Bank of America began coverage on shares of Hannon Armstrong Sustainable Infrastructure Capital (NYSE:HASI - Free Report) in a research note published on Monday morning. The brokerage issued a buy rating and a $40.00 price objective on the real estate investment trust's stock.

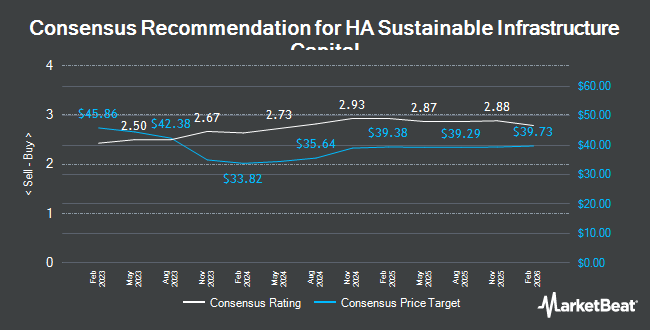

Other equities research analysts also recently issued research reports about the stock. Citigroup upped their price objective on shares of Hannon Armstrong Sustainable Infrastructure Capital from $24.00 to $36.00 and gave the stock a "neutral" rating in a report on Tuesday, October 22nd. Morgan Stanley upped their price target on shares of Hannon Armstrong Sustainable Infrastructure Capital from $30.00 to $44.00 and gave the stock an "overweight" rating in a research note on Wednesday, July 31st. Robert W. Baird raised their price objective on shares of Hannon Armstrong Sustainable Infrastructure Capital from $36.00 to $47.00 and gave the company an "outperform" rating in a research note on Friday, September 27th. Baird R W upgraded Hannon Armstrong Sustainable Infrastructure Capital to a "strong-buy" rating in a research report on Friday, September 27th. Finally, Royal Bank of Canada assumed coverage on Hannon Armstrong Sustainable Infrastructure Capital in a research report on Tuesday, September 3rd. They set an "outperform" rating and a $41.00 price target on the stock. One equities research analyst has rated the stock with a sell rating, two have issued a hold rating, nine have issued a buy rating and two have given a strong buy rating to the company. Based on data from MarketBeat.com, Hannon Armstrong Sustainable Infrastructure Capital presently has a consensus rating of "Moderate Buy" and an average price target of $40.58.

View Our Latest Stock Analysis on HASI

Hannon Armstrong Sustainable Infrastructure Capital Stock Performance

Hannon Armstrong Sustainable Infrastructure Capital stock traded up $1.42 during mid-day trading on Monday, hitting $30.43. 1,458,691 shares of the company's stock traded hands, compared to its average volume of 1,074,853. The company has a quick ratio of 13.55, a current ratio of 13.55 and a debt-to-equity ratio of 1.78. Hannon Armstrong Sustainable Infrastructure Capital has a one year low of $21.77 and a one year high of $36.56. The firm has a 50 day moving average price of $33.01 and a 200 day moving average price of $32.15. The company has a market cap of $3.61 billion, a PE ratio of 16.99, a price-to-earnings-growth ratio of 1.09 and a beta of 1.98.

Hannon Armstrong Sustainable Infrastructure Capital Dividend Announcement

The business also recently disclosed a quarterly dividend, which will be paid on Friday, January 10th. Shareholders of record on Monday, December 30th will be issued a dividend of $0.415 per share. The ex-dividend date of this dividend is Monday, December 30th. This represents a $1.66 annualized dividend and a yield of 5.46%. Hannon Armstrong Sustainable Infrastructure Capital's payout ratio is presently 93.26%.

Insider Buying and Selling

In related news, CFO Marc T. Pangburn acquired 3,500 shares of the company's stock in a transaction on Monday, November 11th. The shares were purchased at an average price of $28.71 per share, for a total transaction of $100,485.00. Following the purchase, the chief financial officer now owns 56,791 shares in the company, valued at $1,630,469.61. This represents a 6.57 % increase in their ownership of the stock. The acquisition was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through this link. Company insiders own 2.00% of the company's stock.

Institutional Inflows and Outflows

A number of institutional investors and hedge funds have recently bought and sold shares of HASI. Swedbank AB increased its holdings in shares of Hannon Armstrong Sustainable Infrastructure Capital by 6.8% during the 2nd quarter. Swedbank AB now owns 4,020,665 shares of the real estate investment trust's stock valued at $119,012,000 after acquiring an additional 257,233 shares during the last quarter. Tidal Investments LLC lifted its holdings in shares of Hannon Armstrong Sustainable Infrastructure Capital by 48.0% during the 1st quarter. Tidal Investments LLC now owns 81,728 shares of the real estate investment trust's stock worth $2,321,000 after acquiring an additional 26,508 shares during the period. Abundance Wealth Counselors bought a new position in Hannon Armstrong Sustainable Infrastructure Capital during the second quarter worth about $1,110,000. Harbor Capital Advisors Inc. acquired a new stake in Hannon Armstrong Sustainable Infrastructure Capital in the 3rd quarter valued at $1,742,000. Finally, Oppenheimer & Co. Inc. boosted its stake in shares of Hannon Armstrong Sustainable Infrastructure Capital by 16.2% in the 3rd quarter. Oppenheimer & Co. Inc. now owns 197,921 shares of the real estate investment trust's stock valued at $6,822,000 after purchasing an additional 27,529 shares in the last quarter. Hedge funds and other institutional investors own 96.14% of the company's stock.

About Hannon Armstrong Sustainable Infrastructure Capital

(

Get Free Report)

Hannon Armstrong Sustainable Infrastructure Capital, Inc, through its subsidiaries, engages in the investment in energy efficiency, renewable energy, and sustainable infrastructure markets in the United States. The company's portfolio includes equity investments, commercial and government receivables, real estate, and debt securities.

Featured Stories

Before you consider Hannon Armstrong Sustainable Infrastructure Capital, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hannon Armstrong Sustainable Infrastructure Capital wasn't on the list.

While Hannon Armstrong Sustainable Infrastructure Capital currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.