GSA Capital Partners LLP acquired a new position in The Buckle, Inc. (NYSE:BKE - Free Report) in the third quarter, according to the company in its most recent disclosure with the SEC. The firm acquired 15,726 shares of the company's stock, valued at approximately $691,000.

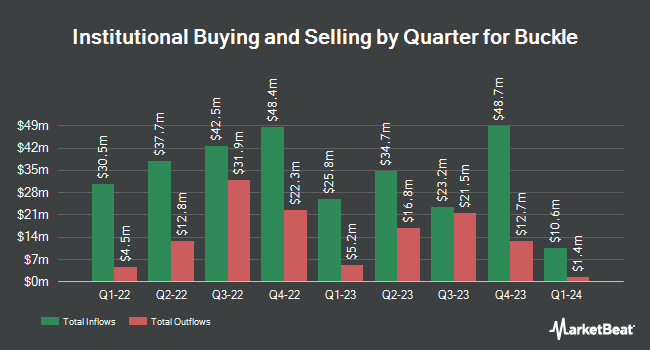

A number of other hedge funds and other institutional investors have also recently added to or reduced their stakes in BKE. Blue Trust Inc. boosted its holdings in Buckle by 52.0% in the third quarter. Blue Trust Inc. now owns 789 shares of the company's stock worth $35,000 after purchasing an additional 270 shares in the last quarter. Unison Advisors LLC boosted its holdings in Buckle by 0.9% in the third quarter. Unison Advisors LLC now owns 37,859 shares of the company's stock worth $1,665,000 after purchasing an additional 334 shares in the last quarter. Redhawk Wealth Advisors Inc. boosted its holdings in Buckle by 2.7% in the second quarter. Redhawk Wealth Advisors Inc. now owns 13,927 shares of the company's stock worth $514,000 after purchasing an additional 370 shares in the last quarter. Exchange Traded Concepts LLC boosted its holdings in Buckle by 0.7% in the third quarter. Exchange Traded Concepts LLC now owns 59,961 shares of the company's stock worth $2,636,000 after purchasing an additional 396 shares in the last quarter. Finally, Louisiana State Employees Retirement System boosted its holdings in Buckle by 2.8% in the second quarter. Louisiana State Employees Retirement System now owns 14,900 shares of the company's stock worth $550,000 after purchasing an additional 400 shares in the last quarter. Institutional investors and hedge funds own 53.93% of the company's stock.

Buckle Trading Down 0.3 %

Buckle stock traded down $0.13 on Monday, reaching $47.79. 372,376 shares of the stock were exchanged, compared to its average volume of 402,246. The stock has a market cap of $2.43 billion, a PE ratio of 11.66 and a beta of 1.14. The Buckle, Inc. has a twelve month low of $34.87 and a twelve month high of $49.78. The firm has a fifty day moving average price of $43.75 and a two-hundred day moving average price of $40.63.

Buckle (NYSE:BKE - Get Free Report) last announced its quarterly earnings data on Friday, August 23rd. The company reported $0.78 EPS for the quarter. The business had revenue of $282.39 million during the quarter. Buckle had a net margin of 16.69% and a return on equity of 46.17%.

Buckle Announces Dividend

The firm also recently announced a quarterly dividend, which was paid on Friday, October 25th. Investors of record on Friday, October 11th were paid a $0.35 dividend. The ex-dividend date of this dividend was Friday, October 11th. This represents a $1.40 dividend on an annualized basis and a yield of 2.93%. Buckle's payout ratio is currently 34.15%.

Wall Street Analysts Forecast Growth

BKE has been the subject of a number of recent research reports. UBS Group upgraded shares of Buckle from a "sell" rating to a "neutral" rating and upped their price objective for the stock from $31.00 to $46.00 in a report on Tuesday, November 12th. StockNews.com upgraded shares of Buckle from a "hold" rating to a "buy" rating in a report on Friday, November 8th.

Get Our Latest Report on Buckle

Insider Activity at Buckle

In related news, SVP Brett P. Milkie sold 16,000 shares of the company's stock in a transaction dated Friday, September 6th. The shares were sold at an average price of $41.35, for a total value of $661,600.00. Following the sale, the senior vice president now owns 80,170 shares of the company's stock, valued at $3,315,029.50. The trade was a 16.64 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is available through this hyperlink. Also, CEO Dennis H. Nelson sold 20,453 shares of the company's stock in a transaction dated Monday, November 4th. The stock was sold at an average price of $42.90, for a total transaction of $877,433.70. Following the sale, the chief executive officer now directly owns 1,822,546 shares in the company, valued at $78,187,223.40. This represents a 1.11 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold a total of 142,931 shares of company stock valued at $6,080,458 over the last quarter. 39.80% of the stock is owned by company insiders.

About Buckle

(

Free Report)

The Buckle, Inc operates as a retailer of casual apparel, footwear, and accessories for young men and women in the United States. It markets a selection of brand name casual apparel, including denims, other casual bottoms, tops, sportswear, outerwear, accessories, and footwear, as well as private label merchandise primarily comprising BKE, Buckle Black, Salvage, Red by BKE, Daytrip, Gimmicks, Gilded Intent, FITZ + EDDI, Willow & Root, Outpost Makers, Departwest, Sterling & Stitch, Reclaim, BKE Vintage, Nova Industries, J.B.

Read More

Before you consider Buckle, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Buckle wasn't on the list.

While Buckle currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.