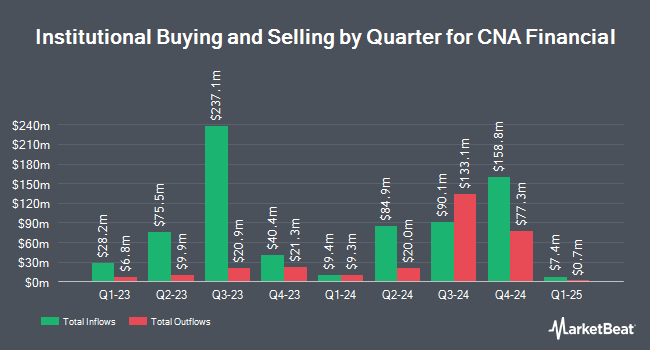

GSA Capital Partners LLP raised its stake in shares of CNA Financial Co. (NYSE:CNA - Free Report) by 131.8% in the 3rd quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The fund owned 35,470 shares of the insurance provider's stock after acquiring an additional 20,169 shares during the period. GSA Capital Partners LLP's holdings in CNA Financial were worth $1,736,000 as of its most recent SEC filing.

Other large investors have also modified their holdings of the company. Fairscale Capital LLC acquired a new stake in shares of CNA Financial during the 2nd quarter valued at approximately $55,000. GAMMA Investing LLC boosted its holdings in shares of CNA Financial by 36.9% during the second quarter. GAMMA Investing LLC now owns 1,566 shares of the insurance provider's stock valued at $72,000 after acquiring an additional 422 shares during the period. Abich Financial Wealth Management LLC grew its stake in shares of CNA Financial by 39.1% in the 1st quarter. Abich Financial Wealth Management LLC now owns 1,756 shares of the insurance provider's stock valued at $80,000 after purchasing an additional 494 shares during the period. Covestor Ltd lifted its holdings in shares of CNA Financial by 82.0% during the first quarter. Covestor Ltd now owns 1,971 shares of the insurance provider's stock valued at $90,000 after acquiring an additional 888 shares during the period. Finally, Whittier Trust Co. acquired a new position in CNA Financial in the second quarter valued at about $92,000. Hedge funds and other institutional investors own 98.45% of the company's stock.

Wall Street Analysts Forecast Growth

A number of equities research analysts recently weighed in on the company. Bank of America raised their price target on CNA Financial from $45.00 to $48.00 and gave the company an "underperform" rating in a report on Thursday, October 10th. Keefe, Bruyette & Woods upped their target price on CNA Financial from $54.00 to $55.00 and gave the company a "market perform" rating in a research report on Friday, November 8th. Finally, StockNews.com raised CNA Financial from a "hold" rating to a "buy" rating in a research report on Wednesday.

Get Our Latest Research Report on CNA

CNA Financial Stock Down 0.1 %

Shares of NYSE:CNA traded down $0.04 during trading on Wednesday, hitting $48.29. The stock had a trading volume of 206,983 shares, compared to its average volume of 276,882. The firm's fifty day moving average is $49.22 and its 200 day moving average is $47.51. The company has a market capitalization of $13.08 billion, a PE ratio of 10.06, a PEG ratio of 6.22 and a beta of 0.65. The company has a quick ratio of 0.26, a current ratio of 0.26 and a debt-to-equity ratio of 0.28. CNA Financial Co. has a 12 month low of $38.87 and a 12 month high of $52.36.

CNA Financial (NYSE:CNA - Get Free Report) last issued its earnings results on Monday, November 4th. The insurance provider reported $1.08 earnings per share (EPS) for the quarter, topping the consensus estimate of $1.07 by $0.01. CNA Financial had a net margin of 9.26% and a return on equity of 13.30%. The firm had revenue of $3.62 billion for the quarter, compared to the consensus estimate of $3.15 billion. During the same quarter in the prior year, the firm posted $1.06 earnings per share. Analysts anticipate that CNA Financial Co. will post 4.65 EPS for the current fiscal year.

CNA Financial Dividend Announcement

The company also recently disclosed a quarterly dividend, which will be paid on Thursday, December 5th. Shareholders of record on Monday, November 18th will be issued a $0.44 dividend. The ex-dividend date is Monday, November 18th. This represents a $1.76 dividend on an annualized basis and a yield of 3.64%. CNA Financial's payout ratio is currently 36.67%.

Insiders Place Their Bets

In related news, EVP Elizabeth Ann Aguinaga sold 26,160 shares of the business's stock in a transaction dated Tuesday, August 20th. The shares were sold at an average price of $49.60, for a total transaction of $1,297,536.00. Following the transaction, the executive vice president now directly owns 47,744 shares in the company, valued at approximately $2,368,102.40. The trade was a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which can be accessed through the SEC website. In other CNA Financial news, EVP Mark Steven James sold 18,547 shares of CNA Financial stock in a transaction dated Monday, September 16th. The stock was sold at an average price of $50.58, for a total value of $938,107.26. Following the completion of the transaction, the executive vice president now directly owns 22,917 shares of the company's stock, valued at $1,159,141.86. The trade was a 0.00 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which is available through this link. Also, EVP Elizabeth Ann Aguinaga sold 26,160 shares of the firm's stock in a transaction that occurred on Tuesday, August 20th. The shares were sold at an average price of $49.60, for a total transaction of $1,297,536.00. Following the completion of the transaction, the executive vice president now directly owns 47,744 shares of the company's stock, valued at approximately $2,368,102.40. The trade was a 0.00 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold a total of 67,680 shares of company stock valued at $3,355,577 in the last 90 days. 0.30% of the stock is owned by insiders.

CNA Financial Company Profile

(

Free Report)

CNA Financial Corporation provides commercial property and casualty insurance products in the United States and internationally. It operates through Specialty, Commercial, International, Life & Group, and Corporate & Other segments. The company offers professional liability coverages and risk management services to various professional firms, including architects, real estate agents, and accounting and law firms; directors and officers, employment practices, fiduciary, and fidelity and cyber coverages to small and mid-size firms, public and privately held firms, and not-for-profit organizations; professional and general liability, as well as associated casualty coverages for healthcare industry; surety and fidelity bonds; and warranty and alternative risks products.

Read More

Before you consider CNA Financial, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CNA Financial wasn't on the list.

While CNA Financial currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.