GSA Capital Partners LLP lessened its holdings in shares of Coeur Mining, Inc. (NYSE:CDE - Free Report) by 64.9% during the 3rd quarter, according to its most recent filing with the Securities and Exchange Commission. The firm owned 148,602 shares of the basic materials company's stock after selling 274,951 shares during the quarter. GSA Capital Partners LLP's holdings in Coeur Mining were worth $1,022,000 as of its most recent SEC filing.

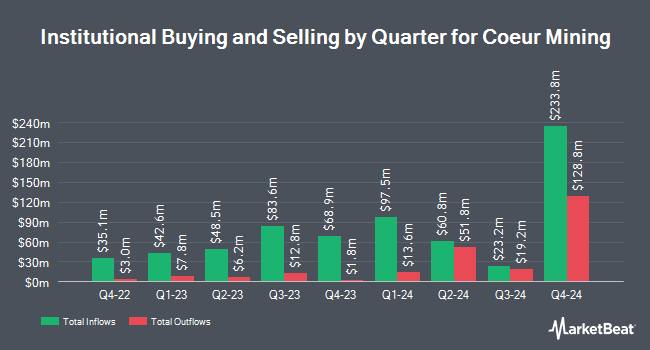

A number of other institutional investors and hedge funds have also recently added to or reduced their stakes in the business. Chartwell Investment Partners LLC bought a new position in shares of Coeur Mining during the 3rd quarter valued at about $1,066,000. Harvest Portfolios Group Inc. acquired a new stake in Coeur Mining during the 3rd quarter worth approximately $665,000. Old West Investment Management LLC lifted its stake in Coeur Mining by 54.3% in the third quarter. Old West Investment Management LLC now owns 385,716 shares of the basic materials company's stock valued at $2,654,000 after buying an additional 135,716 shares in the last quarter. Forum Financial Management LP acquired a new position in shares of Coeur Mining in the third quarter valued at approximately $81,000. Finally, Van ECK Associates Corp increased its position in shares of Coeur Mining by 1.1% during the third quarter. Van ECK Associates Corp now owns 34,469,783 shares of the basic materials company's stock worth $251,629,000 after acquiring an additional 365,115 shares in the last quarter. 63.01% of the stock is owned by institutional investors and hedge funds.

Coeur Mining Stock Down 1.4 %

NYSE CDE traded down $0.09 during trading hours on Friday, hitting $6.14. 12,511,997 shares of the company traded hands, compared to its average volume of 7,942,518. The company has a debt-to-equity ratio of 0.53, a quick ratio of 0.39 and a current ratio of 1.09. The business's 50-day moving average is $6.63 and its 200-day moving average is $6.07. The stock has a market capitalization of $2.45 billion, a price-to-earnings ratio of -204.67 and a beta of 1.65. Coeur Mining, Inc. has a twelve month low of $2.39 and a twelve month high of $7.72.

Coeur Mining (NYSE:CDE - Get Free Report) last released its quarterly earnings data on Wednesday, November 6th. The basic materials company reported $0.12 EPS for the quarter, beating the consensus estimate of $0.07 by $0.05. Coeur Mining had a positive return on equity of 1.78% and a negative net margin of 0.44%. The company had revenue of $313.50 million during the quarter, compared to the consensus estimate of $289.19 million. During the same quarter in the prior year, the firm posted ($0.05) EPS. The firm's revenue for the quarter was up 61.1% compared to the same quarter last year. Sell-side analysts anticipate that Coeur Mining, Inc. will post 0.15 earnings per share for the current year.

Analyst Upgrades and Downgrades

CDE has been the topic of several research reports. Roth Mkm reaffirmed a "buy" rating and issued a $8.50 price objective (down from $9.00) on shares of Coeur Mining in a research report on Friday, November 8th. Canaccord Genuity Group boosted their price target on Coeur Mining from $7.00 to $7.75 and gave the company a "buy" rating in a report on Tuesday, October 8th. BMO Capital Markets increased their price objective on Coeur Mining from $7.50 to $8.00 and gave the stock an "outperform" rating in a report on Monday, September 23rd. Raymond James lifted their target price on Coeur Mining from $6.25 to $7.00 and gave the company a "market perform" rating in a research report on Friday, September 20th. Finally, StockNews.com raised Coeur Mining from a "sell" rating to a "hold" rating in a research report on Friday, November 8th. Two analysts have rated the stock with a hold rating, four have issued a buy rating and one has issued a strong buy rating to the company. According to MarketBeat, Coeur Mining currently has an average rating of "Moderate Buy" and a consensus target price of $7.81.

Get Our Latest Analysis on Coeur Mining

Coeur Mining Profile

(

Free Report)

Coeur Mining, Inc explores for precious metals in the United States, Canada, and Mexico. The company primarily explores for gold, silver, zinc, and lead properties. It markets and sells its concentrates to third-party customers, smelters, under off-take agreements. The company was formerly known as Coeur d'Alene Mines Corporation and changed its name to Coeur Mining, Inc in May 2013.

Further Reading

Before you consider Coeur Mining, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Coeur Mining wasn't on the list.

While Coeur Mining currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.