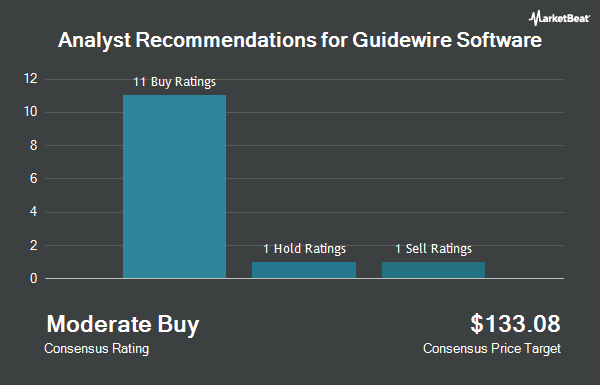

Shares of Guidewire Software, Inc. (NYSE:GWRE - Get Free Report) have earned a consensus recommendation of "Moderate Buy" from the thirteen brokerages that are presently covering the stock, MarketBeat.com reports. One research analyst has rated the stock with a sell recommendation, two have assigned a hold recommendation and ten have assigned a buy recommendation to the company. The average twelve-month price target among brokers that have covered the stock in the last year is $206.08.

GWRE has been the subject of a number of analyst reports. JPMorgan Chase & Co. raised their price objective on Guidewire Software from $228.00 to $231.00 and gave the stock an "overweight" rating in a research report on Friday. Stifel Nicolaus raised their price objective on Guidewire Software from $200.00 to $220.00 and gave the company a "buy" rating in a research note on Tuesday, November 19th. JMP Securities reiterated a "market outperform" rating and set a $231.00 price target on shares of Guidewire Software in a research note on Friday, December 6th. The Goldman Sachs Group boosted their price target on shares of Guidewire Software from $210.00 to $240.00 and gave the stock a "buy" rating in a report on Monday, February 10th. Finally, Royal Bank of Canada lifted their price target on Guidewire Software from $215.00 to $230.00 and gave the stock an "outperform" rating in a report on Friday, December 6th.

View Our Latest Report on GWRE

Guidewire Software Price Performance

NYSE GWRE traded up $6.19 during midday trading on Tuesday, hitting $172.93. The company had a trading volume of 1,764,424 shares, compared to its average volume of 1,331,742. The company has a current ratio of 2.66, a quick ratio of 2.66 and a debt-to-equity ratio of 0.53. The company has a market capitalization of $14.44 billion, a PE ratio of 480.37, a P/E/G ratio of 37.21 and a beta of 1.31. The firm has a 50-day moving average price of $194.72 and a 200-day moving average price of $185.42. Guidewire Software has a twelve month low of $107.00 and a twelve month high of $219.59.

Guidewire Software (NYSE:GWRE - Get Free Report) last announced its quarterly earnings results on Thursday, March 6th. The technology company reported $0.08 EPS for the quarter, missing analysts' consensus estimates of $0.52 by ($0.44). Guidewire Software had a net margin of 2.91% and a return on equity of 2.38%. The firm had revenue of $289.48 million for the quarter, compared to analyst estimates of $285.74 million. As a group, analysts anticipate that Guidewire Software will post 0.52 earnings per share for the current fiscal year.

Insider Buying and Selling

In other Guidewire Software news, CEO Michael George Rosenbaum sold 1,400 shares of the firm's stock in a transaction dated Monday, February 10th. The stock was sold at an average price of $214.68, for a total transaction of $300,552.00. Following the sale, the chief executive officer now owns 274,730 shares in the company, valued at $58,979,036.40. This trade represents a 0.51 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is available at this hyperlink. Also, President John P. Mullen sold 1,350 shares of Guidewire Software stock in a transaction on Friday, December 20th. The stock was sold at an average price of $170.43, for a total transaction of $230,080.50. Following the completion of the transaction, the president now owns 180,746 shares in the company, valued at approximately $30,804,540.78. The trade was a 0.74 % decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 44,056 shares of company stock worth $8,094,892 over the last ninety days. 0.48% of the stock is owned by corporate insiders.

Institutional Trading of Guidewire Software

A number of institutional investors have recently made changes to their positions in GWRE. Versant Capital Management Inc purchased a new stake in Guidewire Software in the 4th quarter worth approximately $25,000. Ossiam bought a new stake in Guidewire Software in the fourth quarter worth $29,000. Assetmark Inc. grew its position in Guidewire Software by 537.0% during the 3rd quarter. Assetmark Inc. now owns 172 shares of the technology company's stock valued at $31,000 after purchasing an additional 145 shares during the last quarter. Point72 Hong Kong Ltd purchased a new position in Guidewire Software in the 3rd quarter worth approximately $33,000. Finally, Cullen Frost Bankers Inc. bought a new position in Guidewire Software in the 4th quarter valued at approximately $34,000.

About Guidewire Software

(

Get Free ReportGuidewire Software, Inc provides a platform for property and casualty (P&C) insurers worldwide. The company offers Guidewire InsuranceSuite Cloud, such as PolicyCenter Cloud, BillingCenter Cloud, and ClaimCenter Cloud applications. It also provides Guidewire InsuranceNow, a cloud-based platform that offers policy, billing, and claims management functionality to insurers; and Guidewire InsuranceSuite for Self-Managed.

Featured Stories

Before you consider Guidewire Software, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Guidewire Software wasn't on the list.

While Guidewire Software currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.