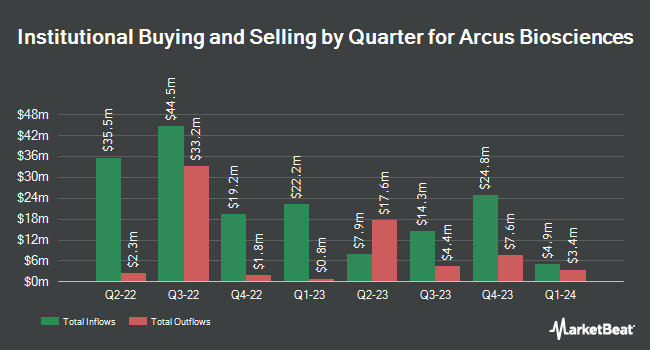

GSA Capital Partners LLP raised its holdings in shares of Arcus Biosciences, Inc. (NYSE:RCUS - Free Report) by 17.8% in the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 187,415 shares of the company's stock after purchasing an additional 28,307 shares during the quarter. GSA Capital Partners LLP owned 0.20% of Arcus Biosciences worth $2,866,000 as of its most recent SEC filing.

Several other institutional investors have also recently made changes to their positions in RCUS. Allspring Global Investments Holdings LLC grew its stake in shares of Arcus Biosciences by 9.2% in the 1st quarter. Allspring Global Investments Holdings LLC now owns 12,940 shares of the company's stock worth $244,000 after acquiring an additional 1,090 shares in the last quarter. Mirae Asset Global Investments Co. Ltd. grew its stake in shares of Arcus Biosciences by 5.6% in the 1st quarter. Mirae Asset Global Investments Co. Ltd. now owns 32,356 shares of the company's stock worth $583,000 after acquiring an additional 1,702 shares in the last quarter. Headlands Technologies LLC bought a new stake in shares of Arcus Biosciences in the 1st quarter worth $59,000. ProShare Advisors LLC grew its position in Arcus Biosciences by 7.4% during the first quarter. ProShare Advisors LLC now owns 10,846 shares of the company's stock valued at $205,000 after buying an additional 746 shares during the period. Finally, BNP PARIBAS ASSET MANAGEMENT Holding S.A. grew its position in Arcus Biosciences by 26.9% during the first quarter. BNP PARIBAS ASSET MANAGEMENT Holding S.A. now owns 685,025 shares of the company's stock valued at $12,933,000 after buying an additional 145,298 shares during the period. Institutional investors own 92.89% of the company's stock.

Analyst Upgrades and Downgrades

Several equities analysts recently weighed in on the stock. Evercore ISI upgraded shares of Arcus Biosciences to a "strong-buy" rating in a research report on Friday, August 9th. Barclays upped their price objective on shares of Arcus Biosciences from $25.00 to $29.00 and gave the company an "overweight" rating in a report on Friday, October 25th. Cantor Fitzgerald reaffirmed an "overweight" rating on shares of Arcus Biosciences in a report on Thursday, October 3rd. HC Wainwright reaffirmed a "neutral" rating and set a $20.00 price objective on shares of Arcus Biosciences in a report on Wednesday, November 6th. Finally, Wedbush reaffirmed an "outperform" rating and set a $36.00 price objective on shares of Arcus Biosciences in a report on Thursday, November 7th. One analyst has rated the stock with a hold rating, eight have issued a buy rating and one has given a strong buy rating to the company's stock. According to data from MarketBeat.com, the company currently has an average rating of "Buy" and an average target price of $34.13.

Get Our Latest Analysis on RCUS

Arcus Biosciences Price Performance

Shares of RCUS stock traded down $0.98 during trading hours on Tuesday, hitting $16.77. 442,074 shares of the company's stock were exchanged, compared to its average volume of 736,818. The company has a market capitalization of $1.53 billion, a PE ratio of -5.63 and a beta of 0.89. Arcus Biosciences, Inc. has a 12-month low of $12.95 and a 12-month high of $20.31. The business's 50 day simple moving average is $16.62 and its 200-day simple moving average is $16.09. The company has a current ratio of 5.24, a quick ratio of 5.14 and a debt-to-equity ratio of 0.08.

Arcus Biosciences (NYSE:RCUS - Get Free Report) last posted its quarterly earnings results on Wednesday, November 6th. The company reported ($1.00) EPS for the quarter, topping the consensus estimate of ($1.06) by $0.06. The firm had revenue of $48.00 million for the quarter, compared to the consensus estimate of $38.95 million. Arcus Biosciences had a negative net margin of 102.66% and a negative return on equity of 45.59%. The business's revenue was up 50.0% compared to the same quarter last year. During the same period last year, the firm posted ($0.94) earnings per share. On average, equities research analysts anticipate that Arcus Biosciences, Inc. will post -3.25 earnings per share for the current year.

Arcus Biosciences Company Profile

(

Free Report)

Arcus Biosciences, Inc, a clinical-stage biopharmaceutical company, develops and commercializes cancer therapies in the United States. The company's pipeline products include Domvanalimab, an anti-TIGIT antibody, which is in Phase 2 and Phase 3 clinical trial; and AB308, an investigational anti-TIGIT monoclonal antibody, which is in Phase 1b clinical trial to study people with advanced solid and hematologic malignancies.

Recommended Stories

Before you consider Arcus Biosciences, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Arcus Biosciences wasn't on the list.

While Arcus Biosciences currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.