GSA Capital Partners LLP lessened its holdings in Transocean Ltd. (NYSE:RIG - Free Report) by 35.7% in the 3rd quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The fund owned 477,831 shares of the offshore drilling services provider's stock after selling 265,653 shares during the period. GSA Capital Partners LLP owned 0.05% of Transocean worth $2,031,000 at the end of the most recent reporting period.

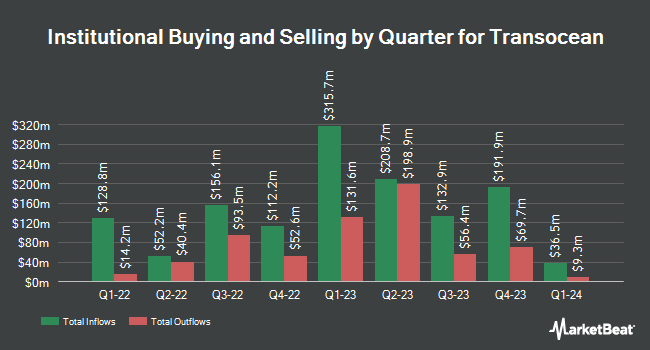

Other large investors have also recently bought and sold shares of the company. Janney Montgomery Scott LLC raised its position in shares of Transocean by 1,748.6% in the first quarter. Janney Montgomery Scott LLC now owns 245,861 shares of the offshore drilling services provider's stock valued at $1,544,000 after purchasing an additional 232,561 shares during the period. Empowered Funds LLC lifted its position in Transocean by 20.6% during the 1st quarter. Empowered Funds LLC now owns 149,785 shares of the offshore drilling services provider's stock worth $941,000 after acquiring an additional 25,555 shares during the last quarter. Oppenheimer Asset Management Inc. boosted its holdings in Transocean by 8.6% during the first quarter. Oppenheimer Asset Management Inc. now owns 22,237 shares of the offshore drilling services provider's stock valued at $140,000 after acquiring an additional 1,767 shares during the period. Swiss National Bank grew its position in shares of Transocean by 3.6% in the first quarter. Swiss National Bank now owns 1,437,730 shares of the offshore drilling services provider's stock valued at $9,029,000 after purchasing an additional 49,800 shares during the last quarter. Finally, Meeder Advisory Services Inc. acquired a new position in shares of Transocean during the 1st quarter worth about $90,000. 67.73% of the stock is currently owned by institutional investors.

Insiders Place Their Bets

In related news, Director Perestroika acquired 1,500,000 shares of the business's stock in a transaction dated Thursday, September 12th. The shares were bought at an average price of $4.13 per share, with a total value of $6,195,000.00. Following the transaction, the director now directly owns 91,074,894 shares of the company's stock, valued at $376,139,312.22. This trade represents a 0.00 % increase in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which can be accessed through the SEC website. Corporate insiders own 13.16% of the company's stock.

Wall Street Analysts Forecast Growth

Several research analysts have commented on RIG shares. StockNews.com raised Transocean to a "sell" rating in a research report on Tuesday. Susquehanna cut their target price on shares of Transocean from $7.00 to $6.50 and set a "positive" rating for the company in a research note on Friday, November 1st. DNB Markets raised shares of Transocean from a "hold" rating to a "buy" rating in a report on Tuesday, September 3rd. Morgan Stanley boosted their price objective on shares of Transocean from $5.00 to $6.00 and gave the stock an "equal weight" rating in a report on Thursday, October 3rd. Finally, Citigroup cut shares of Transocean from a "buy" rating to a "neutral" rating in a research note on Thursday, September 12th. Two equities research analysts have rated the stock with a sell rating, five have given a hold rating and three have assigned a buy rating to the stock. According to MarketBeat, the stock presently has an average rating of "Hold" and an average price target of $6.63.

Check Out Our Latest Report on RIG

Transocean Trading Down 1.2 %

Shares of Transocean stock traded down $0.05 on Wednesday, reaching $4.24. 17,737,932 shares of the company's stock were exchanged, compared to its average volume of 18,588,709. The firm's 50-day moving average is $4.30 and its two-hundred day moving average is $5.01. The company has a debt-to-equity ratio of 0.64, a current ratio of 1.64 and a quick ratio of 1.34. Transocean Ltd. has a 52 week low of $3.85 and a 52 week high of $6.88.

Transocean Profile

(

Free Report)

Transocean Ltd., together with its subsidiaries, provides offshore contract drilling services for oil and gas wells worldwide. It contracts mobile offshore drilling rigs, related equipment, and work crews to drill oil and gas wells. The company operates a fleet of mobile offshore drilling units, consisting of ultra-deepwater floaters and harsh environment floaters.

See Also

Before you consider Transocean, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Transocean wasn't on the list.

While Transocean currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.