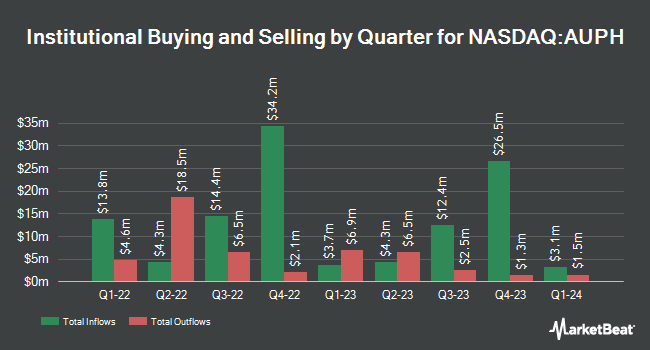

GSA Capital Partners LLP lowered its stake in shares of Aurinia Pharmaceuticals Inc. (NASDAQ:AUPH - Free Report) TSE: AUP by 44.9% during the third quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The firm owned 125,645 shares of the biotechnology company's stock after selling 102,373 shares during the period. GSA Capital Partners LLP owned approximately 0.09% of Aurinia Pharmaceuticals worth $921,000 at the end of the most recent reporting period.

A number of other hedge funds also recently made changes to their positions in the stock. China Universal Asset Management Co. Ltd. lifted its stake in shares of Aurinia Pharmaceuticals by 63.7% in the 3rd quarter. China Universal Asset Management Co. Ltd. now owns 27,502 shares of the biotechnology company's stock valued at $202,000 after purchasing an additional 10,700 shares in the last quarter. CWM LLC raised its holdings in Aurinia Pharmaceuticals by 247.7% in the third quarter. CWM LLC now owns 11,483 shares of the biotechnology company's stock valued at $84,000 after buying an additional 8,180 shares during the period. Handelsbanken Fonder AB lifted its position in Aurinia Pharmaceuticals by 13.2% during the third quarter. Handelsbanken Fonder AB now owns 60,700 shares of the biotechnology company's stock valued at $445,000 after buying an additional 7,100 shares in the last quarter. SG Americas Securities LLC grew its stake in Aurinia Pharmaceuticals by 4,307.9% during the third quarter. SG Americas Securities LLC now owns 547,727 shares of the biotechnology company's stock worth $4,015,000 after buying an additional 535,301 shares during the period. Finally, Stonepine Capital Management LLC purchased a new stake in Aurinia Pharmaceuticals during the second quarter worth approximately $1,713,000. Institutional investors and hedge funds own 36.83% of the company's stock.

Aurinia Pharmaceuticals Stock Down 2.5 %

NASDAQ:AUPH traded down $0.21 on Friday, reaching $8.12. The stock had a trading volume of 1,444,530 shares, compared to its average volume of 1,315,192. The company has a 50-day moving average of $7.26 and a 200 day moving average of $6.24. The company has a current ratio of 5.60, a quick ratio of 5.11 and a debt-to-equity ratio of 0.17. The stock has a market cap of $1.16 billion, a P/E ratio of -54.13 and a beta of 1.45. Aurinia Pharmaceuticals Inc. has a 12-month low of $4.71 and a 12-month high of $10.05.

Analyst Upgrades and Downgrades

AUPH has been the topic of several recent research reports. StockNews.com upgraded shares of Aurinia Pharmaceuticals from a "buy" rating to a "strong-buy" rating in a report on Friday, November 8th. Cantor Fitzgerald restated an "overweight" rating and set a $10.00 price objective on shares of Aurinia Pharmaceuticals in a research note on Monday, September 16th. Finally, HC Wainwright reiterated a "buy" rating and issued a $13.00 target price on shares of Aurinia Pharmaceuticals in a research note on Friday, September 6th. One equities research analyst has rated the stock with a hold rating, three have assigned a buy rating and one has assigned a strong buy rating to the stock. Based on data from MarketBeat.com, the stock currently has an average rating of "Buy" and a consensus target price of $10.00.

Check Out Our Latest Report on Aurinia Pharmaceuticals

Insider Buying and Selling at Aurinia Pharmaceuticals

In related news, Director Jeffrey Allen Bailey sold 4,557 shares of the company's stock in a transaction that occurred on Monday, November 11th. The stock was sold at an average price of $8.43, for a total transaction of $38,415.51. Following the sale, the director now directly owns 13,356 shares of the company's stock, valued at approximately $112,591.08. This represents a 25.44 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which is accessible through this hyperlink. 4.30% of the stock is currently owned by insiders.

About Aurinia Pharmaceuticals

(

Free Report)

Aurinia Pharmaceuticals Inc, a commercial-stage biopharmaceutical company, focuses on developing and commercializing therapies to treat various diseases with unmet medical need in the United States. It offers LUPKYNIS for the treatment of adult patients with active lupus nephritis. It has a collaboration and license agreement with Otsuka Pharmaceutical Co, Ltd.

See Also

Before you consider Aurinia Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Aurinia Pharmaceuticals wasn't on the list.

While Aurinia Pharmaceuticals currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.