GSA Capital Partners LLP raised its stake in shares of Cardlytics, Inc. (NASDAQ:CDLX - Free Report) by 1,273.2% in the 3rd quarter, according to its most recent Form 13F filing with the SEC. The fund owned 382,315 shares of the company's stock after purchasing an additional 354,474 shares during the period. GSA Capital Partners LLP owned 0.77% of Cardlytics worth $1,223,000 at the end of the most recent reporting period.

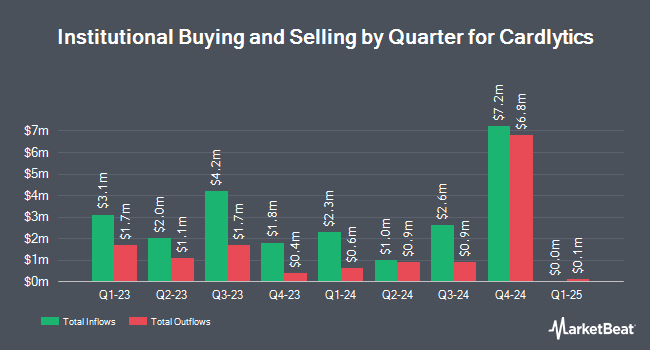

Several other institutional investors and hedge funds have also recently bought and sold shares of the stock. Acorn Financial Advisory Services Inc. ADV increased its position in shares of Cardlytics by 40.5% in the third quarter. Acorn Financial Advisory Services Inc. ADV now owns 164,409 shares of the company's stock worth $526,000 after acquiring an additional 47,358 shares in the last quarter. Creative Planning increased its position in shares of Cardlytics by 35.4% in the third quarter. Creative Planning now owns 29,537 shares of the company's stock worth $95,000 after acquiring an additional 7,721 shares in the last quarter. SG Americas Securities LLC acquired a new stake in shares of Cardlytics in the third quarter worth $45,000. Marshall Wace LLP increased its position in shares of Cardlytics by 6.8% in the second quarter. Marshall Wace LLP now owns 814,281 shares of the company's stock worth $6,685,000 after acquiring an additional 52,081 shares in the last quarter. Finally, XTX Topco Ltd acquired a new stake in shares of Cardlytics in the second quarter worth $107,000. Institutional investors and hedge funds own 68.10% of the company's stock.

Cardlytics Stock Performance

Shares of Cardlytics stock traded down $0.22 during trading hours on Friday, reaching $3.38. The company's stock had a trading volume of 1,038,456 shares, compared to its average volume of 1,235,099. The company's 50 day simple moving average is $3.72 and its 200 day simple moving average is $6.41. The company has a debt-to-equity ratio of 2.40, a quick ratio of 1.18 and a current ratio of 1.18. Cardlytics, Inc. has a one year low of $2.89 and a one year high of $20.52. The stock has a market cap of $171.77 million, a P/E ratio of -0.55 and a beta of 1.61.

Cardlytics (NASDAQ:CDLX - Get Free Report) last posted its quarterly earnings results on Wednesday, November 6th. The company reported ($0.15) earnings per share (EPS) for the quarter, topping analysts' consensus estimates of ($0.33) by $0.18. Cardlytics had a negative net margin of 93.55% and a negative return on equity of 110.67%. The company had revenue of $67.06 million for the quarter, compared to the consensus estimate of $57.77 million. During the same period last year, the firm posted ($0.26) EPS. The company's revenue for the quarter was down 15.1% on a year-over-year basis. As a group, analysts expect that Cardlytics, Inc. will post -1.72 EPS for the current fiscal year.

Wall Street Analysts Forecast Growth

Several equities research analysts have recently issued reports on CDLX shares. Craig Hallum raised shares of Cardlytics from a "hold" rating to a "strong-buy" rating in a research report on Wednesday, November 6th. Evercore ISI assumed coverage on shares of Cardlytics in a report on Friday, October 11th. They set an "in-line" rating and a $4.00 price target for the company. Bank of America lowered shares of Cardlytics from a "neutral" rating to an "underperform" rating and lowered their price target for the company from $4.00 to $3.50 in a report on Thursday, August 15th. Lake Street Capital lowered shares of Cardlytics from a "buy" rating to a "hold" rating and lowered their price target for the company from $18.00 to $5.00 in a report on Thursday, August 8th. Finally, Northland Capmk downgraded shares of Cardlytics from a "strong-buy" rating to a "hold" rating in a research note on Friday, August 16th. One research analyst has rated the stock with a sell rating, five have assigned a hold rating and one has assigned a strong buy rating to the stock. Based on data from MarketBeat.com, Cardlytics currently has an average rating of "Hold" and an average target price of $6.92.

Get Our Latest Analysis on CDLX

Insider Buying and Selling

In other news, CFO Alexis Desieno sold 25,118 shares of Cardlytics stock in a transaction that occurred on Friday, November 15th. The shares were sold at an average price of $3.43, for a total value of $86,154.74. Following the transaction, the chief financial officer now owns 116,481 shares of the company's stock, valued at $399,529.83. The trade was a 17.74 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is accessible through this link. Also, CEO Amit Gupta sold 22,607 shares of Cardlytics stock in a transaction that occurred on Thursday, October 24th. The stock was sold at an average price of $3.85, for a total transaction of $87,036.95. Following the completion of the transaction, the chief executive officer now directly owns 178,519 shares in the company, valued at $687,298.15. This represents a 11.24 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold a total of 68,691 shares of company stock valued at $237,767 in the last quarter. Company insiders own 4.40% of the company's stock.

About Cardlytics

(

Free Report)

Cardlytics, Inc operates an advertising platform in the United States and the United Kingdom. It offers Cardlytics platform, a proprietary native bank advertising channel that enables marketers to reach customers through their network of financial institution partners through digital channels, such as online, mobile applications, email, and various real-time notifications; and Bridg platform, a customer data platform which utilizes point-of-sale data and enables marketers to perform analytics and targeted loyalty marketing, as well as measure the impact of their marketing.

Recommended Stories

Before you consider Cardlytics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cardlytics wasn't on the list.

While Cardlytics currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.