GSA Capital Partners LLP reduced its stake in shares of Arcturus Therapeutics Holdings Inc. (NASDAQ:ARCT - Free Report) by 84.7% in the third quarter, according to its most recent filing with the SEC. The institutional investor owned 9,417 shares of the biotechnology company's stock after selling 52,213 shares during the period. GSA Capital Partners LLP's holdings in Arcturus Therapeutics were worth $219,000 as of its most recent filing with the SEC.

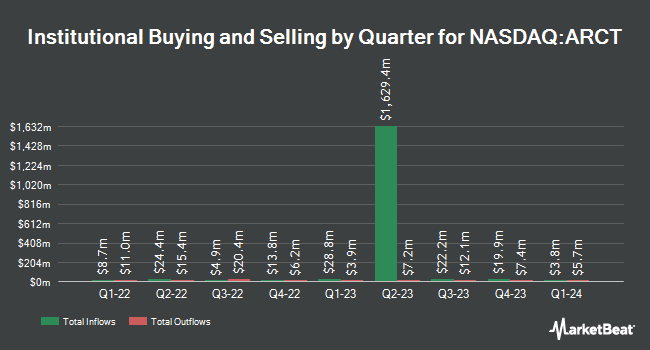

Other hedge funds and other institutional investors have also recently added to or reduced their stakes in the company. Russell Investments Group Ltd. purchased a new stake in shares of Arcturus Therapeutics in the first quarter worth $40,000. nVerses Capital LLC purchased a new stake in Arcturus Therapeutics in the third quarter worth about $42,000. Quest Partners LLC boosted its position in shares of Arcturus Therapeutics by 3,283.5% in the 2nd quarter. Quest Partners LLC now owns 3,688 shares of the biotechnology company's stock worth $90,000 after purchasing an additional 3,579 shares in the last quarter. CANADA LIFE ASSURANCE Co boosted its position in shares of Arcturus Therapeutics by 10.5% in the 1st quarter. CANADA LIFE ASSURANCE Co now owns 4,492 shares of the biotechnology company's stock worth $152,000 after purchasing an additional 428 shares in the last quarter. Finally, Public Employees Retirement System of Ohio lifted its position in Arcturus Therapeutics by 63.8% in the 1st quarter. Public Employees Retirement System of Ohio now owns 4,620 shares of the biotechnology company's stock valued at $156,000 after acquiring an additional 1,800 shares in the last quarter. 94.54% of the stock is owned by institutional investors.

Wall Street Analyst Weigh In

Several equities research analysts have recently commented on the company. Leerink Partners initiated coverage on Arcturus Therapeutics in a research note on Monday, August 12th. They issued an "outperform" rating and a $70.00 price objective for the company. Leerink Partnrs raised shares of Arcturus Therapeutics to a "strong-buy" rating in a report on Monday, August 12th. HC Wainwright restated a "buy" rating and issued a $63.00 target price on shares of Arcturus Therapeutics in a research note on Friday, November 8th. Finally, Cantor Fitzgerald reissued an "overweight" rating on shares of Arcturus Therapeutics in a report on Monday, September 9th. Seven equities research analysts have rated the stock with a buy rating and one has assigned a strong buy rating to the stock. According to MarketBeat.com, the stock currently has a consensus rating of "Buy" and a consensus price target of $71.40.

Read Our Latest Stock Analysis on ARCT

Insider Buying and Selling at Arcturus Therapeutics

In other Arcturus Therapeutics news, COO Pad Chivukula sold 12,000 shares of the business's stock in a transaction dated Tuesday, October 15th. The shares were sold at an average price of $20.76, for a total value of $249,120.00. Following the sale, the chief operating officer now directly owns 435,334 shares in the company, valued at approximately $9,037,533.84. The trade was a 2.68 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. 15.30% of the stock is owned by insiders.

Arcturus Therapeutics Price Performance

Shares of ARCT stock traded up $0.79 during mid-day trading on Monday, hitting $17.70. The stock had a trading volume of 198,624 shares, compared to its average volume of 471,950. The company's 50-day simple moving average is $20.22 and its 200-day simple moving average is $23.57. The firm has a market cap of $479.49 million, a PE ratio of -8.21 and a beta of 2.64. Arcturus Therapeutics Holdings Inc. has a fifty-two week low of $14.93 and a fifty-two week high of $45.00.

Arcturus Therapeutics (NASDAQ:ARCT - Get Free Report) last released its earnings results on Thursday, November 7th. The biotechnology company reported ($0.26) earnings per share (EPS) for the quarter, topping the consensus estimate of ($0.70) by $0.44. The business had revenue of $41.67 million for the quarter, compared to analysts' expectations of $49.16 million. Arcturus Therapeutics had a negative net margin of 36.39% and a negative return on equity of 22.39%. During the same period last year, the company earned ($0.61) earnings per share. On average, analysts expect that Arcturus Therapeutics Holdings Inc. will post -2.31 EPS for the current year.

About Arcturus Therapeutics

(

Free Report)

Arcturus Therapeutics Holdings Inc, a late-stage clinical messenger RNA medicines and vaccine company, focuses on the development of infectious disease vaccines and other products within liver and respiratory rare diseases. Its technology platforms include LUNAR lipid-mediated delivery and STARR mRNA.

See Also

Before you consider Arcturus Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Arcturus Therapeutics wasn't on the list.

While Arcturus Therapeutics currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.