Hantz Financial Services Inc. boosted its stake in shares of Cable One, Inc. (NYSE:CABO - Free Report) by 50.7% in the fourth quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 6,779 shares of the company's stock after purchasing an additional 2,282 shares during the quarter. Hantz Financial Services Inc. owned approximately 0.12% of Cable One worth $2,455,000 at the end of the most recent reporting period.

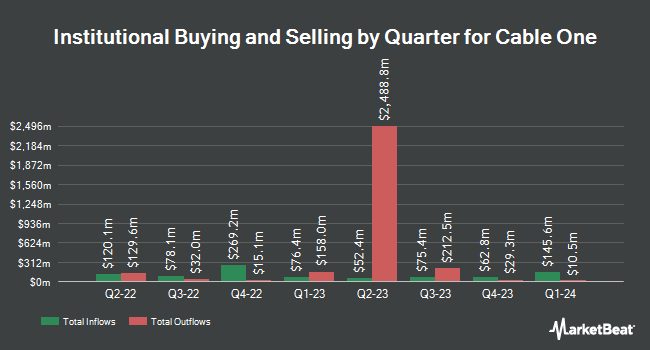

A number of other hedge funds and other institutional investors have also added to or reduced their stakes in the stock. Sound Income Strategies LLC bought a new stake in Cable One during the 4th quarter valued at $50,000. KBC Group NV raised its stake in shares of Cable One by 45.5% in the 3rd quarter. KBC Group NV now owns 160 shares of the company's stock worth $56,000 after buying an additional 50 shares in the last quarter. Public Employees Retirement System of Ohio raised its stake in shares of Cable One by 20.4% in the 3rd quarter. Public Employees Retirement System of Ohio now owns 171 shares of the company's stock worth $60,000 after buying an additional 29 shares in the last quarter. GAMMA Investing LLC lifted its holdings in shares of Cable One by 32.2% during the third quarter. GAMMA Investing LLC now owns 197 shares of the company's stock valued at $69,000 after purchasing an additional 48 shares during the last quarter. Finally, Point72 Asia Singapore Pte. Ltd. purchased a new stake in shares of Cable One during the second quarter valued at $72,000. Institutional investors and hedge funds own 89.92% of the company's stock.

Analysts Set New Price Targets

Separately, JPMorgan Chase & Co. reduced their target price on Cable One from $480.00 to $470.00 and set a "neutral" rating for the company in a report on Tuesday, November 12th. One analyst has rated the stock with a sell rating, two have issued a hold rating and two have assigned a buy rating to the company. According to MarketBeat.com, the company has an average rating of "Hold" and a consensus price target of $554.40.

View Our Latest Stock Analysis on Cable One

Cable One Stock Down 6.3 %

Cable One stock traded down $19.23 during mid-day trading on Monday, hitting $284.78. The company's stock had a trading volume of 95,052 shares, compared to its average volume of 100,443. The firm's 50 day moving average is $366.32 and its 200 day moving average is $363.87. The company has a market cap of $1.60 billion, a PE ratio of 6.58 and a beta of 0.90. The company has a debt-to-equity ratio of 1.84, a current ratio of 0.93 and a quick ratio of 0.93. Cable One, Inc. has a 52-week low of $283.88 and a 52-week high of $515.49.

Cable One Dividend Announcement

The firm also recently disclosed a quarterly dividend, which was paid on Friday, December 20th. Investors of record on Tuesday, December 3rd were paid a $2.95 dividend. This represents a $11.80 annualized dividend and a yield of 4.14%. The ex-dividend date was Tuesday, December 3rd. Cable One's dividend payout ratio is currently 27.29%.

Cable One Profile

(

Free Report)

Cable One, Inc, together with its subsidiaries, provides data, video, and voice services in the United States. The company offers residential data services, a service to enhance Wi-Fi signal throughout the home. It also provides various residential video services from basic video service to digital services with access to hundreds of channels; and provides a cloud-based DVR feature that does not require the use of a set-top boxes.

Featured Articles

Before you consider Cable One, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cable One wasn't on the list.

While Cable One currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.