Hantz Financial Services Inc. increased its position in shares of Zoetis Inc. (NYSE:ZTS - Free Report) by 4.4% during the 3rd quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The fund owned 141,299 shares of the company's stock after acquiring an additional 5,938 shares during the quarter. Hantz Financial Services Inc.'s holdings in Zoetis were worth $27,607,000 as of its most recent SEC filing.

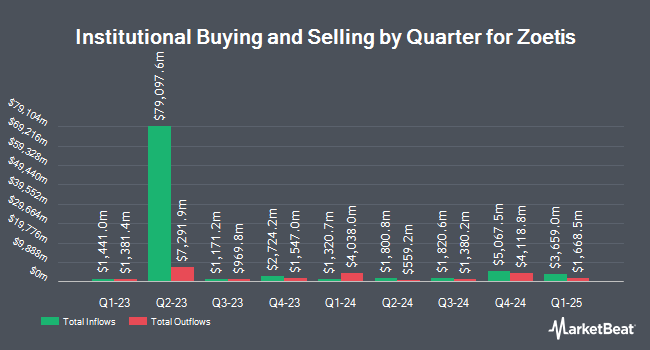

A number of other institutional investors have also recently bought and sold shares of the stock. Mizuho Securities USA LLC lifted its stake in Zoetis by 13,726.9% in the third quarter. Mizuho Securities USA LLC now owns 4,865,000 shares of the company's stock valued at $950,524,000 after buying an additional 4,829,815 shares in the last quarter. Bank of New York Mellon Corp lifted its stake in Zoetis by 4.0% in the second quarter. Bank of New York Mellon Corp now owns 4,687,902 shares of the company's stock valued at $812,695,000 after buying an additional 178,303 shares in the last quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC lifted its stake in Zoetis by 5.3% in the third quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 3,896,106 shares of the company's stock valued at $761,221,000 after buying an additional 194,542 shares in the last quarter. Clearbridge Investments LLC lifted its position in shares of Zoetis by 5.8% in the second quarter. Clearbridge Investments LLC now owns 3,044,384 shares of the company's stock worth $527,774,000 after purchasing an additional 166,517 shares in the last quarter. Finally, Principal Financial Group Inc. lifted its position in shares of Zoetis by 17.3% in the third quarter. Principal Financial Group Inc. now owns 2,377,403 shares of the company's stock worth $464,497,000 after purchasing an additional 351,372 shares in the last quarter. Institutional investors own 92.80% of the company's stock.

Analyst Upgrades and Downgrades

A number of analysts have recently commented on ZTS shares. Stifel Nicolaus boosted their price objective on shares of Zoetis from $200.00 to $210.00 and gave the stock a "buy" rating in a research report on Wednesday, September 18th. Argus raised shares of Zoetis to a "strong-buy" rating in a research report on Friday, August 9th. JPMorgan Chase & Co. boosted their price objective on shares of Zoetis from $225.00 to $230.00 and gave the stock an "overweight" rating in a research report on Friday, October 11th. BTIG Research boosted their price objective on shares of Zoetis from $220.00 to $225.00 and gave the stock a "buy" rating in a research report on Monday, August 12th. Finally, Piper Sandler boosted their price objective on shares of Zoetis from $195.00 to $210.00 and gave the stock an "overweight" rating in a research report on Wednesday, August 14th. Ten investment analysts have rated the stock with a buy rating and one has issued a strong buy rating to the stock. According to data from MarketBeat, Zoetis currently has an average rating of "Buy" and a consensus price target of $221.44.

Check Out Our Latest Stock Report on Zoetis

Zoetis Stock Down 0.8 %

ZTS traded down $1.49 during trading on Friday, reaching $175.25. 1,543,442 shares of the stock were exchanged, compared to its average volume of 2,545,743. Zoetis Inc. has a twelve month low of $144.80 and a twelve month high of $201.92. The stock has a market cap of $79.07 billion, a P/E ratio of 32.94, a price-to-earnings-growth ratio of 2.71 and a beta of 0.90. The stock's 50 day moving average price is $183.83 and its two-hundred day moving average price is $180.84. The company has a debt-to-equity ratio of 1.26, a quick ratio of 2.27 and a current ratio of 3.69.

Zoetis (NYSE:ZTS - Get Free Report) last released its quarterly earnings data on Monday, November 4th. The company reported $1.58 EPS for the quarter, beating the consensus estimate of $1.46 by $0.12. Zoetis had a net margin of 26.55% and a return on equity of 51.98%. The firm had revenue of $2.40 billion for the quarter, compared to the consensus estimate of $2.29 billion. During the same period in the previous year, the company earned $1.36 earnings per share. The company's quarterly revenue was up 11.6% on a year-over-year basis. Equities analysts expect that Zoetis Inc. will post 5.9 EPS for the current year.

Zoetis Announces Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Tuesday, December 3rd. Shareholders of record on Thursday, October 31st will be issued a $0.432 dividend. The ex-dividend date of this dividend is Thursday, October 31st. This represents a $1.73 annualized dividend and a dividend yield of 0.99%. Zoetis's dividend payout ratio is currently 32.52%.

About Zoetis

(

Free Report)

Zoetis Inc engages in the discovery, development, manufacture, and commercialization of animal health medicines, vaccines, and diagnostic products and services in the United States and internationally. The company commercializes products primarily across species, including livestock, such as cattle, swine, poultry, fish, and sheep and others; and companion animals comprising dogs, cats, and horses.

Recommended Stories

Before you consider Zoetis, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Zoetis wasn't on the list.

While Zoetis currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.