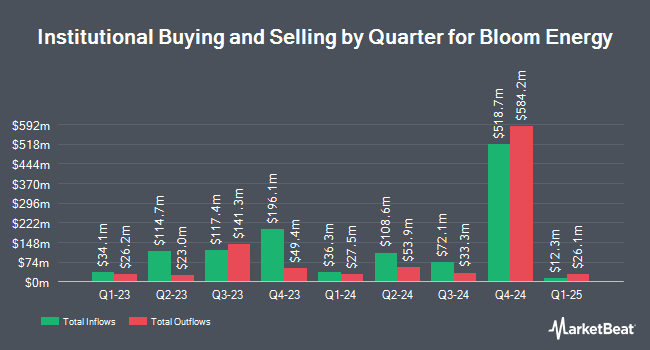

GSA Capital Partners LLP purchased a new stake in Bloom Energy Co. (NYSE:BE - Free Report) in the 3rd quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The institutional investor purchased 25,400 shares of the company's stock, valued at approximately $268,000.

Other large investors have also bought and sold shares of the company. Electron Capital Partners LLC increased its stake in shares of Bloom Energy by 131.5% in the 2nd quarter. Electron Capital Partners LLC now owns 3,152,944 shares of the company's stock valued at $38,592,000 after acquiring an additional 1,790,733 shares in the last quarter. Artemis Investment Management LLP acquired a new stake in shares of Bloom Energy in the 2nd quarter valued at about $7,502,000. DigitalBridge Group Inc. boosted its holdings in Bloom Energy by 66.3% in the second quarter. DigitalBridge Group Inc. now owns 1,160,389 shares of the company's stock worth $14,203,000 after acquiring an additional 462,581 shares in the last quarter. Pier Capital LLC acquired a new position in shares of Bloom Energy during the second quarter worth approximately $5,602,000. Finally, DekaBank Deutsche Girozentrale increased its stake in Bloom Energy by 762.3% during the 1st quarter. DekaBank Deutsche Girozentrale now owns 504,591 shares of the company's stock valued at $5,712,000 after purchasing an additional 446,074 shares in the last quarter. 77.04% of the stock is owned by institutional investors.

Insider Activity at Bloom Energy

In other Bloom Energy news, CEO Kr Sridhar sold 72,903 shares of the stock in a transaction on Wednesday, November 20th. The shares were sold at an average price of $25.02, for a total transaction of $1,824,033.06. Following the completion of the transaction, the chief executive officer now owns 1,869,593 shares in the company, valued at $46,777,216.86. This trade represents a 3.75 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. Also, insider Shawn Marie Soderberg sold 1,289 shares of the company's stock in a transaction that occurred on Monday, November 18th. The shares were sold at an average price of $24.56, for a total value of $31,657.84. Following the sale, the insider now owns 168,561 shares in the company, valued at approximately $4,139,858.16. This trade represents a 0.76 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last ninety days, insiders sold 122,975 shares of company stock worth $3,045,019. 8.81% of the stock is owned by company insiders.

Bloom Energy Stock Performance

Shares of NYSE BE traded up $1.82 during midday trading on Friday, hitting $25.76. 10,584,638 shares of the company's stock traded hands, compared to its average volume of 13,482,251. The firm has a fifty day moving average of $12.22 and a 200 day moving average of $12.71. The company has a debt-to-equity ratio of 3.09, a quick ratio of 2.33 and a current ratio of 3.36. The stock has a market capitalization of $5.89 billion, a price-to-earnings ratio of -46.00 and a beta of 2.71. Bloom Energy Co. has a 1 year low of $8.41 and a 1 year high of $26.26.

Analyst Upgrades and Downgrades

Several research analysts recently issued reports on the company. Piper Sandler lifted their target price on Bloom Energy from $20.00 to $30.00 and gave the company an "overweight" rating in a research report on Friday. Truist Financial cut their price target on shares of Bloom Energy from $13.00 to $12.00 and set a "hold" rating on the stock in a report on Wednesday, October 16th. BTIG Research increased their price objective on shares of Bloom Energy from $16.00 to $20.00 and gave the company a "buy" rating in a research note on Friday, November 15th. Royal Bank of Canada boosted their target price on Bloom Energy from $15.00 to $28.00 and gave the stock an "outperform" rating in a research note on Monday, November 18th. Finally, HSBC downgraded Bloom Energy from a "buy" rating to a "hold" rating and set a $24.50 price target for the company. in a research report on Wednesday. One analyst has rated the stock with a sell rating, ten have given a hold rating, nine have given a buy rating and one has issued a strong buy rating to the company. According to data from MarketBeat.com, the stock has a consensus rating of "Hold" and a consensus target price of $18.66.

View Our Latest Research Report on BE

About Bloom Energy

(

Free Report)

Bloom Energy Corporation designs, manufactures, sells, and installs solid-oxide fuel cell systems for on-site power generation in the United States and internationally. The company offers Bloom Energy Server, a solid oxide technology that converts fuel, such as natural gas, biogas, hydrogen, or a blend of these fuels into electricity through an electrochemical process without combustion.

See Also

Before you consider Bloom Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bloom Energy wasn't on the list.

While Bloom Energy currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for December 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.