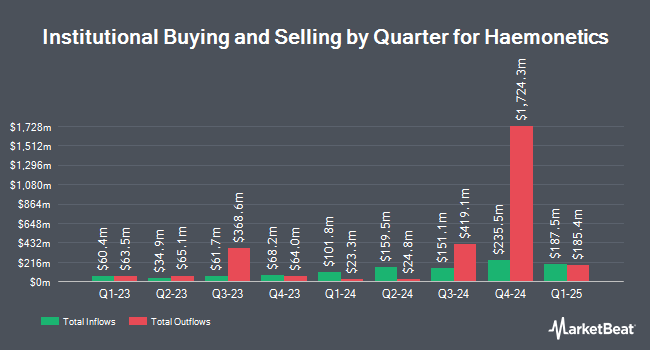

California Public Employees Retirement System cut its holdings in shares of Haemonetics Co. (NYSE:HAE - Free Report) by 3.1% during the fourth quarter, according to its most recent filing with the Securities & Exchange Commission. The firm owned 218,361 shares of the medical instruments supplier's stock after selling 7,015 shares during the period. California Public Employees Retirement System owned approximately 0.43% of Haemonetics worth $17,050,000 as of its most recent SEC filing.

Several other institutional investors and hedge funds have also recently modified their holdings of the business. Whittier Trust Co. acquired a new stake in shares of Haemonetics in the fourth quarter valued at about $62,000. Parkside Financial Bank & Trust lifted its stake in Haemonetics by 25.6% in the 4th quarter. Parkside Financial Bank & Trust now owns 1,176 shares of the medical instruments supplier's stock valued at $92,000 after buying an additional 240 shares in the last quarter. AlphaQuest LLC boosted its holdings in Haemonetics by 36,520.0% in the 4th quarter. AlphaQuest LLC now owns 1,831 shares of the medical instruments supplier's stock worth $143,000 after buying an additional 1,826 shares during the last quarter. KBC Group NV increased its stake in Haemonetics by 54.6% during the 4th quarter. KBC Group NV now owns 2,016 shares of the medical instruments supplier's stock worth $157,000 after buying an additional 712 shares in the last quarter. Finally, iSAM Funds UK Ltd acquired a new position in shares of Haemonetics during the third quarter valued at approximately $204,000. Hedge funds and other institutional investors own 99.67% of the company's stock.

Analyst Ratings Changes

Several analysts recently commented on HAE shares. Raymond James reiterated a "strong-buy" rating and set a $115.00 price target (down from $120.00) on shares of Haemonetics in a research report on Friday, February 7th. Needham & Company LLC dropped their target price on shares of Haemonetics from $108.00 to $104.00 and set a "buy" rating for the company in a report on Tuesday, March 18th. Barrington Research reduced their target price on shares of Haemonetics from $108.00 to $95.00 and set an "outperform" rating for the company in a research report on Friday, February 7th. StockNews.com lowered shares of Haemonetics from a "buy" rating to a "hold" rating in a research report on Saturday, February 15th. Finally, Bank of America downgraded shares of Haemonetics from a "neutral" rating to an "underperform" rating and cut their price objective for the company from $95.00 to $68.00 in a report on Friday, February 7th. One research analyst has rated the stock with a sell rating, two have issued a hold rating, six have assigned a buy rating and one has assigned a strong buy rating to the company. Based on data from MarketBeat.com, the company presently has an average rating of "Moderate Buy" and an average price target of $101.22.

Check Out Our Latest Report on Haemonetics

Haemonetics Trading Up 8.7 %

Shares of Haemonetics stock traded up $4.85 during mid-day trading on Wednesday, hitting $60.89. The stock had a trading volume of 1,895,014 shares, compared to its average volume of 683,732. The firm has a 50-day moving average of $63.92 and a two-hundred day moving average of $73.67. The firm has a market cap of $3.06 billion, a P/E ratio of 23.97, a price-to-earnings-growth ratio of 1.11 and a beta of 0.41. The company has a quick ratio of 2.55, a current ratio of 3.97 and a debt-to-equity ratio of 1.35. Haemonetics Co. has a 12-month low of $55.30 and a 12-month high of $97.97.

Haemonetics (NYSE:HAE - Get Free Report) last issued its quarterly earnings data on Thursday, February 6th. The medical instruments supplier reported $1.19 earnings per share for the quarter, missing the consensus estimate of $1.20 by ($0.01). Haemonetics had a return on equity of 23.66% and a net margin of 9.47%. Sell-side analysts forecast that Haemonetics Co. will post 4.55 earnings per share for the current year.

Haemonetics Company Profile

(

Free Report)

Haemonetics Corporation, a healthcare company, provides suite of medical products and solutions in the United States and internationally. The company offers automated plasma collection systems, donor management software, and supporting software solutions including NexSys PCS and PCS2 plasmapheresis equipment and related disposables and solutions, as well as integrated information technology platforms for plasma customers to manage their donors, operations, and supply chain; and NexLynk DMS donor management system and Donor360 app.

Featured Articles

Before you consider Haemonetics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Haemonetics wasn't on the list.

While Haemonetics currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are hedge funds and endowments buying in today's market? Enter your email address and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying now.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.