc. will post 25.72 EPS for the current fiscal year.

Nexstar Media Group Dividend Announcement

The business also recently disclosed a quarterly dividend, which will be paid on Friday, November 29th. Shareholders of record on Friday, November 15th will be given a $1.69 dividend. This represents a $6.76 annualized dividend and a yield of 4.18%. The ex-dividend date is Friday, November 15th. Nexstar Media Group's payout ratio is presently 39.10%.

Analyst Upgrades and Downgrades

A number of equities analysts have recently issued reports on NXST shares. Deutsche Bank Aktiengesellschaft dropped their price objective on shares of Nexstar Media Group from $207.00 to $205.00 and set a "buy" rating for the company in a research note on Friday, August 9th. Benchmark restated a "buy" rating and issued a $215.00 price objective on shares of Nexstar Media Group in a research note on Friday, November 8th. StockNews.com upgraded shares of Nexstar Media Group from a "hold" rating to a "buy" rating in a research note on Friday, November 8th. Loop Capital cut shares of Nexstar Media Group from a "buy" rating to a "hold" rating and dropped their price objective for the company from $200.00 to $190.00 in a research note on Friday, November 8th. Finally, Barrington Research restated an "outperform" rating and issued a $200.00 price objective on shares of Nexstar Media Group in a research note on Thursday, November 7th. Two investment analysts have rated the stock with a hold rating and seven have given a buy rating to the stock. According to data from MarketBeat, the stock presently has an average rating of "Moderate Buy" and a consensus price target of $198.50.

Check Out Our Latest Stock Report on Nexstar Media Group

About Nexstar Media Group

(

Free Report)

Nexstar Media Group, Inc operates as a diversified media company that produces and distributes engaging local and national news, sports and entertainment content across the television and digital platforms in the United States. It owns, operates, programs, or provides sales and other services to various markets; and offers television programming services.

Further Reading

Before you consider Nexstar Media Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Nexstar Media Group wasn't on the list.

While Nexstar Media Group currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.