GSA Capital Partners LLP trimmed its position in FTI Consulting, Inc. (NYSE:FCN - Free Report) by 61.8% in the 3rd quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm owned 1,863 shares of the business services provider's stock after selling 3,017 shares during the quarter. GSA Capital Partners LLP's holdings in FTI Consulting were worth $424,000 at the end of the most recent quarter.

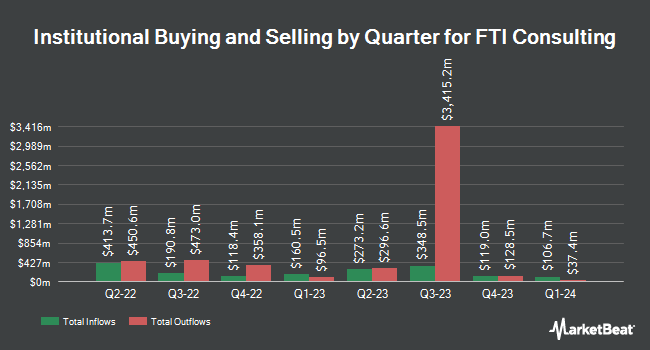

Several other institutional investors have also made changes to their positions in FCN. Envestnet Portfolio Solutions Inc. grew its holdings in shares of FTI Consulting by 4.9% during the 2nd quarter. Envestnet Portfolio Solutions Inc. now owns 1,119 shares of the business services provider's stock valued at $241,000 after acquiring an additional 52 shares in the last quarter. Allegheny Financial Group LTD increased its position in FTI Consulting by 6.5% in the 2nd quarter. Allegheny Financial Group LTD now owns 1,182 shares of the business services provider's stock worth $255,000 after purchasing an additional 72 shares during the last quarter. UMB Bank n.a. raised its stake in shares of FTI Consulting by 76.6% during the 3rd quarter. UMB Bank n.a. now owns 166 shares of the business services provider's stock worth $38,000 after purchasing an additional 72 shares in the last quarter. Truist Financial Corp lifted its holdings in shares of FTI Consulting by 2.1% during the 2nd quarter. Truist Financial Corp now owns 3,757 shares of the business services provider's stock valued at $810,000 after buying an additional 76 shares during the last quarter. Finally, Signaturefd LLC grew its stake in shares of FTI Consulting by 65.9% in the 2nd quarter. Signaturefd LLC now owns 204 shares of the business services provider's stock valued at $44,000 after buying an additional 81 shares in the last quarter. 99.36% of the stock is currently owned by institutional investors and hedge funds.

Analyst Upgrades and Downgrades

A number of research firms have issued reports on FCN. Truist Financial lifted their target price on shares of FTI Consulting from $255.00 to $275.00 and gave the company a "buy" rating in a research note on Wednesday, September 25th. StockNews.com raised shares of FTI Consulting from a "hold" rating to a "buy" rating in a research note on Saturday, November 2nd.

Get Our Latest Stock Analysis on FCN

FTI Consulting Stock Performance

Shares of NYSE FCN traded down $0.39 during mid-day trading on Thursday, reaching $198.59. 60,966 shares of the company traded hands, compared to its average volume of 177,878. The company's fifty day moving average is $215.28 and its two-hundred day moving average is $217.92. FTI Consulting, Inc. has a fifty-two week low of $185.93 and a fifty-two week high of $243.60. The stock has a market cap of $7.14 billion, a PE ratio of 22.83 and a beta of 0.12.

FTI Consulting (NYSE:FCN - Get Free Report) last announced its quarterly earnings results on Thursday, October 24th. The business services provider reported $1.85 EPS for the quarter, missing the consensus estimate of $2.06 by ($0.21). FTI Consulting had a net margin of 8.37% and a return on equity of 14.79%. The company had revenue of $926.00 million for the quarter, compared to analyst estimates of $946.16 million. During the same quarter last year, the business earned $2.34 EPS. The company's revenue for the quarter was up 3.7% on a year-over-year basis. Research analysts forecast that FTI Consulting, Inc. will post 8.1 earnings per share for the current year.

FTI Consulting Company Profile

(

Free Report)

FTI Consulting, Inc provides business advisory services to manage change, mitigate risk, and resolve disputes worldwide. The company operates through Corporate Finance & Restructuring, Forensic and Litigation Consulting, Economic Consulting, Technology, and Strategic Communications segments. The Corporate Finance & Restructuring segment provides business transformation and strategy, transactions, and turnaround and restructuring services.

Read More

Before you consider FTI Consulting, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and FTI Consulting wasn't on the list.

While FTI Consulting currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.