Guggenheim restated their buy rating on shares of Larimar Therapeutics (NASDAQ:LRMR - Free Report) in a research report released on Tuesday morning,Benzinga reports. They currently have a $26.00 target price on the stock.

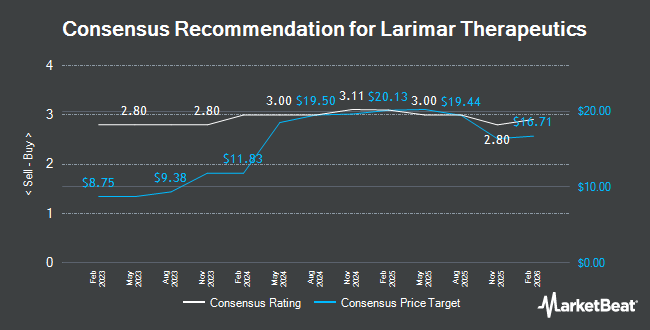

Several other equities analysts also recently commented on LRMR. HC Wainwright upped their price objective on shares of Larimar Therapeutics from $15.00 to $16.00 and gave the company a "buy" rating in a research note on Tuesday. Robert W. Baird dropped their price objective on Larimar Therapeutics from $13.00 to $10.00 and set an "outperform" rating for the company in a report on Tuesday. Finally, Truist Financial assumed coverage on Larimar Therapeutics in a research report on Wednesday, January 29th. They issued a "buy" rating and a $18.00 price objective on the stock. Eleven analysts have rated the stock with a buy rating and one has assigned a strong buy rating to the company. Based on data from MarketBeat.com, the company has a consensus rating of "Buy" and an average price target of $20.22.

View Our Latest Stock Analysis on LRMR

Larimar Therapeutics Stock Performance

LRMR traded down $0.05 on Tuesday, hitting $2.35. 986,346 shares of the company were exchanged, compared to its average volume of 645,138. The firm has a fifty day simple moving average of $3.08 and a two-hundred day simple moving average of $5.12. The stock has a market capitalization of $149.95 million, a PE ratio of -2.04 and a beta of 0.99. Larimar Therapeutics has a 12 month low of $2.19 and a 12 month high of $11.20.

Larimar Therapeutics (NASDAQ:LRMR - Get Free Report) last issued its earnings results on Monday, March 24th. The company reported ($0.45) earnings per share (EPS) for the quarter, missing the consensus estimate of ($0.29) by ($0.16). On average, equities analysts expect that Larimar Therapeutics will post -1.15 earnings per share for the current year.

Hedge Funds Weigh In On Larimar Therapeutics

A number of institutional investors have recently added to or reduced their stakes in LRMR. BNP Paribas Financial Markets purchased a new stake in Larimar Therapeutics in the fourth quarter worth about $25,000. Algert Global LLC purchased a new stake in Larimar Therapeutics during the 4th quarter valued at $47,000. China Universal Asset Management Co. Ltd. purchased a new stake in Larimar Therapeutics during the 4th quarter valued at $52,000. Graham Capital Management L.P. bought a new stake in shares of Larimar Therapeutics in the 4th quarter worth $54,000. Finally, ProShare Advisors LLC purchased a new position in shares of Larimar Therapeutics in the fourth quarter worth $58,000. Institutional investors own 91.92% of the company's stock.

Larimar Therapeutics Company Profile

(

Get Free Report)

Larimar Therapeutics, Inc, a clinical-stage biotechnology company, focuses on developing treatments for rare diseases using its novel cell penetrating peptide technology platform. Its lead product candidate is CTI-1601, which is in Phase 2 OLE clinical trial for the treatment of Friedreich's ataxia, a rare, progressive and fatal genetic disease.

Recommended Stories

Before you consider Larimar Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Larimar Therapeutics wasn't on the list.

While Larimar Therapeutics currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.