GSA Capital Partners LLP reduced its stake in BJ's Wholesale Club Holdings, Inc. (NYSE:BJ - Free Report) by 33.6% during the third quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The firm owned 15,033 shares of the company's stock after selling 7,613 shares during the quarter. GSA Capital Partners LLP's holdings in BJ's Wholesale Club were worth $1,240,000 at the end of the most recent reporting period.

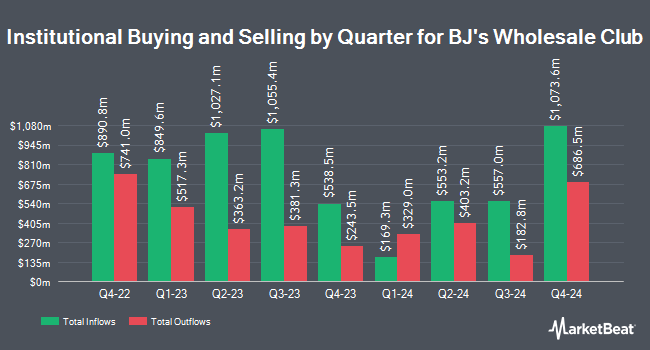

A number of other hedge funds and other institutional investors also recently made changes to their positions in the stock. Blue Trust Inc. bought a new stake in shares of BJ's Wholesale Club during the second quarter valued at approximately $25,000. Davis Capital Management bought a new stake in shares of BJ's Wholesale Club during the third quarter valued at approximately $25,000. UMB Bank n.a. increased its holdings in shares of BJ's Wholesale Club by 375.6% during the third quarter. UMB Bank n.a. now owns 371 shares of the company's stock valued at $31,000 after acquiring an additional 293 shares in the last quarter. Reston Wealth Management LLC bought a new stake in shares of BJ's Wholesale Club during the third quarter valued at approximately $41,000. Finally, J.Safra Asset Management Corp bought a new stake in shares of BJ's Wholesale Club during the second quarter valued at approximately $45,000. 98.60% of the stock is owned by institutional investors and hedge funds.

BJ's Wholesale Club Trading Up 0.3 %

BJ traded up $0.26 on Friday, hitting $87.23. 1,112,989 shares of the company were exchanged, compared to its average volume of 1,465,049. The firm has a fifty day simple moving average of $84.59 and a two-hundred day simple moving average of $84.76. The company has a debt-to-equity ratio of 0.24, a quick ratio of 0.15 and a current ratio of 0.76. BJ's Wholesale Club Holdings, Inc. has a 12 month low of $63.08 and a 12 month high of $92.37. The stock has a market capitalization of $11.57 billion, a PE ratio of 22.26, a price-to-earnings-growth ratio of 3.23 and a beta of 0.24.

BJ's Wholesale Club (NYSE:BJ - Get Free Report) last released its earnings results on Thursday, August 22nd. The company reported $1.09 EPS for the quarter, beating analysts' consensus estimates of $1.00 by $0.09. BJ's Wholesale Club had a return on equity of 36.12% and a net margin of 2.62%. The company had revenue of $5.21 billion during the quarter, compared to analysts' expectations of $5.15 billion. During the same quarter last year, the business posted $0.97 EPS. The firm's revenue for the quarter was up 4.9% compared to the same quarter last year. Sell-side analysts expect that BJ's Wholesale Club Holdings, Inc. will post 3.82 earnings per share for the current year.

Wall Street Analyst Weigh In

Several research firms have recently commented on BJ. JPMorgan Chase & Co. upgraded BJ's Wholesale Club from an "underweight" rating to a "neutral" rating and boosted their price objective for the company from $76.00 to $78.00 in a report on Monday, August 26th. Jefferies Financial Group boosted their price objective on BJ's Wholesale Club from $95.00 to $105.00 and gave the company a "buy" rating in a report on Friday. Wells Fargo & Company boosted their price objective on BJ's Wholesale Club from $92.00 to $100.00 and gave the company an "overweight" rating in a report on Tuesday. Roth Mkm upped their price target on BJ's Wholesale Club from $68.00 to $75.00 and gave the stock a "neutral" rating in a report on Friday, August 23rd. Finally, Melius Research assumed coverage on BJ's Wholesale Club in a report on Monday, September 23rd. They set a "buy" rating and a $90.00 price target for the company. Six equities research analysts have rated the stock with a hold rating and ten have given a buy rating to the company's stock. According to MarketBeat, the company currently has a consensus rating of "Moderate Buy" and a consensus price target of $88.94.

Check Out Our Latest Report on BJ's Wholesale Club

Insiders Place Their Bets

In related news, CEO Robert W. Eddy sold 11,000 shares of BJ's Wholesale Club stock in a transaction on Friday, November 1st. The stock was sold at an average price of $85.47, for a total transaction of $940,170.00. Following the transaction, the chief executive officer now directly owns 423,792 shares in the company, valued at approximately $36,221,502.24. The trade was a 2.53 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through the SEC website. Also, SVP Joseph Mcgrail sold 1,000 shares of the business's stock in a transaction dated Monday, August 26th. The shares were sold at an average price of $83.57, for a total value of $83,570.00. Following the completion of the transaction, the senior vice president now owns 13,566 shares in the company, valued at $1,133,710.62. The trade was a 6.87 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last quarter, insiders sold 34,000 shares of company stock valued at $2,818,390. Corporate insiders own 2.00% of the company's stock.

BJ's Wholesale Club Company Profile

(

Free Report)

BJ's Wholesale Club Holdings, Inc, together with its subsidiaries, operates warehouse clubs on the eastern half of the United States. It provides groceries, general merchandise, gasoline and other ancillary services, coupon books, and promotions. The company sells its products through the websites BJs.com, BerkleyJensen.com, and Wellsleyfarms.com, as well as the mobile app.

Further Reading

Before you consider BJ's Wholesale Club, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BJ's Wholesale Club wasn't on the list.

While BJ's Wholesale Club currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.