GXO Logistics (NYSE:GXO - Free Report) had its price objective lowered by Morgan Stanley from $63.00 to $57.00 in a report released on Friday morning,Benzinga reports. Morgan Stanley currently has an overweight rating on the stock.

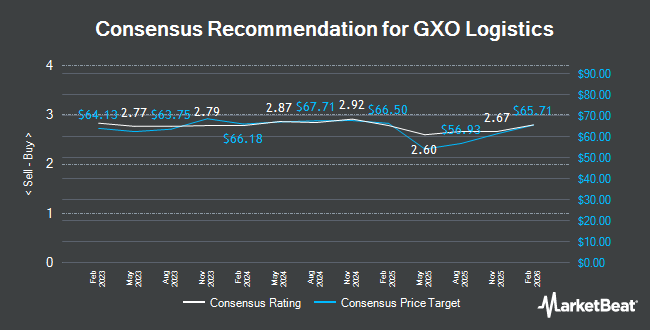

Several other research analysts have also recently issued reports on GXO. UBS Group increased their price objective on shares of GXO Logistics from $66.00 to $72.00 and gave the company a "buy" rating in a report on Wednesday, November 6th. TD Cowen increased their target price on shares of GXO Logistics from $82.00 to $83.00 and gave the company a "buy" rating in a research note on Wednesday, November 6th. Loop Capital lowered shares of GXO Logistics from a "buy" rating to a "hold" rating and cut their target price for the company from $71.00 to $49.00 in a research note on Monday, February 3rd. The Goldman Sachs Group cut their target price on shares of GXO Logistics from $63.00 to $54.00 and set a "neutral" rating for the company in a research note on Thursday, January 16th. Finally, Barclays cut their target price on shares of GXO Logistics from $52.00 to $45.00 and set an "equal weight" rating for the company in a research note on Thursday, February 13th. Four equities research analysts have rated the stock with a hold rating and nine have issued a buy rating to the company. According to data from MarketBeat, the stock presently has a consensus rating of "Moderate Buy" and a consensus price target of $57.62.

View Our Latest Stock Analysis on GXO

GXO Logistics Price Performance

Shares of GXO Logistics stock traded up $1.66 on Friday, hitting $41.07. The company had a trading volume of 3,126,472 shares, compared to its average volume of 1,562,244. The business has a 50-day simple moving average of $44.03 and a 200-day simple moving average of $50.61. The company has a debt-to-equity ratio of 0.81, a current ratio of 0.86 and a quick ratio of 0.86. The company has a market cap of $4.91 billion, a PE ratio of 45.63, a PEG ratio of 1.19 and a beta of 1.60. GXO Logistics has a 52 week low of $34.51 and a 52 week high of $63.33.

GXO Logistics (NYSE:GXO - Get Free Report) last posted its quarterly earnings data on Wednesday, February 12th. The company reported $1.00 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.94 by $0.06. GXO Logistics had a net margin of 0.97% and a return on equity of 10.03%. Research analysts expect that GXO Logistics will post 2.73 EPS for the current fiscal year.

Institutional Investors Weigh In On GXO Logistics

Hedge funds have recently made changes to their positions in the company. DekaBank Deutsche Girozentrale purchased a new stake in shares of GXO Logistics in the 3rd quarter valued at approximately $28,000. Murphy & Mullick Capital Management Corp purchased a new stake in GXO Logistics in the 4th quarter worth approximately $41,000. Summit Securities Group LLC lifted its position in GXO Logistics by 870.9% in the 4th quarter. Summit Securities Group LLC now owns 1,000 shares of the company's stock worth $44,000 after buying an additional 897 shares in the last quarter. Signaturefd LLC lifted its position in GXO Logistics by 37.2% in the 3rd quarter. Signaturefd LLC now owns 918 shares of the company's stock worth $48,000 after buying an additional 249 shares in the last quarter. Finally, Hara Capital LLC purchased a new stake in GXO Logistics in the 3rd quarter worth approximately $50,000. Hedge funds and other institutional investors own 90.67% of the company's stock.

GXO Logistics Company Profile

(

Get Free Report)

GXO Logistics, Inc, together with its subsidiaries, provides logistics services worldwide. The company provides warehousing and distribution, order fulfilment, e-commerce, reverse logistics, and other supply chain services. As of December 31, 2023, it operated in approximately 974 facilities. The company serves various customers in the e-commerce, omnichannel retail, technology and consumer electronics, food and beverage, industrial and manufacturing, consumer packaged goods, and others.

Read More

Before you consider GXO Logistics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and GXO Logistics wasn't on the list.

While GXO Logistics currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.