Guaranty Bancshares (NASDAQ:GNTY - Get Free Report) is expected to be posting its quarterly earnings results before the market opens on Tuesday, January 21st. Analysts expect Guaranty Bancshares to post earnings of $0.61 per share and revenue of $29,491.00 billion for the quarter.

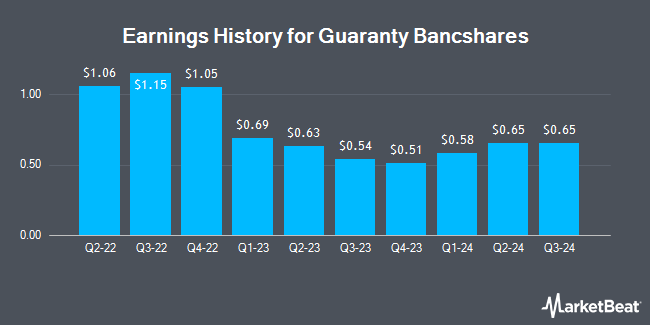

Guaranty Bancshares (NASDAQ:GNTY - Get Free Report) last announced its quarterly earnings data on Monday, October 21st. The company reported $0.65 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.62 by $0.03. Guaranty Bancshares had a net margin of 15.01% and a return on equity of 8.86%. The business had revenue of $45.59 million for the quarter, compared to analysts' expectations of $29.40 million. During the same period last year, the firm posted $0.54 earnings per share. On average, analysts expect Guaranty Bancshares to post $2 EPS for the current fiscal year and $2 EPS for the next fiscal year.

Guaranty Bancshares Price Performance

NASDAQ GNTY traded up $1.17 on Wednesday, hitting $35.27. 24,559 shares of the company's stock were exchanged, compared to its average volume of 70,184. The stock has a 50-day moving average of $35.73 and a 200-day moving average of $34.03. The stock has a market cap of $402.92 million, a price-to-earnings ratio of 14.76 and a beta of 0.61. Guaranty Bancshares has a 52 week low of $27.01 and a 52 week high of $38.93. The company has a current ratio of 0.83, a quick ratio of 0.83 and a debt-to-equity ratio of 0.14.

Guaranty Bancshares Announces Dividend

The firm also recently declared a quarterly dividend, which was paid on Wednesday, January 8th. Stockholders of record on Monday, December 30th were issued a dividend of $0.24 per share. The ex-dividend date of this dividend was Monday, December 30th. This represents a $0.96 dividend on an annualized basis and a dividend yield of 2.72%. Guaranty Bancshares's dividend payout ratio (DPR) is currently 40.17%.

Wall Street Analysts Forecast Growth

A number of research analysts have issued reports on the company. Stephens lifted their target price on Guaranty Bancshares from $38.00 to $40.00 and gave the company an "overweight" rating in a research report on Tuesday, October 22nd. Keefe, Bruyette & Woods raised their price target on shares of Guaranty Bancshares from $35.00 to $40.00 and gave the company a "market perform" rating in a research note on Wednesday, December 4th.

Get Our Latest Stock Report on GNTY

Insider Activity

In other Guaranty Bancshares news, CEO Tyson T. Abston sold 7,000 shares of the company's stock in a transaction dated Wednesday, November 6th. The stock was sold at an average price of $34.02, for a total value of $238,140.00. Following the completion of the transaction, the chief executive officer now owns 101,000 shares of the company's stock, valued at $3,436,020. This represents a 6.48 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. 26.39% of the stock is owned by corporate insiders.

About Guaranty Bancshares

(

Get Free Report)

Guaranty Bancshares, Inc operates as the bank holding company for Guaranty Bank & Trust, N.A. that provides a range of commercial and consumer banking products and services for small- and medium-sized businesses, professionals, and individuals. The company offers checking and savings, money market, and business accounts, as well as certificates of deposit; and commercial and industrial, construction and development, 1-4 family residential, commercial real estate, farmland, agricultural, multi-family residential, and consumer loans.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Guaranty Bancshares, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Guaranty Bancshares wasn't on the list.

While Guaranty Bancshares currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.