Investment analysts at Guggenheim initiated coverage on shares of Kroger (NYSE:KR - Get Free Report) in a note issued to investors on Thursday,Benzinga reports. The brokerage set a "buy" rating and a $68.00 price target on the stock. Guggenheim's target price indicates a potential upside of 11.55% from the stock's previous close.

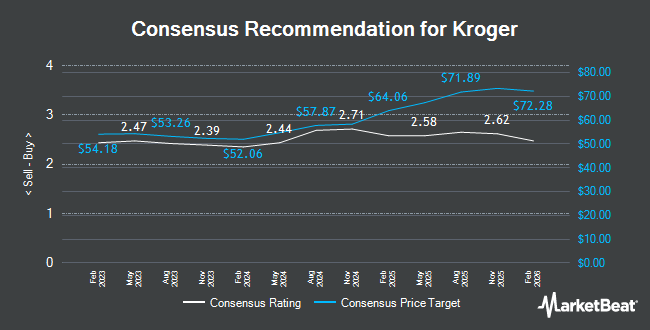

A number of other research firms have also recently commented on KR. UBS Group boosted their target price on shares of Kroger from $63.00 to $66.00 and gave the stock a "neutral" rating in a research report on Thursday, December 12th. Melius Research assumed coverage on shares of Kroger in a report on Monday, September 23rd. They issued a "hold" rating and a $55.00 price objective on the stock. StockNews.com cut shares of Kroger from a "strong-buy" rating to a "buy" rating in a research report on Monday, September 16th. Jefferies Financial Group raised Kroger from a "hold" rating to a "buy" rating and lifted their target price for the stock from $54.00 to $73.00 in a research report on Tuesday, December 3rd. Finally, Morgan Stanley increased their price target on Kroger from $58.00 to $62.00 and gave the company an "equal weight" rating in a report on Wednesday, December 11th. Six equities research analysts have rated the stock with a hold rating, eight have given a buy rating and one has assigned a strong buy rating to the company's stock. According to data from MarketBeat, the stock currently has an average rating of "Moderate Buy" and a consensus target price of $64.69.

View Our Latest Stock Report on KR

Kroger Stock Up 0.1 %

Kroger stock traded up $0.07 during trading on Thursday, reaching $60.96. 5,096,089 shares of the company's stock were exchanged, compared to its average volume of 4,744,864. The company's 50-day moving average is $58.60 and its two-hundred day moving average is $55.09. The company has a debt-to-equity ratio of 1.74, a quick ratio of 1.07 and a current ratio of 1.54. Kroger has a 52-week low of $44.48 and a 52-week high of $63.59. The firm has a market cap of $44.10 billion, a price-to-earnings ratio of 16.13, a PEG ratio of 0.96 and a beta of 0.48.

Kroger (NYSE:KR - Get Free Report) last issued its earnings results on Thursday, December 5th. The company reported $0.98 earnings per share for the quarter, topping the consensus estimate of $0.97 by $0.01. The company had revenue of $33.63 billion during the quarter, compared to the consensus estimate of $34.19 billion. Kroger had a return on equity of 27.73% and a net margin of 1.85%. The company's revenue was down 1.0% compared to the same quarter last year. During the same quarter in the prior year, the business earned $0.95 earnings per share. On average, analysts predict that Kroger will post 4.44 earnings per share for the current year.

Kroger declared that its board has initiated a share buyback program on Wednesday, December 11th that allows the company to repurchase $7.50 billion in outstanding shares. This repurchase authorization allows the company to repurchase up to 16.9% of its stock through open market purchases. Stock repurchase programs are often an indication that the company's board believes its stock is undervalued.

Insider Activity at Kroger

In related news, SVP Valerie L. Jabbar sold 3,000 shares of the company's stock in a transaction on Monday, September 23rd. The stock was sold at an average price of $55.91, for a total transaction of $167,730.00. Following the completion of the transaction, the senior vice president now directly owns 74,084 shares in the company, valued at $4,142,036.44. This represents a 3.89 % decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available through this hyperlink. Also, SVP Stuart Aitken sold 132,627 shares of the stock in a transaction on Thursday, December 12th. The stock was sold at an average price of $63.18, for a total value of $8,379,373.86. Following the completion of the sale, the senior vice president now directly owns 217,523 shares in the company, valued at $13,743,103.14. This represents a 37.88 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold a total of 188,438 shares of company stock valued at $11,657,598 in the last quarter. Insiders own 1.40% of the company's stock.

Institutional Inflows and Outflows

Several institutional investors and hedge funds have recently bought and sold shares of the company. State Street Corp boosted its position in shares of Kroger by 6.8% during the third quarter. State Street Corp now owns 33,057,629 shares of the company's stock worth $1,894,202,000 after buying an additional 2,110,681 shares during the period. Geode Capital Management LLC boosted its position in Kroger by 0.8% during the 3rd quarter. Geode Capital Management LLC now owns 16,019,726 shares of the company's stock worth $914,795,000 after acquiring an additional 126,303 shares during the period. Dimensional Fund Advisors LP grew its stake in shares of Kroger by 5.6% in the second quarter. Dimensional Fund Advisors LP now owns 13,591,402 shares of the company's stock worth $678,562,000 after purchasing an additional 723,771 shares in the last quarter. Legal & General Group Plc increased its holdings in shares of Kroger by 13.4% during the second quarter. Legal & General Group Plc now owns 7,759,992 shares of the company's stock valued at $387,456,000 after purchasing an additional 917,923 shares during the period. Finally, Point72 Asset Management L.P. raised its stake in shares of Kroger by 96.6% during the second quarter. Point72 Asset Management L.P. now owns 5,381,311 shares of the company's stock valued at $268,689,000 after purchasing an additional 2,643,811 shares in the last quarter. Institutional investors own 80.93% of the company's stock.

About Kroger

(

Get Free Report)

The Kroger Co operates as a food and drug retailer in the United States. The company operates combination food and drug stores, multi-department stores, marketplace stores, and price impact warehouses. Its combination food and drug stores offer natural food and organic sections, pharmacies, general merchandise, pet centers, fresh seafood, and organic produce; and multi-department stores provide apparel, home fashion and furnishings, outdoor living, electronics, automotive products, and toys.

Featured Stories

Before you consider Kroger, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Kroger wasn't on the list.

While Kroger currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report