GSA Capital Partners LLP cut its holdings in shares of Star Bulk Carriers Corp. (NASDAQ:SBLK - Free Report) by 20.2% in the 3rd quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor owned 168,764 shares of the shipping company's stock after selling 42,608 shares during the period. Star Bulk Carriers comprises about 0.3% of GSA Capital Partners LLP's investment portfolio, making the stock its 9th biggest holding. GSA Capital Partners LLP owned approximately 0.20% of Star Bulk Carriers worth $3,998,000 at the end of the most recent quarter.

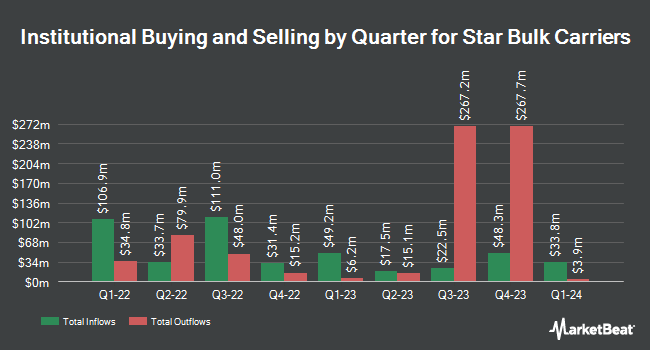

Several other institutional investors have also modified their holdings of SBLK. Nisa Investment Advisors LLC bought a new stake in Star Bulk Carriers in the second quarter valued at about $32,000. Blue Trust Inc. raised its position in shares of Star Bulk Carriers by 190.5% during the 3rd quarter. Blue Trust Inc. now owns 2,025 shares of the shipping company's stock valued at $49,000 after acquiring an additional 1,328 shares in the last quarter. Allspring Global Investments Holdings LLC bought a new position in Star Bulk Carriers during the second quarter worth $54,000. Point72 DIFC Ltd acquired a new position in Star Bulk Carriers in the second quarter worth $72,000. Finally, Banque Cantonale Vaudoise increased its stake in Star Bulk Carriers by 88.2% during the second quarter. Banque Cantonale Vaudoise now owns 5,014 shares of the shipping company's stock valued at $122,000 after purchasing an additional 2,350 shares during the last quarter. Institutional investors and hedge funds own 33.91% of the company's stock.

Analyst Ratings Changes

SBLK has been the subject of several research reports. DNB Markets lowered shares of Star Bulk Carriers from a "hold" rating to a "sell" rating in a report on Friday, October 11th. Deutsche Bank Aktiengesellschaft assumed coverage on Star Bulk Carriers in a research note on Wednesday, September 4th. They issued a "buy" rating and a $26.00 target price for the company. Finally, Stifel Nicolaus cut Star Bulk Carriers from a "buy" rating to a "hold" rating and dropped their price target for the stock from $30.00 to $21.00 in a research report on Wednesday, October 23rd. One investment analyst has rated the stock with a sell rating, one has given a hold rating and three have issued a buy rating to the stock. According to MarketBeat.com, the stock has a consensus rating of "Hold" and a consensus target price of $25.67.

Check Out Our Latest Research Report on SBLK

Star Bulk Carriers Stock Performance

Shares of NASDAQ SBLK traded down $0.43 during midday trading on Tuesday, hitting $19.90. 1,685,109 shares of the company's stock were exchanged, compared to its average volume of 1,586,638. Star Bulk Carriers Corp. has a twelve month low of $17.92 and a twelve month high of $27.47. The firm has a market cap of $1.67 billion, a P/E ratio of 7.47 and a beta of 1.00. The stock's 50 day moving average price is $20.86 and its 200-day moving average price is $22.88. The company has a debt-to-equity ratio of 0.48, a current ratio of 1.51 and a quick ratio of 1.34.

Star Bulk Carriers Profile

(

Free Report)

Star Bulk Carriers Corp., a shipping company, engages in the ocean transportation of dry bulk cargoes worldwide. Its vessels transport a range of bulk commodities, including iron ores, minerals and grains, bauxite, fertilizers, and steel products. As of December 31, 2023, the company owned a fleet of 116 dry bulk vessels with combined carrying capacity of 13.1 million deadweight tonnage (dwt) consisting of Newcastlemax, Capesize, Post Panamax, Kamsarmax, Panamax, Ultramax, and Supramax vessels with carrying capacities between 53,489 dwt and 209,537 dwt.

See Also

Before you consider Star Bulk Carriers, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Star Bulk Carriers wasn't on the list.

While Star Bulk Carriers currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.