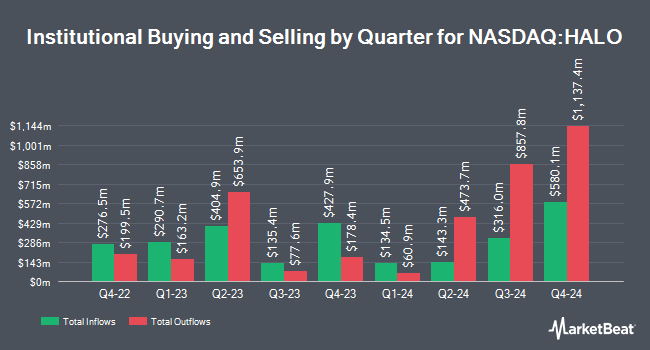

Hanseatic Management Services Inc. acquired a new position in Halozyme Therapeutics, Inc. (NASDAQ:HALO - Free Report) in the 3rd quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The institutional investor acquired 10,153 shares of the biopharmaceutical company's stock, valued at approximately $581,000.

Other hedge funds and other institutional investors have also recently modified their holdings of the company. TD Asset Management Inc increased its stake in Halozyme Therapeutics by 28.1% in the 1st quarter. TD Asset Management Inc now owns 2,541,266 shares of the biopharmaceutical company's stock worth $103,379,000 after buying an additional 557,350 shares in the last quarter. Congress Asset Management Co. increased its stake in Halozyme Therapeutics by 446.5% in the 3rd quarter. Congress Asset Management Co. now owns 2,433,579 shares of the biopharmaceutical company's stock worth $139,298,000 after buying an additional 1,988,238 shares in the last quarter. Handelsbanken Fonder AB increased its stake in Halozyme Therapeutics by 76.9% in the 3rd quarter. Handelsbanken Fonder AB now owns 1,969,169 shares of the biopharmaceutical company's stock worth $112,715,000 after buying an additional 856,200 shares in the last quarter. Dimensional Fund Advisors LP increased its stake in Halozyme Therapeutics by 12.4% in the 2nd quarter. Dimensional Fund Advisors LP now owns 1,897,759 shares of the biopharmaceutical company's stock worth $99,363,000 after buying an additional 209,530 shares in the last quarter. Finally, Epoch Investment Partners Inc. increased its stake in Halozyme Therapeutics by 23.3% in the 1st quarter. Epoch Investment Partners Inc. now owns 1,433,612 shares of the biopharmaceutical company's stock worth $58,319,000 after buying an additional 270,579 shares in the last quarter. 97.79% of the stock is currently owned by hedge funds and other institutional investors.

Analyst Upgrades and Downgrades

Several research firms have commented on HALO. Piper Sandler increased their price objective on shares of Halozyme Therapeutics from $51.00 to $52.00 and gave the company a "neutral" rating in a report on Monday. The Goldman Sachs Group increased their price objective on shares of Halozyme Therapeutics from $44.00 to $49.00 and gave the company a "neutral" rating in a report on Monday, July 22nd. HC Wainwright increased their price objective on shares of Halozyme Therapeutics from $65.00 to $68.00 and gave the company a "buy" rating in a report on Friday, November 1st. Cowen reissued a "buy" rating on shares of Halozyme Therapeutics in a report on Friday, October 18th. Finally, JPMorgan Chase & Co. downgraded shares of Halozyme Therapeutics from an "overweight" rating to a "neutral" rating and increased their price objective for the company from $52.00 to $57.00 in a report on Thursday, September 19th. Four analysts have rated the stock with a hold rating and seven have issued a buy rating to the company. According to data from MarketBeat.com, the stock presently has a consensus rating of "Moderate Buy" and an average target price of $61.11.

Get Our Latest Stock Report on HALO

Insiders Place Their Bets

In other Halozyme Therapeutics news, Director Matthew L. Posard sold 9,881 shares of the firm's stock in a transaction dated Wednesday, August 14th. The shares were sold at an average price of $57.70, for a total value of $570,133.70. Following the completion of the sale, the director now owns 69,874 shares of the company's stock, valued at $4,031,729.80. This trade represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at this hyperlink. In other news, Director Matthew L. Posard sold 10,000 shares of the firm's stock in a transaction that occurred on Monday, August 12th. The shares were sold at an average price of $55.72, for a total transaction of $557,200.00. Following the transaction, the director now directly owns 89,755 shares of the company's stock, valued at approximately $5,001,148.60. This trade represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which can be accessed through this link. Also, Director Matthew L. Posard sold 9,881 shares of the firm's stock in a transaction that occurred on Wednesday, August 14th. The stock was sold at an average price of $57.70, for a total transaction of $570,133.70. Following the transaction, the director now directly owns 69,874 shares in the company, valued at approximately $4,031,729.80. This trade represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold a total of 89,881 shares of company stock valued at $5,169,834 over the last 90 days. Insiders own 2.70% of the company's stock.

Halozyme Therapeutics Trading Down 1.6 %

Shares of NASDAQ:HALO traded down $0.98 during trading on Thursday, reaching $59.65. The company's stock had a trading volume of 1,061,025 shares, compared to its average volume of 1,288,829. The company has a current ratio of 10.36, a quick ratio of 9.15 and a debt-to-equity ratio of 3.32. Halozyme Therapeutics, Inc. has a 12 month low of $33.15 and a 12 month high of $65.53. The firm's 50 day simple moving average is $56.67 and its two-hundred day simple moving average is $52.53. The stock has a market capitalization of $7.59 billion, a PE ratio of 19.75, a price-to-earnings-growth ratio of 0.53 and a beta of 1.29.

Halozyme Therapeutics (NASDAQ:HALO - Get Free Report) last announced its quarterly earnings data on Tuesday, August 6th. The biopharmaceutical company reported $0.91 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.73 by $0.18. The business had revenue of $231.40 million during the quarter, compared to the consensus estimate of $204.94 million. Halozyme Therapeutics had a net margin of 41.43% and a return on equity of 179.82%. The firm's quarterly revenue was up 4.7% compared to the same quarter last year. During the same quarter last year, the firm earned $0.68 earnings per share. On average, research analysts predict that Halozyme Therapeutics, Inc. will post 3.84 EPS for the current fiscal year.

Halozyme Therapeutics Profile

(

Free Report)

Halozyme Therapeutics, Inc, a biopharma technology platform company, researches, develops, and commercializes proprietary enzymes and devices in the United States, Switzerland, Belgium, Japan, and internationally. The company's products are based on the patented recombinant human hyaluronidase enzyme (rHuPH20) that enables delivery of injectable biologics, such as monoclonal antibodies and other therapeutic molecules, as well as small molecules and fluids.

See Also

Before you consider Halozyme Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Halozyme Therapeutics wasn't on the list.

While Halozyme Therapeutics currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report