Guild (NYSE:GHLD - Get Free Report) was upgraded by equities researchers at JPMorgan Chase & Co. from an "underweight" rating to a "neutral" rating in a research note issued on Tuesday, MarketBeat.com reports. The firm presently has a $12.00 target price on the stock, down from their prior target price of $12.50. JPMorgan Chase & Co.'s price target indicates a potential downside of 7.16% from the company's current price.

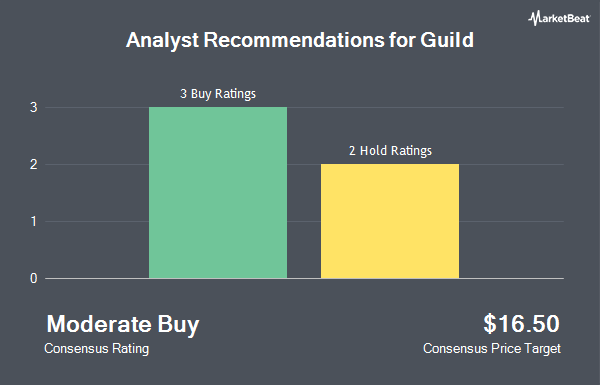

Separately, Compass Point lifted their price target on Guild from $16.00 to $19.00 and gave the company a "buy" rating in a research report on Tuesday, January 21st. Two analysts have rated the stock with a hold rating and three have given a buy rating to the stock. According to data from MarketBeat, the company currently has an average rating of "Moderate Buy" and an average price target of $16.50.

Check Out Our Latest Report on GHLD

Guild Price Performance

NYSE:GHLD traded down $0.18 during trading hours on Tuesday, hitting $12.93. 17,745 shares of the company's stock traded hands, compared to its average volume of 12,705. Guild has a 52 week low of $11.21 and a 52 week high of $18.26. The business's fifty day simple moving average is $13.26 and its two-hundred day simple moving average is $13.78. The company has a quick ratio of 0.06, a current ratio of 0.06 and a debt-to-equity ratio of 0.92. The firm has a market cap of $800.11 million, a P/E ratio of -8.34, a P/E/G ratio of 0.27 and a beta of 0.79.

Hedge Funds Weigh In On Guild

Several institutional investors and hedge funds have recently bought and sold shares of the stock. HighTower Advisors LLC boosted its holdings in shares of Guild by 419.9% during the fourth quarter. HighTower Advisors LLC now owns 125,311 shares of the company's stock worth $1,768,000 after purchasing an additional 101,209 shares during the period. Bayview Asset Management LLC lifted its holdings in Guild by 6.4% in the 4th quarter. Bayview Asset Management LLC now owns 1,595,844 shares of the company's stock worth $22,517,000 after buying an additional 95,327 shares during the period. Adage Capital Partners GP L.L.C. lifted its holdings in Guild by 5.3% in the 4th quarter. Adage Capital Partners GP L.L.C. now owns 628,650 shares of the company's stock worth $8,870,000 after buying an additional 31,540 shares during the period. Basswood Capital Management L.L.C. grew its position in shares of Guild by 3.2% in the 4th quarter. Basswood Capital Management L.L.C. now owns 674,805 shares of the company's stock worth $9,521,000 after buying an additional 20,848 shares during the last quarter. Finally, Citadel Advisors LLC increased its stake in shares of Guild by 57.5% during the fourth quarter. Citadel Advisors LLC now owns 16,799 shares of the company's stock valued at $237,000 after buying an additional 6,134 shares during the period. 17.52% of the stock is currently owned by institutional investors.

Guild Company Profile

(

Get Free Report)

Guild Holdings Company originates, sells, and services residential mortgage loans in the United States. It operates in two segments, Origination and Servicing. The company offers residential mortgages through retail and correspondent channels. Guild Holdings Company was incorporated in 1960 and is headquartered in San Diego, California.

Read More

Before you consider Guild, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Guild wasn't on the list.

While Guild currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.