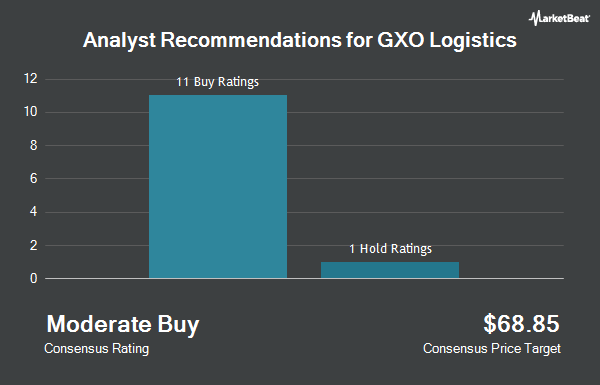

Shares of GXO Logistics, Inc. (NYSE:GXO - Get Free Report) have received an average recommendation of "Moderate Buy" from the twelve research firms that are currently covering the stock, Marketbeat.com reports. Two analysts have rated the stock with a hold rating and ten have issued a buy rating on the company. The average twelve-month price target among analysts that have issued a report on the stock in the last year is $66.33.

A number of equities research analysts recently weighed in on the company. Citigroup assumed coverage on GXO Logistics in a report on Wednesday, October 9th. They issued a "buy" rating and a $60.00 price target on the stock. UBS Group raised their price target on GXO Logistics from $66.00 to $72.00 and gave the company a "buy" rating in a research report on Wednesday, November 6th. Susquehanna cut their price target on GXO Logistics from $75.00 to $73.00 and set a "positive" rating for the company in a research note on Thursday, September 26th. TD Cowen increased their price objective on shares of GXO Logistics from $82.00 to $83.00 and gave the company a "buy" rating in a research note on Wednesday, November 6th. Finally, Oppenheimer raised their target price on shares of GXO Logistics from $63.00 to $67.00 and gave the company an "outperform" rating in a report on Wednesday, November 27th.

Check Out Our Latest Stock Report on GXO Logistics

Hedge Funds Weigh In On GXO Logistics

Institutional investors and hedge funds have recently bought and sold shares of the stock. Eminence Capital LP purchased a new stake in shares of GXO Logistics during the 2nd quarter worth about $79,698,000. Spruce House Investment Management LLC grew its stake in GXO Logistics by 827.8% during the second quarter. Spruce House Investment Management LLC now owns 900,000 shares of the company's stock worth $45,450,000 after buying an additional 803,000 shares during the period. American Century Companies Inc. increased its position in shares of GXO Logistics by 25.2% in the second quarter. American Century Companies Inc. now owns 3,221,818 shares of the company's stock worth $162,702,000 after acquiring an additional 648,547 shares in the last quarter. Global Alpha Capital Management Ltd. purchased a new position in shares of GXO Logistics in the 3rd quarter valued at $32,434,000. Finally, Fort Pitt Capital Group LLC lifted its holdings in shares of GXO Logistics by 30.4% during the 2nd quarter. Fort Pitt Capital Group LLC now owns 2,416,606 shares of the company's stock valued at $122,039,000 after acquiring an additional 563,057 shares in the last quarter. Institutional investors and hedge funds own 90.67% of the company's stock.

GXO Logistics Price Performance

NYSE:GXO traded down $2.35 during trading hours on Thursday, hitting $42.76. The company's stock had a trading volume of 2,549,594 shares, compared to its average volume of 975,733. GXO Logistics has a 52-week low of $42.73 and a 52-week high of $63.33. The company has a debt-to-equity ratio of 0.81, a quick ratio of 0.86 and a current ratio of 0.86. The business's 50-day moving average is $57.56 and its two-hundred day moving average is $52.87. The company has a market capitalization of $5.11 billion, a PE ratio of 47.51, a PEG ratio of 1.49 and a beta of 1.52.

GXO Logistics (NYSE:GXO - Get Free Report) last announced its quarterly earnings data on Monday, November 4th. The company reported $0.79 EPS for the quarter, beating the consensus estimate of $0.78 by $0.01. GXO Logistics had a net margin of 0.97% and a return on equity of 10.03%. The firm had revenue of $3.16 billion during the quarter, compared to analysts' expectations of $3.01 billion. During the same quarter last year, the business earned $0.69 earnings per share. The business's revenue for the quarter was up 27.8% compared to the same quarter last year. As a group, research analysts anticipate that GXO Logistics will post 2.76 EPS for the current fiscal year.

GXO Logistics Company Profile

(

Get Free ReportGXO Logistics, Inc, together with its subsidiaries, provides logistics services worldwide. The company provides warehousing and distribution, order fulfilment, e-commerce, reverse logistics, and other supply chain services. As of December 31, 2023, it operated in approximately 974 facilities. The company serves various customers in the e-commerce, omnichannel retail, technology and consumer electronics, food and beverage, industrial and manufacturing, consumer packaged goods, and others.

Read More

Before you consider GXO Logistics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and GXO Logistics wasn't on the list.

While GXO Logistics currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.