GSA Capital Partners LLP lessened its position in Applied Optoelectronics, Inc. (NASDAQ:AAOI - Free Report) by 70.4% in the third quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The fund owned 26,915 shares of the semiconductor company's stock after selling 63,989 shares during the period. GSA Capital Partners LLP owned about 0.07% of Applied Optoelectronics worth $385,000 as of its most recent SEC filing.

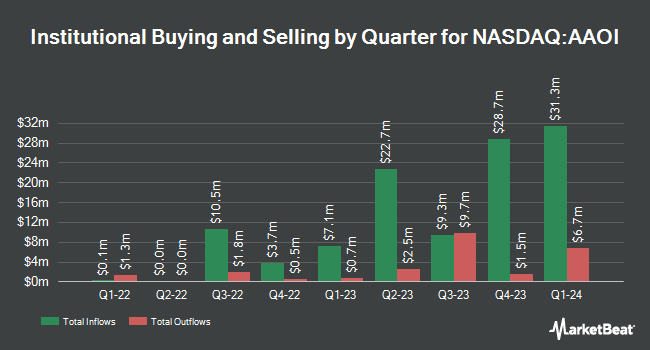

Several other institutional investors and hedge funds have also modified their holdings of the company. CANADA LIFE ASSURANCE Co purchased a new stake in Applied Optoelectronics in the 1st quarter valued at about $46,000. Zurcher Kantonalbank Zurich Cantonalbank grew its holdings in Applied Optoelectronics by 272.1% in the second quarter. Zurcher Kantonalbank Zurich Cantonalbank now owns 9,281 shares of the semiconductor company's stock valued at $77,000 after purchasing an additional 6,787 shares during the period. Point72 Hong Kong Ltd acquired a new position in Applied Optoelectronics during the second quarter worth approximately $89,000. Summit Securities Group LLC purchased a new position in Applied Optoelectronics during the second quarter worth approximately $109,000. Finally, The Manufacturers Life Insurance Company acquired a new position in shares of Applied Optoelectronics in the 2nd quarter valued at $118,000. Hedge funds and other institutional investors own 61.72% of the company's stock.

Applied Optoelectronics Price Performance

Shares of Applied Optoelectronics stock traded up $2.49 during trading on Friday, hitting $37.99. The stock had a trading volume of 4,933,543 shares, compared to its average volume of 2,641,034. Applied Optoelectronics, Inc. has a fifty-two week low of $6.70 and a fifty-two week high of $38.94. The company has a debt-to-equity ratio of 0.36, a current ratio of 1.61 and a quick ratio of 1.06. The business has a fifty day moving average of $19.08 and a two-hundred day moving average of $13.15. The firm has a market cap of $1.71 billion, a P/E ratio of -18.44 and a beta of 1.96.

Insider Transactions at Applied Optoelectronics

In related news, CFO Stefan J. Murry sold 5,000 shares of the stock in a transaction dated Wednesday, November 20th. The shares were sold at an average price of $31.56, for a total value of $157,800.00. Following the completion of the sale, the chief financial officer now owns 216,129 shares in the company, valued at approximately $6,821,031.24. This trade represents a 2.26 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Also, insider Hung-Lun (Fred) Chang sold 20,323 shares of the company's stock in a transaction dated Wednesday, November 20th. The shares were sold at an average price of $30.35, for a total transaction of $616,803.05. Following the completion of the sale, the insider now directly owns 195,572 shares in the company, valued at approximately $5,935,610.20. The trade was a 9.41 % decrease in their position. The disclosure for this sale can be found here. Insiders sold 58,817 shares of company stock valued at $1,687,174 in the last three months. Corporate insiders own 5.40% of the company's stock.

Analyst Ratings Changes

A number of research analysts have weighed in on the stock. Raymond James lifted their price target on shares of Applied Optoelectronics from $17.00 to $23.00 and gave the company an "outperform" rating in a research report on Friday, November 8th. Northland Securities upped their price target on shares of Applied Optoelectronics from $18.00 to $25.00 and gave the stock an "outperform" rating in a research report on Friday, November 8th. StockNews.com raised Applied Optoelectronics to a "sell" rating in a research report on Friday, October 25th. B. Riley Financial reaffirmed a "neutral" rating and issued a $9.00 target price on shares of Applied Optoelectronics in a research report on Thursday, August 8th. Finally, B. Riley dropped their target price on Applied Optoelectronics from $12.00 to $9.00 and set a "neutral" rating on the stock in a report on Wednesday, August 7th. One investment analyst has rated the stock with a sell rating, two have issued a hold rating and three have assigned a buy rating to the company. Based on data from MarketBeat, the stock presently has an average rating of "Hold" and an average price target of $18.70.

Read Our Latest Stock Report on AAOI

Applied Optoelectronics Profile

(

Free Report)

Applied Optoelectronics, Inc designs, manufactures, and sells fiber-optic networking products in the United States, Taiwan, and China. It offers optical modules, optical filters, lasers, laser components, subassemblies, transmitters and transceivers, turn-key equipment, headend, node, distribution equipment, and amplifiers.

Further Reading

Before you consider Applied Optoelectronics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Applied Optoelectronics wasn't on the list.

While Applied Optoelectronics currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.