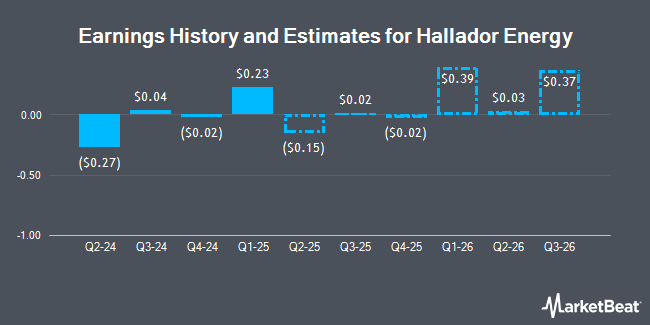

Hallador Energy (NASDAQ:HNRG - Free Report) - Investment analysts at B. Riley upped their FY2024 earnings per share (EPS) estimates for Hallador Energy in a research note issued to investors on Wednesday, November 13th. B. Riley analyst L. Pipes now forecasts that the energy company will post earnings per share of ($0.31) for the year, up from their prior estimate of ($0.41). B. Riley currently has a "Buy" rating and a $13.00 price objective on the stock. The consensus estimate for Hallador Energy's current full-year earnings is ($0.31) per share. B. Riley also issued estimates for Hallador Energy's Q4 2024 earnings at ($0.03) EPS, Q1 2025 earnings at $0.02 EPS, Q4 2025 earnings at $0.05 EPS, FY2025 earnings at $0.16 EPS, Q1 2026 earnings at $0.45 EPS, Q2 2026 earnings at $0.26 EPS, Q3 2026 earnings at $0.44 EPS and FY2026 earnings at $1.43 EPS.

Hallador Energy (NASDAQ:HNRG - Get Free Report) last announced its quarterly earnings data on Tuesday, November 12th. The energy company reported $0.04 EPS for the quarter, topping analysts' consensus estimates of ($0.10) by $0.14. Hallador Energy had a negative return on equity of 6.71% and a negative net margin of 4.85%. The firm had revenue of $105.04 million during the quarter, compared to analyst estimates of $117.10 million. During the same period last year, the company earned $0.47 earnings per share.

Separately, StockNews.com lowered Hallador Energy from a "hold" rating to a "sell" rating in a report on Sunday, August 18th.

Read Our Latest Report on HNRG

Hallador Energy Stock Down 0.8 %

Shares of NASDAQ:HNRG traded down $0.10 during trading on Monday, hitting $12.75. 639,446 shares of the company's stock traded hands, compared to its average volume of 486,765. The company has a market cap of $543.37 million, a price-to-earnings ratio of -23.36 and a beta of 0.62. The company has a 50-day moving average price of $9.31 and a 200-day moving average price of $7.87. The company has a current ratio of 0.58, a quick ratio of 0.16 and a debt-to-equity ratio of 0.16. Hallador Energy has a 52 week low of $4.33 and a 52 week high of $13.57.

Insider Buying and Selling

In other news, Director Charles Ray Iv Wesley purchased 25,000 shares of the business's stock in a transaction on Friday, September 6th. The shares were acquired at an average price of $5.97 per share, for a total transaction of $149,250.00. Following the completion of the acquisition, the director now owns 184,302 shares in the company, valued at approximately $1,100,282.94. The trade was a 15.69 % increase in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which can be accessed through this link. Also, Director Zarrell Thomas Gray purchased 5,000 shares of the business's stock in a transaction on Thursday, August 22nd. The stock was purchased at an average price of $5.75 per share, for a total transaction of $28,750.00. Following the acquisition, the director now owns 33,000 shares of the company's stock, valued at approximately $189,750. This represents a 17.86 % increase in their position. The disclosure for this purchase can be found here. Insiders acquired a total of 46,000 shares of company stock worth $280,040 in the last ninety days. 32.30% of the stock is owned by insiders.

Institutional Inflows and Outflows

A number of large investors have recently modified their holdings of the stock. Bank of New York Mellon Corp increased its position in Hallador Energy by 1.7% in the second quarter. Bank of New York Mellon Corp now owns 183,683 shares of the energy company's stock worth $1,427,000 after buying an additional 3,017 shares during the last quarter. Exchange Traded Concepts LLC lifted its stake in shares of Hallador Energy by 66.4% in the 3rd quarter. Exchange Traded Concepts LLC now owns 10,357 shares of the energy company's stock valued at $98,000 after acquiring an additional 4,132 shares during the last quarter. Janney Montgomery Scott LLC increased its holdings in Hallador Energy by 10.1% during the 1st quarter. Janney Montgomery Scott LLC now owns 53,172 shares of the energy company's stock valued at $283,000 after purchasing an additional 4,887 shares during the period. CWM LLC grew its holdings in shares of Hallador Energy by 154.4% during the 3rd quarter. CWM LLC now owns 8,227 shares of the energy company's stock worth $78,000 after acquiring an additional 4,993 shares during the period. Finally, Rhumbline Advisers raised its position in shares of Hallador Energy by 16.1% in the 2nd quarter. Rhumbline Advisers now owns 37,757 shares of the energy company's stock worth $293,000 after acquiring an additional 5,241 shares in the last quarter. Institutional investors own 61.38% of the company's stock.

About Hallador Energy

(

Get Free Report)

Hallador Energy Company, through its subsidiaries, engages in the production of steam coal in the State of Indiana for the electric power generation industry. The company owns the Oaktown Mine 1 and Oaktown Mine 2 underground mines in Oaktown; Freelandville Center Pit surface mine in Freelandville; and Prosperity Surface mine in Petersburg, Indiana.

Read More

Before you consider Hallador Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hallador Energy wasn't on the list.

While Hallador Energy currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.