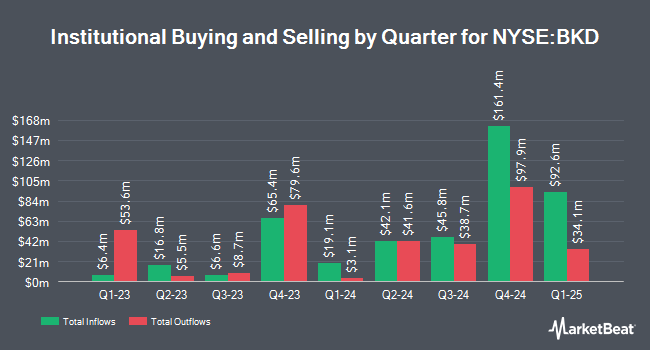

GSA Capital Partners LLP lessened its stake in Brookdale Senior Living Inc. (NYSE:BKD - Free Report) by 95.9% in the 3rd quarter, according to its most recent filing with the SEC. The fund owned 11,234 shares of the company's stock after selling 266,018 shares during the period. GSA Capital Partners LLP's holdings in Brookdale Senior Living were worth $76,000 at the end of the most recent quarter.

A number of other institutional investors and hedge funds also recently added to or reduced their stakes in BKD. Atria Investments Inc grew its position in Brookdale Senior Living by 68.6% in the 3rd quarter. Atria Investments Inc now owns 41,469 shares of the company's stock valued at $282,000 after acquiring an additional 16,878 shares in the last quarter. Principal Financial Group Inc. grew its holdings in shares of Brookdale Senior Living by 449.5% in the third quarter. Principal Financial Group Inc. now owns 136,531 shares of the company's stock valued at $927,000 after purchasing an additional 111,686 shares in the last quarter. Hedges Asset Management LLC increased its stake in Brookdale Senior Living by 13.7% during the 3rd quarter. Hedges Asset Management LLC now owns 207,000 shares of the company's stock worth $1,406,000 after buying an additional 25,000 shares during the period. Assenagon Asset Management S.A. lifted its holdings in Brookdale Senior Living by 4.9% during the 3rd quarter. Assenagon Asset Management S.A. now owns 1,475,211 shares of the company's stock worth $10,017,000 after buying an additional 69,171 shares in the last quarter. Finally, SG Americas Securities LLC boosted its position in Brookdale Senior Living by 13.8% in the 3rd quarter. SG Americas Securities LLC now owns 43,053 shares of the company's stock valued at $292,000 after buying an additional 5,208 shares during the period.

Brookdale Senior Living Stock Up 0.9 %

Shares of NYSE:BKD traded up $0.05 on Tuesday, hitting $5.61. 1,396,104 shares of the company's stock were exchanged, compared to its average volume of 2,038,899. Brookdale Senior Living Inc. has a 1-year low of $5.08 and a 1-year high of $8.12. The company has a market capitalization of $1.12 billion, a PE ratio of -5.99 and a beta of 1.32. The company has a debt-to-equity ratio of 14.46, a quick ratio of 0.81 and a current ratio of 0.81. The firm's 50-day moving average is $6.11 and its 200 day moving average is $6.70.

Brookdale Senior Living (NYSE:BKD - Get Free Report) last posted its earnings results on Wednesday, November 6th. The company reported ($0.22) earnings per share for the quarter, missing the consensus estimate of ($0.16) by ($0.06). The business had revenue of $784.17 million for the quarter, compared to analysts' expectations of $785.61 million. Brookdale Senior Living had a negative return on equity of 59.06% and a negative net margin of 6.75%. During the same quarter in the previous year, the firm earned ($0.22) EPS. Sell-side analysts predict that Brookdale Senior Living Inc. will post -0.7 EPS for the current year.

Wall Street Analysts Forecast Growth

A number of analysts have recently weighed in on the company. Macquarie reaffirmed an "outperform" rating and set a $8.00 price objective on shares of Brookdale Senior Living in a research report on Wednesday, October 9th. Bank of America downgraded Brookdale Senior Living from a "neutral" rating to an "underperform" rating and cut their price target for the stock from $7.75 to $6.00 in a report on Monday, October 7th. Royal Bank of Canada reiterated an "outperform" rating and issued a $9.00 price objective on shares of Brookdale Senior Living in a research note on Wednesday, October 9th. Finally, Jefferies Financial Group started coverage on shares of Brookdale Senior Living in a research note on Wednesday, October 16th. They set a "buy" rating and a $8.00 target price on the stock. Two analysts have rated the stock with a sell rating and three have assigned a buy rating to the company's stock. Based on data from MarketBeat.com, the company has an average rating of "Hold" and an average target price of $7.75.

Get Our Latest Report on BKD

Brookdale Senior Living Company Profile

(

Free Report)

Brookdale Senior Living Inc owns, manages, and operates senior living communities in the United States. It operates in three segments: Independent Living, Assisted Living and Memory Care, and Continuing Care Retirement Communities (CCRCs). The Independent Living segment owns or leases communities comprising independent and assisted living units in a single community that are primarily designed for middle to upper income seniors.

Featured Stories

Before you consider Brookdale Senior Living, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Brookdale Senior Living wasn't on the list.

While Brookdale Senior Living currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.