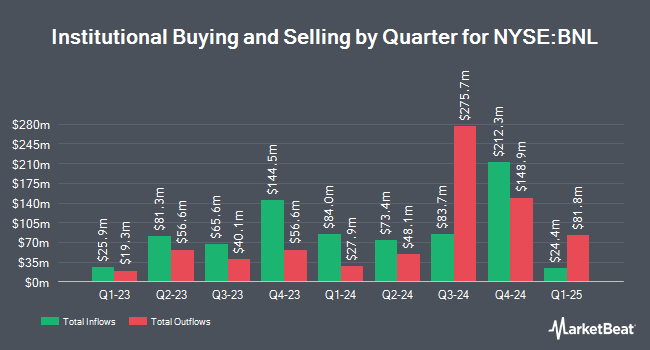

GSA Capital Partners LLP lowered its holdings in Broadstone Net Lease, Inc. (NYSE:BNL - Free Report) by 78.3% during the third quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The firm owned 18,055 shares of the company's stock after selling 65,257 shares during the quarter. GSA Capital Partners LLP's holdings in Broadstone Net Lease were worth $342,000 as of its most recent SEC filing.

Other hedge funds and other institutional investors have also made changes to their positions in the company. Versor Investments LP grew its position in shares of Broadstone Net Lease by 196.9% during the 3rd quarter. Versor Investments LP now owns 38,289 shares of the company's stock valued at $726,000 after acquiring an additional 25,391 shares during the period. Meritage Portfolio Management acquired a new stake in Broadstone Net Lease in the third quarter valued at approximately $5,610,000. QRG Capital Management Inc. raised its stake in shares of Broadstone Net Lease by 10.1% during the 3rd quarter. QRG Capital Management Inc. now owns 13,247 shares of the company's stock worth $251,000 after buying an additional 1,220 shares during the period. Asset Management One Co. Ltd. raised its stake in shares of Broadstone Net Lease by 1.8% during the 3rd quarter. Asset Management One Co. Ltd. now owns 350,929 shares of the company's stock worth $6,650,000 after buying an additional 6,215 shares during the period. Finally, BSW Wealth Partners purchased a new position in shares of Broadstone Net Lease during the 3rd quarter valued at approximately $758,000. Institutional investors and hedge funds own 89.07% of the company's stock.

Wall Street Analysts Forecast Growth

Several research firms have issued reports on BNL. The Goldman Sachs Group increased their price objective on shares of Broadstone Net Lease from $14.50 to $16.00 and gave the company a "sell" rating in a report on Friday, September 13th. Truist Financial lifted their price objective on Broadstone Net Lease from $16.00 to $18.00 and gave the stock a "hold" rating in a report on Friday, August 16th. Wedbush initiated coverage on Broadstone Net Lease in a research report on Monday, August 19th. They issued an "outperform" rating and a $20.00 target price on the stock. Finally, UBS Group assumed coverage on Broadstone Net Lease in a research report on Thursday, November 14th. They set a "neutral" rating and a $18.00 price target for the company. One equities research analyst has rated the stock with a sell rating, four have issued a hold rating and two have given a buy rating to the company's stock. According to MarketBeat, the company currently has an average rating of "Hold" and an average target price of $18.20.

Read Our Latest Stock Analysis on BNL

Broadstone Net Lease Stock Up 0.4 %

Shares of Broadstone Net Lease stock traded up $0.07 during mid-day trading on Friday, hitting $17.25. The stock had a trading volume of 697,834 shares, compared to its average volume of 1,183,558. The firm has a market cap of $3.25 billion, a P/E ratio of 22.70 and a beta of 1.12. Broadstone Net Lease, Inc. has a 12-month low of $14.20 and a 12-month high of $19.15. The firm has a 50-day moving average of $18.07 and a two-hundred day moving average of $17.12.

Broadstone Net Lease (NYSE:BNL - Get Free Report) last issued its quarterly earnings data on Wednesday, October 30th. The company reported $0.19 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.34 by ($0.15). The business had revenue of $108.40 million for the quarter, compared to analyst estimates of $106.47 million. Broadstone Net Lease had a return on equity of 4.47% and a net margin of 33.56%. During the same period in the previous year, the business posted $0.36 earnings per share. Sell-side analysts expect that Broadstone Net Lease, Inc. will post 1.39 earnings per share for the current year.

Broadstone Net Lease Announces Dividend

The company also recently declared a quarterly dividend, which will be paid on Wednesday, January 15th. Shareholders of record on Tuesday, December 31st will be paid a dividend of $0.29 per share. This represents a $1.16 dividend on an annualized basis and a yield of 6.72%. The ex-dividend date of this dividend is Tuesday, December 31st. Broadstone Net Lease's dividend payout ratio (DPR) is 152.63%.

Broadstone Net Lease Company Profile

(

Free Report)

Broadstone Net Lease, Inc (the Corporation) is a Maryland corporation formed on October 18, 2007, that elected to be taxed as a real estate investment trust (REIT) commencing with the taxable year ended December 31, 2008. Broadstone Net Lease, LLC (the Corporation's operating company, or the OP), is the entity through which the Corporation conducts its business and owns (either directly or through subsidiaries) all of the Corporation's properties.

Recommended Stories

Before you consider Broadstone Net Lease, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Broadstone Net Lease wasn't on the list.

While Broadstone Net Lease currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.