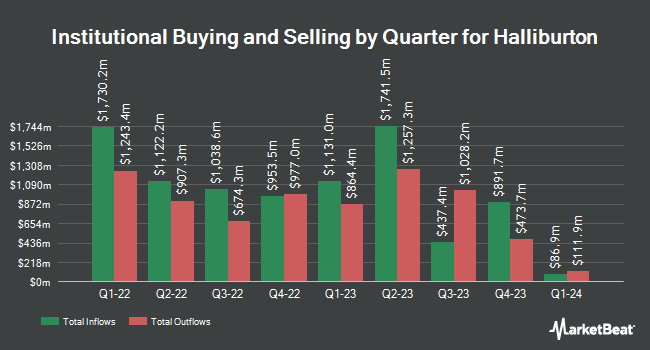

Kovitz Investment Group Partners LLC grew its stake in Halliburton (NYSE:HAL - Free Report) by 83.4% during the 3rd quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The firm owned 239,167 shares of the oilfield services company's stock after purchasing an additional 108,775 shares during the quarter. Kovitz Investment Group Partners LLC's holdings in Halliburton were worth $6,694,000 as of its most recent SEC filing.

Other institutional investors and hedge funds have also modified their holdings of the company. Pacer Advisors Inc. boosted its holdings in Halliburton by 17,317.6% in the 2nd quarter. Pacer Advisors Inc. now owns 13,631,188 shares of the oilfield services company's stock worth $460,462,000 after buying an additional 13,552,927 shares during the last quarter. LSV Asset Management increased its position in shares of Halliburton by 24,954.1% during the second quarter. LSV Asset Management now owns 2,730,900 shares of the oilfield services company's stock worth $92,250,000 after purchasing an additional 2,720,000 shares in the last quarter. Thompson Siegel & Walmsley LLC acquired a new stake in shares of Halliburton in the third quarter valued at about $55,132,000. Dimensional Fund Advisors LP raised its holdings in Halliburton by 20.0% in the 2nd quarter. Dimensional Fund Advisors LP now owns 10,087,115 shares of the oilfield services company's stock valued at $340,752,000 after acquiring an additional 1,681,620 shares during the last quarter. Finally, Thrivent Financial for Lutherans lifted its position in Halliburton by 22.0% during the third quarter. Thrivent Financial for Lutherans now owns 5,520,383 shares of the oilfield services company's stock worth $160,367,000 after buying an additional 995,649 shares in the last quarter. Hedge funds and other institutional investors own 85.23% of the company's stock.

Analyst Upgrades and Downgrades

HAL has been the topic of several analyst reports. The Goldman Sachs Group reduced their price target on Halliburton from $47.00 to $40.00 and set a "buy" rating on the stock in a report on Thursday, August 29th. Susquehanna cut their price target on shares of Halliburton from $42.00 to $40.00 and set a "positive" rating for the company in a report on Friday, November 8th. Wells Fargo & Company lowered their price objective on Halliburton from $46.00 to $39.00 and set an "overweight" rating for the company in a research report on Wednesday, September 25th. Morgan Stanley reduced their target price on Halliburton from $35.00 to $34.00 and set an "overweight" rating on the stock in a research report on Monday, November 18th. Finally, Stifel Nicolaus lowered their price target on Halliburton from $45.00 to $42.00 and set a "buy" rating for the company in a report on Friday, October 11th. Four analysts have rated the stock with a hold rating, sixteen have given a buy rating and one has assigned a strong buy rating to the company. According to data from MarketBeat.com, Halliburton presently has an average rating of "Moderate Buy" and a consensus target price of $40.74.

Check Out Our Latest Report on HAL

Halliburton Stock Down 4.1 %

Shares of Halliburton stock traded down $1.24 on Friday, reaching $28.78. 10,347,226 shares of the company were exchanged, compared to its average volume of 9,146,110. The stock's 50 day moving average price is $29.87 and its 200-day moving average price is $31.56. The company has a market cap of $25.28 billion, a P/E ratio of 10.03, a price-to-earnings-growth ratio of 3.78 and a beta of 1.90. Halliburton has a 1-year low of $27.26 and a 1-year high of $41.56. The company has a debt-to-equity ratio of 0.74, a current ratio of 2.21 and a quick ratio of 1.62.

Halliburton (NYSE:HAL - Get Free Report) last released its quarterly earnings data on Thursday, November 7th. The oilfield services company reported $0.73 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.75 by ($0.02). The firm had revenue of $5.70 billion for the quarter, compared to analysts' expectations of $5.83 billion. Halliburton had a return on equity of 28.33% and a net margin of 11.04%. Halliburton's revenue for the quarter was down 1.8% on a year-over-year basis. During the same period last year, the firm posted $0.79 earnings per share. As a group, equities analysts forecast that Halliburton will post 3 EPS for the current year.

Halliburton Dividend Announcement

The firm also recently declared a quarterly dividend, which will be paid on Thursday, December 26th. Investors of record on Wednesday, December 4th will be issued a $0.17 dividend. This represents a $0.68 dividend on an annualized basis and a yield of 2.36%. The ex-dividend date of this dividend is Wednesday, December 4th. Halliburton's dividend payout ratio (DPR) is 23.69%.

Halliburton Profile

(

Free Report)

Halliburton Company provides products and services to the energy industry worldwide. It operates through two segments, Completion and Production, and Drilling and Evaluation. The Completion and Production segment offers production enhancement services that include stimulation and sand control services; cementing services, such as well bonding and casing, and casing equipment; and completion tools that offer downhole solutions and services, including well completion products and services, intelligent well completions, and service tools, as well as liner hanger, sand control, and multilateral systems.

Featured Stories

Before you consider Halliburton, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Halliburton wasn't on the list.

While Halliburton currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.