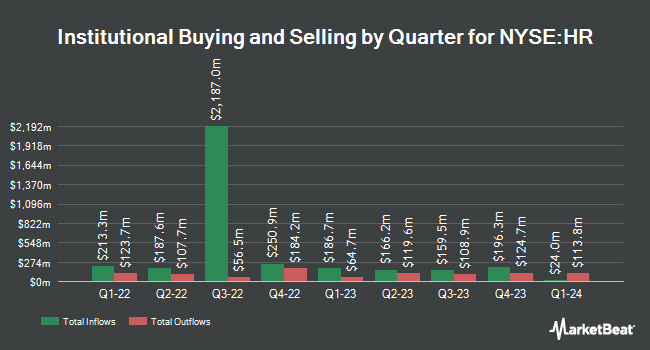

GSA Capital Partners LLP bought a new stake in Healthcare Realty Trust Incorporated (NYSE:HR - Free Report) in the 3rd quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The institutional investor bought 60,982 shares of the real estate investment trust's stock, valued at approximately $1,107,000.

A number of other hedge funds have also recently modified their holdings of the stock. Centersquare Investment Management LLC acquired a new position in Healthcare Realty Trust in the 1st quarter valued at about $1,246,000. Vanguard Group Inc. lifted its holdings in shares of Healthcare Realty Trust by 1.4% during the first quarter. Vanguard Group Inc. now owns 54,246,277 shares of the real estate investment trust's stock worth $767,585,000 after purchasing an additional 723,197 shares during the period. Tidal Investments LLC purchased a new position in Healthcare Realty Trust in the 1st quarter valued at $1,360,000. Linden Thomas Advisory Services LLC acquired a new stake in Healthcare Realty Trust in the second quarter valued at about $515,000. Finally, Deerfield Management Company L.P. Series C acquired a new stake in shares of Healthcare Realty Trust in the 2nd quarter valued at approximately $471,000.

Insider Activity at Healthcare Realty Trust

In other Healthcare Realty Trust news, Director John Knox Singleton bought 6,500 shares of Healthcare Realty Trust stock in a transaction that occurred on Thursday, September 5th. The shares were purchased at an average cost of $18.24 per share, for a total transaction of $118,560.00. Following the completion of the transaction, the director now owns 57,082 shares of the company's stock, valued at $1,041,175.68. This represents a 12.85 % increase in their position. The acquisition was disclosed in a filing with the Securities & Exchange Commission, which is available at this hyperlink. 0.56% of the stock is currently owned by corporate insiders.

Healthcare Realty Trust Stock Performance

HR stock traded up $0.10 on Friday, reaching $17.49. The company had a trading volume of 3,110,676 shares, compared to its average volume of 3,501,568. The company's fifty day moving average is $17.81 and its 200 day moving average is $17.15. The company has a market cap of $6.20 billion, a P/E ratio of -11.07 and a beta of 0.91. Healthcare Realty Trust Incorporated has a 1 year low of $12.77 and a 1 year high of $18.90.

Healthcare Realty Trust Dividend Announcement

The business also recently disclosed a quarterly dividend, which will be paid on Wednesday, November 27th. Investors of record on Tuesday, November 12th will be given a dividend of $0.31 per share. This represents a $1.24 dividend on an annualized basis and a yield of 7.09%. The ex-dividend date of this dividend is Tuesday, November 12th. Healthcare Realty Trust's dividend payout ratio is presently -78.48%.

Analysts Set New Price Targets

HR has been the subject of several recent analyst reports. Scotiabank raised their price objective on shares of Healthcare Realty Trust from $17.00 to $18.00 and gave the company a "sector perform" rating in a research note on Wednesday, August 7th. Wedbush boosted their price target on Healthcare Realty Trust from $15.00 to $18.00 and gave the stock a "neutral" rating in a research note on Monday, August 5th. Finally, Wells Fargo & Company reaffirmed an "underweight" rating and issued a $17.00 price objective (up from $16.00) on shares of Healthcare Realty Trust in a research note on Tuesday, October 1st. One research analyst has rated the stock with a sell rating, four have given a hold rating and one has given a buy rating to the company. Based on data from MarketBeat, the stock presently has a consensus rating of "Hold" and a consensus target price of $17.17.

View Our Latest Report on Healthcare Realty Trust

About Healthcare Realty Trust

(

Free Report)

Healthcare Realty NYSE: HR is a real estate investment trust (REIT) that owns and operates medical outpatient buildings primarily located around market-leading hospital campuses. The Company selectively grows its portfolio through property acquisition and development. As the first and largest REIT to specialize in medical outpatient buildings, Healthcare Realty's portfolio includes more than 700 properties totaling over 40 million square feet concentrated in 15 growth markets.

Recommended Stories

Before you consider Healthcare Realty Trust, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Healthcare Realty Trust wasn't on the list.

While Healthcare Realty Trust currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for December 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.