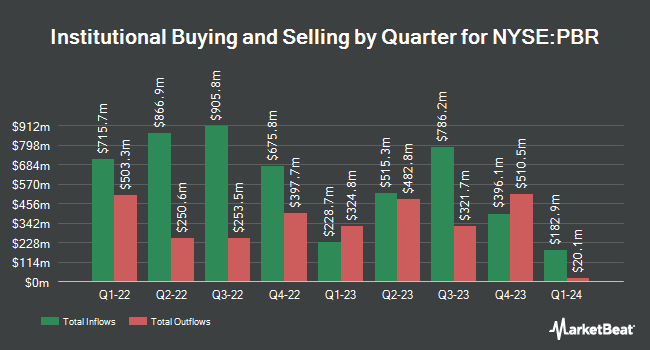

GSA Capital Partners LLP purchased a new stake in Petróleo Brasileiro S.A. - Petrobras (NYSE:PBR - Free Report) in the 3rd quarter, according to the company in its most recent Form 13F filing with the SEC. The firm purchased 60,840 shares of the oil and gas exploration company's stock, valued at approximately $877,000.

Several other institutional investors have also modified their holdings of the business. Mondrian Investment Partners LTD boosted its holdings in Petróleo Brasileiro S.A. - Petrobras by 23.0% in the second quarter. Mondrian Investment Partners LTD now owns 10,099,766 shares of the oil and gas exploration company's stock valued at $144,124,000 after purchasing an additional 1,889,313 shares during the period. Encompass Capital Advisors LLC purchased a new position in shares of Petróleo Brasileiro S.A. - Petrobras in the 2nd quarter valued at about $73,174,000. Victory Capital Management Inc. grew its position in shares of Petróleo Brasileiro S.A. - Petrobras by 38.4% during the second quarter. Victory Capital Management Inc. now owns 3,745,895 shares of the oil and gas exploration company's stock worth $54,278,000 after buying an additional 1,039,700 shares in the last quarter. Earnest Partners LLC increased its stake in shares of Petróleo Brasileiro S.A. - Petrobras by 4.8% during the first quarter. Earnest Partners LLC now owns 3,276,414 shares of the oil and gas exploration company's stock worth $49,834,000 after buying an additional 151,056 shares during the period. Finally, Perpetual Ltd lifted its stake in Petróleo Brasileiro S.A. - Petrobras by 0.9% in the third quarter. Perpetual Ltd now owns 3,152,289 shares of the oil and gas exploration company's stock worth $45,424,000 after acquiring an additional 29,267 shares during the last quarter.

Petróleo Brasileiro S.A. - Petrobras Stock Up 0.9 %

NYSE PBR traded up $0.12 on Friday, reaching $14.11. The stock had a trading volume of 14,584,013 shares, compared to its average volume of 14,976,368. Petróleo Brasileiro S.A. - Petrobras has a 12-month low of $12.90 and a 12-month high of $17.91. The business's 50-day moving average price is $14.26 and its 200 day moving average price is $14.71. The company has a debt-to-equity ratio of 0.65, a current ratio of 0.94 and a quick ratio of 0.67.

Petróleo Brasileiro S.A. - Petrobras Increases Dividend

The firm also recently disclosed a Variable dividend, which will be paid on Thursday, March 27th. Shareholders of record on Friday, December 27th will be paid a $0.227 dividend. The ex-dividend date is Friday, December 27th. This is a positive change from Petróleo Brasileiro S.A. - Petrobras's previous Variable dividend of $0.17. This represents a yield of 16.3%. Petróleo Brasileiro S.A. - Petrobras's payout ratio is currently 33.59%.

Analysts Set New Price Targets

A number of equities research analysts have commented on PBR shares. Morgan Stanley raised shares of Petróleo Brasileiro S.A. - Petrobras from an "equal weight" rating to an "overweight" rating and increased their price objective for the company from $18.00 to $20.00 in a research report on Monday, August 26th. The Goldman Sachs Group lifted their price target on Petróleo Brasileiro S.A. - Petrobras from $15.40 to $17.00 and gave the stock a "buy" rating in a report on Tuesday, November 12th. UBS Group dropped their price objective on Petróleo Brasileiro S.A. - Petrobras from $19.40 to $18.10 and set a "buy" rating on the stock in a report on Monday, August 19th. Hsbc Global Res cut Petróleo Brasileiro S.A. - Petrobras from a "strong-buy" rating to a "hold" rating in a research note on Monday, October 21st. Finally, JPMorgan Chase & Co. upgraded shares of Petróleo Brasileiro S.A. - Petrobras from a "neutral" rating to an "overweight" rating and increased their price target for the company from $16.50 to $19.00 in a research note on Wednesday, September 25th. Three analysts have rated the stock with a hold rating and six have issued a buy rating to the stock. Based on data from MarketBeat, the company currently has an average rating of "Moderate Buy" and an average price target of $18.24.

View Our Latest Report on Petróleo Brasileiro S.A. - Petrobras

About Petróleo Brasileiro S.A. - Petrobras

(

Free Report)

Petróleo Brasileiro SA - Petrobras explores, produces, and sells oil and gas in Brazil and internationally. The company operates through three segments: Exploration and Production; Refining, Transportation and Marketing; and Gas and Power. The Exploration and Production segment explores, develops, and produces crude oil, natural gas liquids, and natural gas primarily for supplies to the domestic refineries.

Further Reading

Before you consider Petróleo Brasileiro S.A. - Petrobras, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Petróleo Brasileiro S.A. - Petrobras wasn't on the list.

While Petróleo Brasileiro S.A. - Petrobras currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.