Hantz Financial Services Inc. purchased a new position in US Foods Holding Corp. (NYSE:USFD - Free Report) in the third quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The fund purchased 174,277 shares of the company's stock, valued at approximately $10,718,000. Hantz Financial Services Inc. owned about 0.07% of US Foods at the end of the most recent quarter.

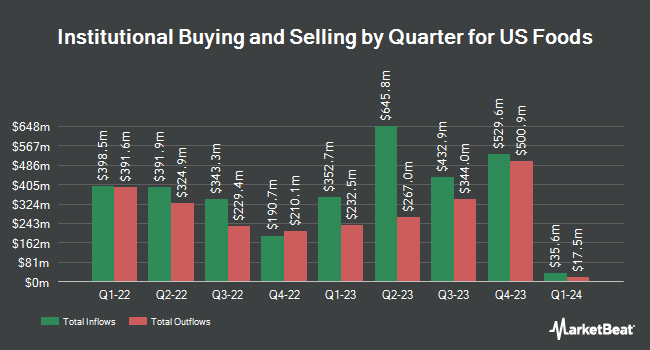

Several other institutional investors have also recently added to or reduced their stakes in the stock. Public Sector Pension Investment Board raised its stake in US Foods by 100.2% during the third quarter. Public Sector Pension Investment Board now owns 6,000 shares of the company's stock valued at $369,000 after buying an additional 2,500,000 shares in the last quarter. Zurcher Kantonalbank Zurich Cantonalbank increased its holdings in shares of US Foods by 1.1% in the 3rd quarter. Zurcher Kantonalbank Zurich Cantonalbank now owns 50,815 shares of the company's stock valued at $3,125,000 after acquiring an additional 549 shares during the last quarter. MetLife Investment Management LLC raised its position in shares of US Foods by 5.8% during the 3rd quarter. MetLife Investment Management LLC now owns 126,127 shares of the company's stock valued at $7,757,000 after acquiring an additional 6,964 shares in the last quarter. Townsquare Capital LLC bought a new position in US Foods during the third quarter worth $2,632,000. Finally, BNP Paribas Financial Markets boosted its holdings in shares of US Foods by 2,338.8% in the 3rd quarter. BNP Paribas Financial Markets now owns 233,806 shares of the company's stock valued at $14,379,000 after buying an additional 224,219 shares during the period. 98.76% of the stock is owned by institutional investors and hedge funds.

US Foods Price Performance

NYSE:USFD traded down $0.03 during mid-day trading on Friday, reaching $69.82. 865,303 shares of the stock were exchanged, compared to its average volume of 1,802,404. The company has a current ratio of 1.19, a quick ratio of 0.72 and a debt-to-equity ratio of 1.01. The business has a fifty day moving average price of $63.60 and a 200 day moving average price of $57.75. US Foods Holding Corp. has a 1-year low of $42.96 and a 1-year high of $70.80. The firm has a market capitalization of $16.26 billion, a PE ratio of 29.94, a PEG ratio of 1.15 and a beta of 1.66.

Insider Transactions at US Foods

In other news, CFO Dirk J. Locascio sold 10,000 shares of the firm's stock in a transaction on Thursday, September 12th. The stock was sold at an average price of $57.95, for a total transaction of $579,500.00. Following the completion of the sale, the chief financial officer now directly owns 88,563 shares of the company's stock, valued at $5,132,225.85. This trade represents a 10.15 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which is available through this link. Corporate insiders own 0.70% of the company's stock.

Analysts Set New Price Targets

A number of brokerages recently commented on USFD. Deutsche Bank Aktiengesellschaft upped their price objective on US Foods from $72.00 to $75.00 and gave the stock a "buy" rating in a research note on Friday, August 9th. Wells Fargo & Company increased their price objective on shares of US Foods from $66.00 to $75.00 and gave the stock an "overweight" rating in a report on Wednesday, September 18th. UBS Group boosted their target price on shares of US Foods from $67.00 to $77.00 and gave the company a "buy" rating in a research note on Friday, November 8th. Jefferies Financial Group raised their price target on shares of US Foods from $66.00 to $71.00 and gave the company a "buy" rating in a research note on Wednesday, September 25th. Finally, Barclays raised their target price on US Foods from $71.00 to $78.00 and gave the company an "overweight" rating in a research report on Friday, November 8th. One analyst has rated the stock with a hold rating, ten have assigned a buy rating and one has issued a strong buy rating to the company. According to data from MarketBeat, US Foods presently has an average rating of "Buy" and a consensus target price of $71.09.

Get Our Latest Analysis on US Foods

About US Foods

(

Free Report)

US Foods Holding Corp., together with its subsidiaries, engages in marketing, sale, and distribution of fresh, frozen, and dry food and non-food products to foodservice customers in the United States. The company's customers include independently owned single and multi-unit restaurants, regional concepts, national restaurant chains, hospitals, nursing homes, hotels and motels, country clubs, government and military organizations, colleges and universities, and retail locations.

Further Reading

Before you consider US Foods, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and US Foods wasn't on the list.

While US Foods currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.