GSA Capital Partners LLP trimmed its stake in shares of Anavex Life Sciences Corp. (NASDAQ:AVXL - Free Report) by 59.6% in the 3rd quarter, according to its most recent disclosure with the SEC. The institutional investor owned 89,299 shares of the biotechnology company's stock after selling 131,561 shares during the period. GSA Capital Partners LLP owned 0.11% of Anavex Life Sciences worth $507,000 at the end of the most recent quarter.

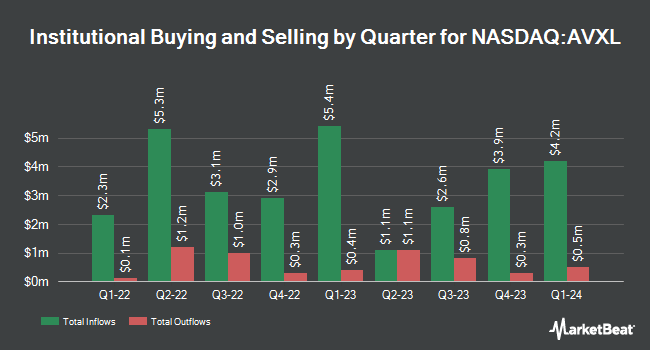

Several other institutional investors have also bought and sold shares of AVXL. Renaissance Technologies LLC lifted its holdings in shares of Anavex Life Sciences by 483.8% in the 2nd quarter. Renaissance Technologies LLC now owns 466,437 shares of the biotechnology company's stock worth $1,968,000 after acquiring an additional 386,537 shares during the last quarter. Deerfield Management Company L.P. Series C purchased a new position in Anavex Life Sciences during the 2nd quarter valued at about $346,000. Vanguard Group Inc. grew its position in shares of Anavex Life Sciences by 1.2% in the 1st quarter. Vanguard Group Inc. now owns 4,414,682 shares of the biotechnology company's stock worth $22,471,000 after buying an additional 54,034 shares during the last quarter. Squarepoint Ops LLC purchased a new position in shares of Anavex Life Sciences in the 2nd quarter worth approximately $191,000. Finally, Bank of New York Mellon Corp grew its position in shares of Anavex Life Sciences by 17.1% in the 2nd quarter. Bank of New York Mellon Corp now owns 280,556 shares of the biotechnology company's stock worth $1,184,000 after buying an additional 40,895 shares during the last quarter. Institutional investors own 31.55% of the company's stock.

Anavex Life Sciences Price Performance

NASDAQ AVXL traded up $0.23 on Wednesday, hitting $8.48. The company had a trading volume of 923,648 shares, compared to its average volume of 1,193,225. The company has a market capitalization of $718.68 million, a PE ratio of -16.95 and a beta of 0.60. The company's fifty day moving average price is $6.24 and its 200-day moving average price is $5.46. Anavex Life Sciences Corp. has a 12-month low of $3.25 and a 12-month high of $10.45.

Analyst Ratings Changes

Separately, HC Wainwright reissued a "buy" rating and set a $40.00 target price on shares of Anavex Life Sciences in a research report on Monday, November 4th.

View Our Latest Report on Anavex Life Sciences

Anavex Life Sciences Company Profile

(

Free Report)

Anavex Life Sciences Corp., a clinical stage biopharmaceutical company, engages in the development of therapeutics for the treatment of central nervous system diseases. Its lead product candidate is ANAVEX 2-73 for the treatment of Alzheimer's disease and Parkinson's disease, as well as other central nervous system diseases, including rare diseases, such as Rett syndrome, a rare severe neurological monogenic disorder; and infantile spasms, Fragile X syndrome, and Angelman syndrome.

Further Reading

Before you consider Anavex Life Sciences, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Anavex Life Sciences wasn't on the list.

While Anavex Life Sciences currently has a "Strong Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.