GSA Capital Partners LLP acquired a new position in shares of Dycom Industries, Inc. (NYSE:DY - Free Report) in the 3rd quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor acquired 10,824 shares of the construction company's stock, valued at approximately $2,133,000.

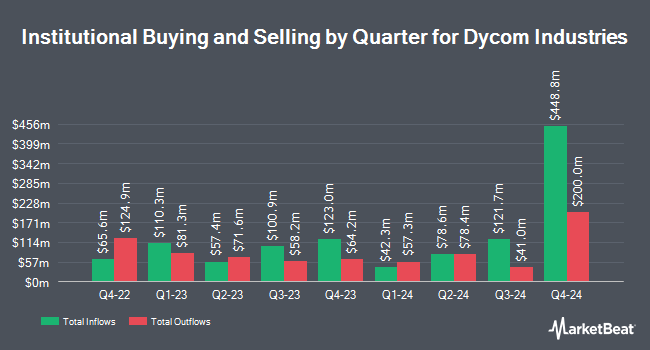

Other hedge funds have also modified their holdings of the company. Allspring Global Investments Holdings LLC bought a new position in shares of Dycom Industries in the first quarter valued at $28,000. Annapolis Financial Services LLC acquired a new position in shares of Dycom Industries during the 3rd quarter worth approximately $29,000. Anchor Investment Management LLC boosted its position in Dycom Industries by 50.4% during the second quarter. Anchor Investment Management LLC now owns 194 shares of the construction company's stock worth $33,000 after purchasing an additional 65 shares during the period. GAMMA Investing LLC increased its holdings in shares of Dycom Industries by 107.8% in the second quarter. GAMMA Investing LLC now owns 293 shares of the construction company's stock valued at $49,000 after purchasing an additional 152 shares during the last quarter. Finally, SJS Investment Consulting Inc. raised its position in shares of Dycom Industries by 5,071.4% in the second quarter. SJS Investment Consulting Inc. now owns 362 shares of the construction company's stock valued at $61,000 after purchasing an additional 355 shares during the period. 98.33% of the stock is currently owned by institutional investors.

Dycom Industries Trading Down 2.2 %

Shares of DY stock traded down $4.32 during trading hours on Tuesday, hitting $188.99. 139,087 shares of the company's stock traded hands, compared to its average volume of 287,070. The company has a quick ratio of 3.25, a current ratio of 3.44 and a debt-to-equity ratio of 0.81. Dycom Industries, Inc. has a 12 month low of $82.71 and a 12 month high of $207.20. The stock has a market cap of $5.50 billion, a PE ratio of 24.03, a price-to-earnings-growth ratio of 1.56 and a beta of 1.44. The stock's 50 day simple moving average is $187.51 and its 200 day simple moving average is $176.73.

Dycom Industries (NYSE:DY - Get Free Report) last posted its quarterly earnings data on Wednesday, August 21st. The construction company reported $2.46 EPS for the quarter, topping analysts' consensus estimates of $2.26 by $0.20. Dycom Industries had a return on equity of 22.28% and a net margin of 5.37%. The company had revenue of $1.20 billion for the quarter, compared to analyst estimates of $1.20 billion. During the same period in the previous year, the firm earned $2.03 earnings per share. The firm's quarterly revenue was up 15.5% on a year-over-year basis. On average, sell-side analysts anticipate that Dycom Industries, Inc. will post 8.02 EPS for the current year.

Analyst Upgrades and Downgrades

Several brokerages have issued reports on DY. StockNews.com downgraded shares of Dycom Industries from a "buy" rating to a "hold" rating in a research report on Friday, July 26th. KeyCorp boosted their target price on shares of Dycom Industries from $200.00 to $227.00 and gave the company an "overweight" rating in a research report on Tuesday, October 8th. Wells Fargo & Company lifted their price objective on shares of Dycom Industries from $185.00 to $200.00 and gave the stock an "overweight" rating in a research note on Wednesday, July 17th. B. Riley raised their target price on shares of Dycom Industries from $205.00 to $208.00 and gave the stock a "buy" rating in a report on Thursday, August 22nd. Finally, Bank of America lifted their price objective on Dycom Industries from $198.00 to $204.00 and gave the company a "buy" rating in a report on Friday, August 23rd. One investment analyst has rated the stock with a hold rating, six have assigned a buy rating and one has assigned a strong buy rating to the company. According to MarketBeat.com, Dycom Industries presently has a consensus rating of "Buy" and an average price target of $203.43.

Check Out Our Latest Report on Dycom Industries

About Dycom Industries

(

Free Report)

Dycom Industries, Inc provides specialty contracting services to the telecommunications infrastructure and utility industries in the United States. The company offers engineering services to telecommunications providers, including the planning and design of aerial, underground, and buried fiber optic, copper, and coaxial cable systems; wireless networks in connection with the deployment of macro cell and new small cell sites; and program and project management and inspection personnel.

See Also

Before you consider Dycom Industries, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Dycom Industries wasn't on the list.

While Dycom Industries currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.