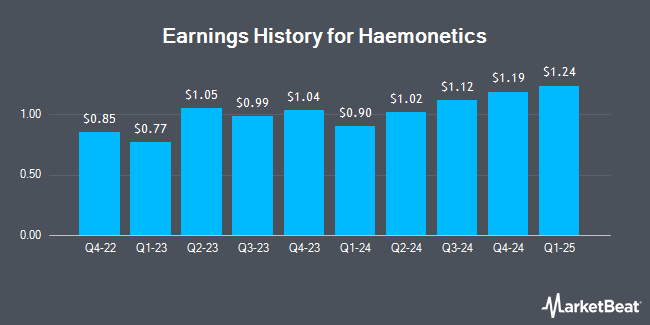

Haemonetics (NYSE:HAE - Get Free Report) is projected to release its Q3 2025 earnings data before the market opens on Thursday, February 6th. Analysts expect Haemonetics to post earnings of $1.20 per share and revenue of $354.46 million for the quarter. Haemonetics has set its FY 2025 guidance at 4.500-4.700 EPS.Parties that are interested in participating in the company's conference call can do so using this link.

Haemonetics (NYSE:HAE - Get Free Report) last released its earnings results on Thursday, February 6th. The medical instruments supplier reported $1.19 EPS for the quarter, missing analysts' consensus estimates of $1.20 by ($0.01). Haemonetics had a return on equity of 23.66% and a net margin of 9.47%. On average, analysts expect Haemonetics to post $5 EPS for the current fiscal year and $5 EPS for the next fiscal year.

Haemonetics Price Performance

NYSE:HAE traded down $3.66 during trading hours on Friday, hitting $59.34. 2,702,592 shares of the stock traded hands, compared to its average volume of 959,630. The stock has a 50 day moving average price of $76.38 and a 200 day moving average price of $78.32. The company has a quick ratio of 2.09, a current ratio of 3.97 and a debt-to-equity ratio of 1.35. The company has a market cap of $2.98 billion, a price-to-earnings ratio of 23.36, a price-to-earnings-growth ratio of 0.98 and a beta of 0.39. Haemonetics has a 1 year low of $59.09 and a 1 year high of $97.97.

Wall Street Analyst Weigh In

HAE has been the subject of several recent analyst reports. Raymond James reaffirmed a "strong-buy" rating and issued a $115.00 target price (down previously from $120.00) on shares of Haemonetics in a report on Friday. StockNews.com raised Haemonetics from a "hold" rating to a "buy" rating in a research note on Friday. JPMorgan Chase & Co. assumed coverage on Haemonetics in a research note on Friday, December 6th. They set an "overweight" rating and a $116.00 target price on the stock. Bank of America cut Haemonetics from a "neutral" rating to an "underperform" rating and lowered their price target for the stock from $95.00 to $68.00 in a report on Friday. Finally, JMP Securities cut their price objective on shares of Haemonetics from $125.00 to $100.00 and set a "market outperform" rating for the company in a report on Friday. One research analyst has rated the stock with a sell rating, one has issued a hold rating, seven have given a buy rating and one has issued a strong buy rating to the stock. According to MarketBeat.com, Haemonetics has a consensus rating of "Moderate Buy" and a consensus price target of $101.67.

Get Our Latest Research Report on HAE

Haemonetics Company Profile

(

Get Free Report)

Haemonetics Corporation, a healthcare company, provides suite of medical products and solutions in the United States and internationally. The company offers automated plasma collection systems, donor management software, and supporting software solutions including NexSys PCS and PCS2 plasmapheresis equipment and related disposables and solutions, as well as integrated information technology platforms for plasma customers to manage their donors, operations, and supply chain; and NexLynk DMS donor management system and Donor360 app.

Further Reading

Before you consider Haemonetics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Haemonetics wasn't on the list.

While Haemonetics currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.