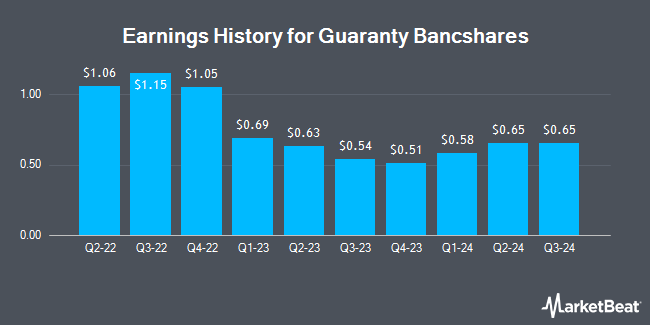

Guaranty Bancshares (NASDAQ:GNTY - Get Free Report) is expected to release its earnings data before the market opens on Monday, April 21st. Analysts expect Guaranty Bancshares to post earnings of $0.77 per share and revenue of $30.94 million for the quarter. Individual that wish to register for the company's earnings conference call can do so using this link.

Guaranty Bancshares Price Performance

GNTY stock traded up $0.15 during mid-day trading on Friday, hitting $39.24. The company had a trading volume of 27,072 shares, compared to its average volume of 27,505. The company has a 50-day moving average price of $39.71 and a 200 day moving average price of $37.33. Guaranty Bancshares has a 12-month low of $27.01 and a 12-month high of $42.95. The company has a market capitalization of $445.41 million, a price-to-earnings ratio of 14.27 and a beta of 0.49. The company has a quick ratio of 0.83, a current ratio of 0.83 and a debt-to-equity ratio of 0.14.

Guaranty Bancshares Increases Dividend

The company also recently announced a quarterly dividend, which was paid on Wednesday, April 9th. Investors of record on Monday, March 31st were given a $0.25 dividend. This is an increase from Guaranty Bancshares's previous quarterly dividend of $0.24. This represents a $1.00 dividend on an annualized basis and a dividend yield of 2.55%. The ex-dividend date was Monday, March 31st. Guaranty Bancshares's payout ratio is currently 36.36%.

Wall Street Analyst Weigh In

Separately, Keefe, Bruyette & Woods raised their price target on Guaranty Bancshares from $40.00 to $42.00 and gave the company a "market perform" rating in a report on Wednesday, January 22nd.

View Our Latest Stock Analysis on Guaranty Bancshares

Guaranty Bancshares Company Profile

(

Get Free Report)

Guaranty Bancshares, Inc operates as the bank holding company for Guaranty Bank & Trust, N.A. that provides a range of commercial and consumer banking products and services for small- and medium-sized businesses, professionals, and individuals. The company offers checking and savings, money market, and business accounts, as well as certificates of deposit; and commercial and industrial, construction and development, 1-4 family residential, commercial real estate, farmland, agricultural, multi-family residential, and consumer loans.

Featured Articles

Before you consider Guaranty Bancshares, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Guaranty Bancshares wasn't on the list.

While Guaranty Bancshares currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.